- Home price appreciation is predicted to slow in markets with tight inventories

- Less expensive, inland markets will account for a higher volume of sales

- Housing affordability will drop to 27 percent in the state next year

In 2016, home sales volume in the Golden State will outpace 2015 totals by nearly 26,000 closings.

According to a California Association of Realtors housing forecast, 433,000 existing homes will sell next year, with overall activity rising by 6.3 percent year-over-year.

If the projections are accurate, 2016 is shaping up to be the best year for sales activity since 2012, when 439,800 homes sold.

[Tweet “California Association of Realtors: 2016 will be the best year for home sales activity since 2012.”]

“Demand in less expensive areas such as Solano County, the Central Valley, and Riverside/San Bernardino areas will remain strong thanks to solid job growth in warehousing, transportation, logistics and manufacturing in these areas,” said Chris Kutzkey, president of the association.

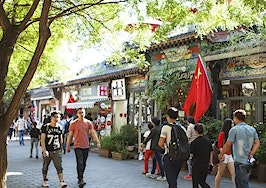

Jeffrey M. Frank / Shutterstock.com

Solano County sits between San Francisco’s East Bay and Sacramento. Its largest cities are Vallejo, Fairfield and Vacaville.

In the Central Valley, sales activity should be highest in Bakersfield, Fresno and Modesto.

“In regions where inventory is tight, such as the San Francisco Bay Area, sales growth could be limited by stiff market competition and diminishing housing affordability,” Kutzkey added.

More sales activity shifting to inland regions will temper statewide median home price increases.

The forecast calls for a 3.2 percent increase in home prices next year, which would be the slowest rate of appreciation seen in the last five years.

This year, California’s median price will have grown by 6.5 percent year-over-year. In the previous three years, appreciation of 9.8 percent (2014), 27.5 percent (2013) and 11.6 percent (2012) occurred.

In 2016, the median home price is predicted to reach $491,300, which means affordability will remain an issue despite tempered appreciation.

In short, half of the homes considered affordable in 2011 and 2012 are no longer in that category, as the percentage of homes considered affordable will drop to 27 percent next year.

The association also expects fixed rates on 30-year mortgages to reach 4.5 percent.