Takeaways:

- Listing agents can request “instant offers” from Opendoor on behalf of sellers.

- The well-funded, fast-growing startup factors detailed information from sellers into its home valuations.

- Operating in Phoenix, Opendoor plans to expand to Portland, Oregon, and Dallas.

Opendoor, a real estate tech startup that launched in December 2014 and has raised $30 million in funding so far, is shaking up the Phoenix real estate market by making “instant offers” on homes online, buying them in a matter of days and then flipping the properties.

Charging a commission that can run north of 9 percent, Opendoor, which is gearing up to expand to Portland, Oregon, and Dallas, has bought 226 homes since making its first purchase in August 2014 — but the startup has snapped up more than half of that total in just the last 60 days, said local broker-owner Bob Hertzog, citing Maricopa County, Arizona, tax records.

Opendoor currently owns 144 homes, according to a search of the Maricopa County Assessor’s Office.

The startup, which claims to close transactions in as little as three days, isn’t only hawking offers to sellers. It also encourages listing agents to request offers and then show them to clients.

If a seller accepts an online offer from Opendoor, the firm sends home inspectors to verify the home’s condition before closing. Depending on the results of the inspection, Opendoor might ask a seller to sign an addendum to the offer stipulating that the seller cover the costs of repairs in a credit at closing.

But testifying to the firm’s confidence in its initial valuations, Opendoor doesn’t order appraisals on properties before moving forward with a purchase.

Check out our step-by-step overview of Opendoor’s online offer process for some insight into the automated valuation model that’s powering one of the most talked-about startups in real estate.

Step 1: Build your home profile

After entering and confirming an address on opendoor.com, users must specify the basics of a home along with details such as whether the property has covered parking spaces or a pool.

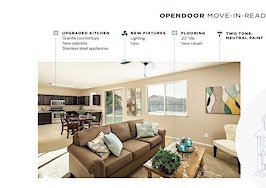

Step 2: Specify cost of home upgrades (if any)

Step 3: Describe kitchen

Now you know you’re dealing with a highly sophisticated automated home valuation model. Sellers must specify a kitchen’s condition, countertop type and features.

[Tweet “Opendoor invites listing agents to request instant offers on behalf of seller clients.”]

Step 4: Describe master bathroom

Whether the bathroom has tile shower walls, updated tile floors or a double sink evidently all factor into Opendoor’s home value estimates.

Step 5: Describe home and yard

Does a home’s living area have tile, laminate, hardwood, carpet or some other type of flooring? What’s the condition of that flooring?

And don’t forget about the ceiling’s surface type: Does it have popcorn texture, orange peel texture — or no texture at all?

Opendoor won’t cook up an offer unless it knows the answers to these questions.

Step 6: Opendoor generates valuation

After Opendoor has collected data on a home that’s difficult, if not impossible, to gather independently without physically visiting a property, the firm crunches those inputs with public and private data to come up with a valuation.

Opendoor wouldn’t specify any of its data sources, but home sales records — either public, those stored in the multiple listing service (of which Opendoor is a member) or both — undoubtedly help determine Opendoor’s valuations.

Opendoor’s automated valuation model incorporates “thousands of features,” according to the firm.

But the valuation process isn’t always entirely automated. An Opendoor employee can review and tweak a valuation when the firm’s algorithm produces a “low confidence” estimate, Opendoor said in a statement.

Step 7: Opendoor sends offer

Sellers or listing agents receive a link to the offer via email very quickly — or, if the valuation requires a human review, after a delay. The link brings sellers to a Web page that provides an outline of how Opendoor calculated its offer, citing comparable home sales and listings, and the property’s upgrades or “needed repairs.”

The offer also presents a breakdown of Opendoor’s commission charge. The charge can run upwards of 9 percent, which Opendoor breaks down into a “service charge,” buyer broker charge (Opendoor offers a commission split of 3 percent to buyer’s brokers in Phoenix), “holding costs” and “market risk.”

Reception

Opendoor makes a typical offer of compensation to buyer’s agents for bringing a buyer to the closing table, but also offers the option for house hunters to “buy direct.” Buyers can use Opendoor’s technology platform to make offers, complete paperwork and visit any of its listings 24/7 using a mobile phone.

Some agents aren’t crazy about Opendoor’s approach to real estate. A few think it shouldn’t enable consumers to visit vacant homes at any hour, according to Hertzog. (Hertzog says the practice can create safety risks.)

But Scottsdale, Arizona-based broker John Wake, who has penned a blog post casting Opendoor as a “cool option” for some sellers, said he’s surprised that Opendoor hasn’t gotten “the full Zillow treatment from agents.”

Agents “seem fine with Opendoor,” he said in a comment on the Facebook group Inman Coast to Coast.

Editor’s note: This story has been updated to correct that Opendoor conducts home inspections after a seller accepts its online offer. A previous version of this story incorrectly stated that Opendoor conducts home inspections before finalizing an offer.

![How hybrid brokerages are changing real estate [Special Report]](https://inmansandbox.imgix.net/wp-content/uploads/2015/07/hybridreportheader-1024x454.jpg?fit=crop&crop=entropy&w=266&h=188&usm=20&usmrad=4&auto=format)