- PNC Bank's Insight Planner is part of a larger trend toward total cost-of-homeownership property search.

Homeownership is a lot more expensive than just your monthly mortgage principal and interest payments, what with property taxes, homeowner’s association (HOA) dues and other costs.

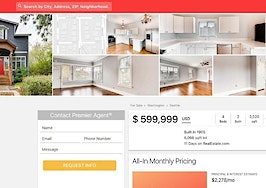

Some new search tools are built with this in mind, prompting users to browse listings based on monthly housing budget, rather than list price.

PNC Bank’s Insight Planner marks the latest tool to fit this mold. It debuted only a week after the launch of another site that could popularize budget-based search, Zillow Group’s RealEstate.com.

Before homebuyers can begin browsing listings with Insight Planner, they must “build a budget” by entering their household income, number of household members, debt, monthly living expenses and income and payroll taxes, among other variables.

Listing search results represent properties in relation to a user’s housing budget. For example, for a buyer with a housing budget of $2,000, the listing result for a home with a monthly cost of $3,000 would indicate that it’s $1,000 over budget.

Housing cost estimates are based on mortgage principal and interest payments, mortgage insurance fees, property taxes, property insurance and HOA dues (if applicable). Utility costs aren’t included in housing cost estimates, but they appear separately on listings.

PNC Bank’s housing budget builder

Users can save their favorite homes and choose to “start a conversation” with a PNC Bank loan officer when they’re ready to take the next step, potentially generating mortgage leads for the bank. They’re also invited to contact a home’s listing agent.

TLCengine pioneered budget-based property search. Its “True Lifestyle Cost” represents a cost estimate that, in addition to housing costs, factors in commute costs, auto insurance and even child care (if applicable), among other expenses.

TLCengine’s platform powers the public-facing search tools of multiple listing services representing around 83,000 real estate agents.

PNC Bank offers two other online homebuying tools.

Home Insight Tracker lets customers receive loan status updates, upload loan documents and communicate with a loan officer.

PNC AgentView provides real estate agents with a window into a client’s loan application with progress updates and a weekly status update for all clients working with PNC.