- Most sellers are also hoping to buy, so they are facing the same market constraints as buyers.

- Housing supply has not kept up with demand because building has become increasingly expensive.

- Rising mortgage rates and equity concerns could be encouraging homeowners to stay put and renovate.

- Agents need to focus on educating clients (both buyers and sellers) and think outside the box when looking for listings.

“Inventory,” “low inventory,” “multiple offers,” “low,” “high,” “strong,” “new” — these words paint a clear picture of an unbalanced housing market, one where buyers are competing for too-few homes for sale.

They were standouts in a recent survey conducted by the National Association of Realtors (NAR), which measures Realtor confidence every month; NAR used the additional comments section of the March Realtors Confidence Index to create this word cloud.

Inventory has been named the no. 1 problem in the housing market for more than a few months, and the problem just seems to be getting more acute.

One major contributing factor to the state of the market is the fact that fewer homeowners seem interested in selling — they’re staying put.

But why?

First: Is this really happening?

It’s not just your imagination. Real estate economists agree that a number of factors are discouraging sellers from moving — or encouraging them to stay put, depending on your perspective.

“There are inventory shortages,” confirmed Danielle Hale, NAR’s managing director of housing research, “and they’re pretty prevalent across the U.S.”

The inventory level wouldn’t be a problem, she notes, if demand weren’t so strong. “It’s all about balance,” she said. “We have a lot of buyers in the market; there’s strong demand because we’ve had several years of steady job growth — people are interested in owning a home of their own.

“It’s good that people are in such a healthy economic and financial situation that they’re seriously considering homeownership and getting into the market, but they just don’t have inventory to buy,” she added.

“We finally have people turning back toward homeownership; we also have millennials who are experiencing those major life events,” noted Skylar Olsen, senior economist at Zillow. “We’ve got this extra pressure that’s happening, and it’s really reinforcing this inventory problem.”

One piece of evidence that inventory is short: The median age of homes sold.

“The age of sold homes has almost doubled since the housing collapse because of the lack of new construction,” Olsen said. “In 2006 the median age was 15 years old; in 2015 it was 28 years old.”

“Our data definitely are showing that people are staying in their homes longer,” said Daren Blomquist, vice president of communications at Attom Data Solutions.

“Up until 2008, the average homeownership tenure was about four and one-quarter years,” he noted. “Since the end of 2008, we’ve just seen it steadily increase from that 4.25 to almost 8 years.”

There’s demand coming from two big groups, according to Joe Kirchner, chief economist at realtor.com.

“The millennials will have typically been living in the basement of their parents’ house because there’s been trouble with the economy in the last eight years,” he noted. “But since then we’ve been climbing out of that recession. We’re now at full employment, people have jobs, and demand is strong.”

And there’s another side of the coin, too: “Perhaps mom and dad are glad that junior has left the basement, and they’re now thinking about downsizing. That’s not going to be a net addition to the market because they’re selling and they’re buying.”

Chicken and egg

One economist referred to it as a “housing prisoner’s dilemma,” while agents and brokers on Inman’s Coast to Coast Facebook group referred to it as a “chicken-and-egg” scenario.

Whatever you call it, the fact remains that many sellers are also hoping to buy. “Once people make a transition from renting to owning, they typically stay homeowners for the rest of their lives,” Hale explained. “So most potential sellers are also going to be homebuyers.”

After their home sells, the sellers are going to be diving back into the market as buyers — and that prospect doesn’t seem appealing when other sellers aren’t willing to sell.

“The ‘housing prisoner’s dilemma’ is driven fundamentally by the fact by the seller that is also ultimately a buyer, and that’s a unique factor of the housing market,” noted First American Financial Services’ chief economist, Mark Fleming. “In a typical market, we are independent actors, but the housing market’s not this way.”

And so, Fleming notes, everybody would be better off if buyers and sellers cooperated — “but we end up in the non-cooperative outcome because it’s too risky to take the chance of being the seller and having the other guy not sell,” Fleming explained. “Then you’re even worse off.”

“The market in general is so in favor of sellers in terms of bargaining power that a lot of people don’t want to sell because where would they buy?” confirmed Olsen.

Matthew Gardner, chief economist at Windermere, added: “People want to move but they are not going to list their home to sell unless they find somewhere they want to buy, and if they can’t find somewhere else to buy, they’ll stay put.

“Interest rates are still historically cheap — 5-percent mortgage rates are going to be a 2018 story. It’s so easy now to do your research, but if you can’t find something, you’re not going to list, and it’s as simple as that.”

Supply and demand

“We have a population that’s growing,” said Gardner. “We’re creating households, and they need to live somewhere.

“And we only have a certain number of houses in America,” he added.

“The entire decade of the 1990s and through to 2006, we were building nearly a million houses a year,” Gardner said. “Last year, we had a low of about 700,000.”

Normally when there are supply constraints, builders ramp up production — but that hasn’t happened post-Great Recession, Gardner explained. Builders are focused primarily on multifamily and high-end properties as opposed to the much-coveted entry-level housing for first-time homebuyers that’s in short supply everywhere.

Olsen pointed to a couple of additional factors at play.

“At least with the national numbers, it’s easy to see that the premium — or the distance between the median price of new homes versus the median price of existing homes — is getting much wider over time,” Olsen said.

“It’s not just building fancy; it’s putting more house on the same size lots,” she added. “We see smaller lots over time, but lot size isn’t dropping as much as median square footage is increasing. We’re squeezing more house and more features on the lot.”

Why?

“Land costs have gone up dramatically,” Gardner said, “especially areas with geopolitical constraints — definitive boundaries inside which you can build and outside which you basically can’t. Certainly markets on the West Coast are seeing job growth, migration patterns shift, so that puts even more pressure on it.”

Materials and costs of labor have also gone up, Gardner notes — and there are more job openings in the construction field than there are people to fill them. “People got out of homebuilding during the recession,” he said. “Last time I checked there were 70,000 job openings for construction in America, and we’re just not seeing people go to vocational school to become plumbers, electricians and contractors.”

Some builders are starting to shift away from the “bigger is better” trend, said Kirchner. During a recent discussion with builders, “they said it all depends on each market and even submarkets within a metropolitan area,” he said.

“Some at the upper end are selling well, but in some cases they’re beginning to see that all of those bells and whistles that they offer as options — by throwing those in, they’re taking longer to sell, so they’ve decided in order to sell more quickly, they’re not going to put in all those bells and whistles. But there needs to be a shift in the thinking.”

Regulation makes building more expensive

“The challenge is really trying to figure out how the economics of profitability for homebuilders for less expensive housing needs to change in order for that building to come to bear,” Fleming opined. “The amount of fixed costs in the form of regulation and zoning and red tape — maybe you have to spend $70,000 out of the gate just on zoning and permit and regulation fees.”

So 7DS Associates consultant Rob Hahn is at least partially correct in his opinion that sellers aren’t moving because “as usual, the answer is government.”

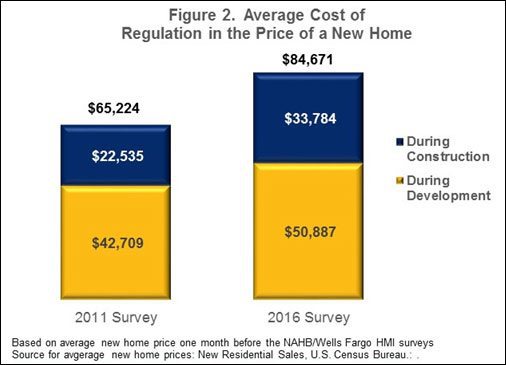

The National Association of Home Builders noted in a special study last May that the average cost of regulation in the price of a new home has increased from $65,224 in 2011 to $84,671 in 2016.

From the National Association of Home Builders’ “Government Regulation in the Price of a New Home” study.

“Maybe you could drive down the cost of construction through some innovative ways, like manufactured housing — not trailer homes, but where you manufacture it in a factory more efficiently and assemble it later,” Fleming added.

Of course, local and state zoning laws might need to change for those kinds of homes to be viable — or legal — in many parts of the country.

“The whole host of issues with zoning in California run so deep,” said Selma Hepp, chief economist at Pacific Union. “It’s a must at this point to look at it.”

She adds that the California property tax structure offers “more incentive to provide commercial space than residential space,” and that certainly doesn’t help builders decide to build homes, especially affordable ones.

“I have definitely seen companies that are springing up to offer those kinds of products,” Olsen said. “I think a big barrier to their rapid adoption is these land use requirements. You can provide the product, but can you get it approved?”

She mentions a proposal in Portland that would allow homeowners to build tiny homes in their backyards — on the condition that the tiny home be used to house a homeless household or person for five years.

“They’re doing it to try to tackle a really serious homelessness problem,” Olsen explained. “There are other areas with similar endeavors, but these proposals get incredibly fierce opposition.”

Mortgage rates up, up and away

Apart from the “housing prisoner’s dilemma,” Fleming identifies another issue that could be keeping sellers in their homes: rising mortgage rates.

“If I’m sitting on a 3.5 or 3.75 mortgage and effectively moving will cost me: 1. all the transaction fees, but 2. I can’t even buy my own home back from myself — why would I do that?” he asked.

He thinks that this is likely to be a long-term issue. “After the last 30 years, we’ve had a downward trend on mortgage rates,” he noted. “We’ve all gotten used to the housing market operating with that tailwind. And now it’s going to go the other way — it’s a headwind.”

That’s changing the decisions that buyers are able to make. “People have a certain amount of money to spend on a home,” explained Kirchner. “Because prices and interest rates are going up, that means monthly payments are going up, so people are saying ‘I really like that four-bedroom house but I’m going to have to take the three-bedroom,’ or ‘I really like that 10-minute commute but have to take a 20.'”

“Once mortgage rates start to significantly go up — which we all know is inevitable — I think that’s going to be a positive for home improvement activity,” noted Brad Hunter, chief economist at HomeAdvisor, a technology platform that connects homeowners with contractors.

“If somebody has a nice lock-in at a 30-year fixed rate of 3.5, 3.75, then when rates get up to 4.5, that’s a pretty big increase in monthly payment with all things held equal. That’ll motivate people even more to say, ‘I’ll keep my 3-something mortgage.'”

Equity concerns

Another theory: Are homeowners holding their breath for perfect timing?

“I think the psychology of making decisions to move is something that’s under-explored and that may explain more about the inventory problem than any economist would care to admit,” said Ralph McLaughlin, chief economist at Trulia.

“Nationally only about 34 percent of homes have come back to their pre-recession peak, so there may be some psychology out there that ‘my house was worth $X amount in 2005, 2006, and now it’s worth $X minus $Y, so I might try to hold out until it comes back to $X — and then I’ll move.'”

By contrast, Hunter thinks that an increase in home equity is encouraging homeowners to invest in home improvements; a HomeAdvisor report found that the average homeowner spent nearly 60 percent more on home projects over a 12-month period and attributes at least some of that increase to equity.

“We’ve seen a massive increase in homeowner equity,” he said. “A lot of people who were underwater are now above-water and able to move around. People feel richer, and they feel more able to justify expenditures on their lifestyle” — and they also have increased access to home equity lines of credit.

“I don’t think we can completely blame it on equity anymore,” opined Blomquist. “There’s still this long tail of homeowners underwater — as of Q1 this year it’s 9.7 percent, about 5.5 million people, so it’s been cut more than in half over the past five years,” he noted.

However, “there are certainly a lot of people who are equity rich and, if they sold, would walk away with a nice down payment on a new home if they wanted to,” he added.

Don’t relocate; renovate

According to Hunter, homeowners may be looking more carefully at the option of renovating their current home.

That’s for a few different reasons, he added. He thinks the multigenerational housing trend is resulting in some renovation, and he also noted that NAR’s 2016 “Profile of Home Buyers and Sellers” showed that the main reason why sellers want to move (at 18 percent of respondents) was because their current home is too small.

By contrast, a job relocation was responsible for 14 percent of seller moves.

“What that tells me is those people are prime candidates for a remodel,” Hunter added. “If they don’t have to move for a job, then there are a lot of things people can do to refresh the house and make it exciting again.”

The age of sellers (and buyers) also plays into the renovation question.

“Millennials are certainly the bull in the room,” allowed Gardner. “However, don’t ignore us baby boomers.”

He cited a recent Freddie Mac survey, which found that two-thirds of homeowners ages 55 and older would like to stay in their current homes.

“The presumption of us retiring at the normal age — we’re not doing it; we’re staying in the workforce later,” he added. “Twenty-two percent of us aged over 55 are in the workforce, and that’s going to rise to over 25 percent in 2020.

“We’re still active and doing our thing; we’re not worried about a flight of stairs or anything else. That lends credence to the argument that we’re not going to see the natural turnover of homes.”

McLaughlin echoed a similar sentiment.

“Boomers are, depending on your definitions, either the largest or the second-largest generation,” McLaughlin said, “but a much larger share of them own their homes. They are the gatekeeper to a lot of inventory.”

And he agrees with Gardner that “just like millennials, boomers are trying to do things a little later in life, too — like retire.”

As a result, he thinks it’s difficult to say whether boomers are planning on staying in their current homes forever — or just until they do decide to retire. “The question is, is this just delayed retirement that makes them look like they’re aging in place — or are they actually aging in place?” he wondered.

As mortgage rates rise, Gardner expects more homeowners to use the equity in their homes to renovate instead of move up. “It could be a longer-term phenomenon,” he said.

Some sellers are investors

The Great Recession took a toll on the U.S. homeownership rate, which dropped six percentage points — from 69 percent before the Recession to 63 percent after, McLaughlin said. That decline “represents a transition of owner-occupied to renter-occupied homes,” he added.

Gardner noted that the market experienced increased investor activity on the heels of the Recession.

“That took a number of units off the marketplace that are still cash-flowing nicely,” he said. “What’s the incentive for the owner or landlord to sell? They’re making money.”

He added that it’s possible that we could see a slowing of demand for single-family rental homes. “Will that free up or allow the landlord to then sell those homes? Possibly,” he allowed.

But he doesn’t think that there will be “a big bump in supply from homes lost to foreclosure.

“A lot of them were transacted already and sold to institutions,” he added — and potential home sale revenue would have to outbalance potential rental revenue before those sellers are moved to sell.

Olsen noted that rent prices have started to slow down. “That huge rent spike happened in 2015,” she said, “and then slowed down to where incomes should grow faster than rent — that should help affordability.

“In some places it’s still going to be bad and get worse,” she added, “but in areas where it’s getting better, that will also help that rent vs. buy decision where people want to rent a little longer.” And that, in turn, should help alleviate the demand for first-time buyer housing.

Fleming, however, thinks the rental issue is “a red herring.

“About one-third of single-family housing stock has always been rental,” he noted. “Maybe in certain submarkets or concentrated areas, it might be playing a role, but as a broad statement, the single-family institutional investing in rental residential housing — they don’t own enough of them for that to be a meaningful issue. Same thing with the Airbnb effect.”

On the other hand, the very existence of Airbnb means that homeowners have options other than “sell” if their mortgage isn’t aligning with their lifestyle anymore.

“Sellers now have this ability to have the extra income from Airbnb,” noted Hepp. “If they got way in over their head with their mortgage, they are able to supplement their income with Airbnb rentals. So say their home is too big for them — now they can just rent that, and they have supplemental income.”

“In 2016, 33 percent of all single-family homes were non-owner-occupied, which would indicate they’re either rentals or vacation homes, and that 33 percent is the highest it’s been since tracking back to 2004,” said Blomquist. “That points to folks holding onto them, but we have no way of knowing if it’s a vacation home, short-term rental or long-term rental.”

Lifestyle and social changes

“In the past, job relocation more often required physical relocation,” noted broker Andrea Geller.

But that’s no longer true. “More and more of the workforce is working remotely, so no need to move,” she added.

Trainer Valerie Garcia agreed. “A rise in telecommuting and work-from home” in addition to “uncertainty about crazy politics” and “less of a ‘I need a McMansion’ philosophy with younger generations” are all contributing to sellers staying put.

Multigenerational housing is also a real trend, Hunter noted.

Some of the “refreshments” that HomeAdvisor has seen homeowners make include increasing the amount of living space available in the current home instead of trading up.

“You can see it through things like garage remodels or additions to the house — those are indications as well,” Hunter noted. “I think it does relate to the lack of available inventory; it is motivating more people to put in a mother-in-law suite, whether it’s for their mother-in-law or their 31-year-old son.”

According to HomeAdvisor’s True Cost Guide, it costs:

- $41,551 to build an addition

- $18,832 to remodel a basement

- $10,662 to remodel a garage

The fixes for agents, brokers and buyers?

Seller’s market, buyer’s market — one way or another, real estate professionals are used to dealing with imbalances. Agents are navigating a long inventory dry spell with a number of approaches.

“Who cares what the reasons are?” asks team leader Sue Adler. “People move in good markets and bad, and it is just a matter of finding the motivated and helping them.

“We hit our all-time record this month listing 21 homes in one month and are having our best year ever in this low inventory market,” she added. “Maybe the market as a whole has less inventory, so it is just a matter of being more proactive in lead generating for listings.”

“The industry needs to keep promoting ethics, values and education,” opined Realtor Jack Attridge. “Be smart and work hard. Leave no stone unturned.

“Network with other agents and really know your own book of buyers and sellers to create opportunities,” he added.

“Propelling [sellers] to move is not just a function of ‘look how much your neighbor’s home sold for’ anymore,” noted broker-owner Tracy Sichterman. “We bring accountants and financial planners into the conversation. Talk to them about factors they may benefit from, such as taking their tax base to a neighboring community. We are honest if a remodel or addition will better accomplish their goals.”

That means a more complicated conversation, Sichterman added. “There is a reason teams are developing in order to handle the breadth of listing a home.”

Geller adds that the proliferation of teams can make it difficult to measure “how many agents are actually producing.”

Education is big for both buyers and sellers, suggested broker-owner Stacie Perrault Staub, who thinks agents can help offer homeowners “a realistic knowledge of their equity and financial position.”

And agents can help find replacement homes for those sellers by “thinking outside the box,” Perrault Staub added. “Use both old school and new school tools — think door-knocking combined with predictive analytics.”

And “know that the market will eventually turn — it always does,” she concluded.

Blomquist suggests that agents tackle the equity issue. “There may be a psychological component for that where homeowners just kind of kept their heads down because they lost so much equity during the downturn and they don’t realize how much wealth they actually have now in their home,” he noted. “So marketing and education pieces that speak to that could be good from an agent perspective.”

Hunter thinks that agents should talk to their buyers about how long they plan to stay in their new home.

“It would be helpful if real estate agents gave people advice in terms of, ‘Hey, when you buy this house, you might want to put in such and such changes to prepare’ — and obviously they have to talk very diplomatically because they don’t want to imply someone is old,” Hunter advised. “I suggest that agents avoid the term ‘aging in place.’ To me it has a connotation of somebody sitting in a chair and gathering cobwebs.”

“The focus is to try to get a listing,” said Blomquist, “but the market has changed. We’re in a market that has near-50-year lows in homeownership rates, and we’re seeing an increasing number of people buying investment properties. Tap into that market.

“It may not mean you’re getting the listing right away from the person who’s selling the home they’re living in,” he added, “but helping them find a rental property — that’s another angle to look at and part of the market that’s growing.”

Broker-owner Jim Weix thinks that inventory is going to level out eventually, but that in the meantime, it’s an agent’s responsibility to “educate” buyers “to understand that they aren’t going to ‘steal’ a home anymore. Then they don’t waste their time with silly low-ball offers.”

What could the government do, if anything?

“There are a few high-level policies from a tax perspective that could be implemented to encourage investors to sell their investment,” McLaughlin said. “One is that you could have a one-time reduction or elimination in the capital gains tax.”

This would encourage investors holding on to rental properties to sell — they’d get to keep more of their profit from the sale if there was a 12-month moratorium (for example) on capital gains tax.

“An equal and opposite policy on the other side of the political aisle would be to tax rental income at a higher rate,” he added. “If you tax rental income at a higher rate than it is now, that reduces the end-of-the-day take-home” — also encouraging investors to sell.

“At the end of the day, it is mostly a low supply issue,” noted Blomquist, “and so you’ve got to be willing to let developers come in and have a little more freedom in what they do to create more supply, and more dense supply, and not implementing restrictions on that supply.”

Boosting consumer confidence might also help, noted broker Stephen Ellerbrake.

“Maybe it would be helpful if we keep repeating sentiments such as: Interest rates are currently quite low, lending restraints are easing, millennials are starting to value the American Dream, unemployment rates are improving.”

That’s advice given to agents — but building consumer confidence is something the government could help with, too.

“Then we all hire another assistant to keep the unemployment rates low,” Ellerbrake added. “Perception is reality.”