Modern consumers love their craft breweries, coffee shops and retail boutiques. But they also can’t say no to the convenience and scale of the robust Amazon Prime. In the real estate industry, you could say there’s a comparable David-and-Goliath competition between the nimble indie brokerages and giants the likes of Keller Williams Realty, Century 21 Real Estate, Coldwell Banker Real Estate, Re/Max and Berkshire Hathaway HomeServices. Though they tend to be smaller, to label indie brokerages as underdogs based on size might be a stretch. As one independent Kentucky broker put it: “Craft is cool right now. We feel that consumers trust independent brokerages more.”

Modern consumers love their craft breweries, coffee shops and retail boutiques. But they also can’t say no to the convenience and scale of the robust Amazon Prime.

In the real estate industry, you could say there’s a comparable David-and-Goliath competition between the nimble indie brokerages and giants the likes of Keller Williams, Century 21 Real Estate, Coldwell Banker Real Estate, Re/Max and Berkshire Hathaway HomeServices.

Though they tend to be smaller, to label indie brokerages as underdogs based on size might be a stretch. As one independent Kentucky broker put it: “Craft is cool right now. We feel that consumers trust independent brokerages more.”

Register for the Indie Broker Summit

While mega real estate companies continue to snatch up smaller brokerages throughout the country and grow ever bigger, indies remain a substantial life force of the industry.

Collectively, indies pack a punch — over half of Realtors today (51 percent) are affiliated with an independent company, according to the National Association of Realtors (NAR) 2016 Member Profile.

As Inman’s 2015 indie brokerage Special Report noted, from 2013 to 2014, the percentage of agents at independent firms jumped from 52 to 54 percent.

Compare these numbers with 2006, for example, when the percentage hovered in the mid-40 percent range. The timing of this lift correlates with the end of the recession, when the benefits of a more flexible business model were highlighted by the housing crisis, and the total number of indie brokerages rose.

What makes the independent path attractive in 2017? Above appealing to millennial consumers and touting local market expertise, an indie brokerage’s local control over branding and technology — which in turn gives agents a sense of ownership — is considered the top reason today, according to Inman’s most recent Special Report survey on the threats and advantages of this model.

The entrepreneurial founders of these firms believe they will be the ones to set the direction of the real estate industry, with the flexibility to try new things and change strategy on a dime. But they must do so without the national exposure, brand recognition, access to enterprise-scale technology and other perks that come with being part of a large franchise brand.

Free to be indie

Of the real estate professionals who went independent in their careers, over half said they felt more profitable as an independent (55 percent).

Indie brokers and agents also like having total control of branding decisions at their firms (53 percent) and are motivated by wanting to build their own brand (52 percent).

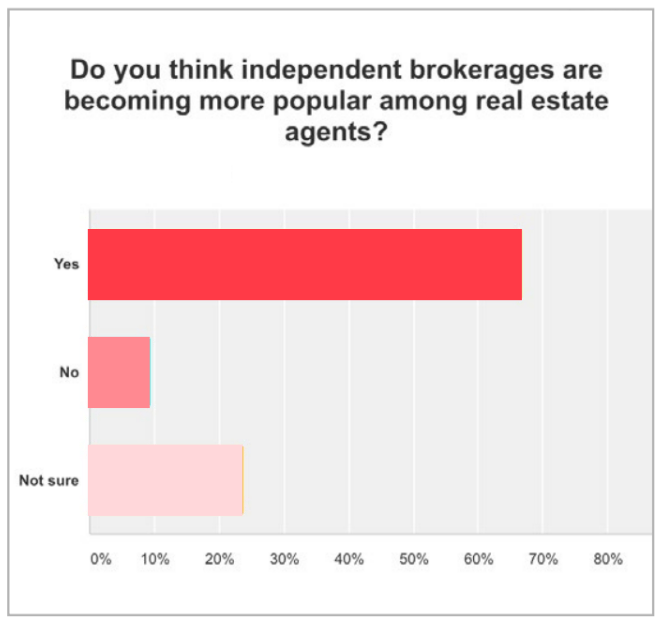

Nearly 56 percent of respondents (coming from both the franchise and indie sphere) felt that independent brokerages were becoming more popular among real estate agents, while 21 percent did not think so, and nearly 23 percent were not sure.

The deal that independents can offer agents is more sustainable, one broker argued, because it sets agents up to be their own business generators: “Broker distribution of leads is a broken model — a race to the bottom. We teach our agents how to generate leads and run their business, which sets us apart from a lead factory. To the consumer, we are seen as professionals and not sales people who are out for themselves.”

Either running or working in an independent brokerage gives you an “opportunity to innovate beyond the 100-year-old brokerage model that most of the franchises operate within,” said a successful Pennsylvania-based independent broker.

To make this business model work, however, respondents said that a visionary leader (26 percent) is the most important factor driving indie brokerage success, followed by recruiting and retaining high quality agents (18 percent).

Franchise vs. indie: Who’s got the edge?

According to survey respondents across the real estate industry, the top advantages in running an indie brokerage are not having to pay franchise fees (68 percent) and the ability to be nimble (67 percent). Respondents also cited more in-depth local knowledge (39 percent) and a better support ratio (36 percent).

Among independent brokers only, the most popular benefits cited were the ability to move more quickly (84 percent) and adapt to changing local market conditions, and the opportunity to come up with customized solutions to problems (74 percent).

Over 60 percent said they could offer a higher level of service to their customers as independents, while more than 50 percent felt they could offer a high level of sales support to their agents.

Indie brokers also said they could offer their agents better technology suited to their market (52 percent), and that their agents had a higher buy-in to the firm because they felt a sense of ownership (42 percent).

An independent Atlanta-based broker spoke of “the freedom and flexibility” for indie brokers “to envision their own operation and make it come to life with their ideas.”

Other independents want to avoid the “headcount mentality,” and the pressure from “absentee shareholders.”

Respondents also commented that independents were appealing to agents, where they’re not pushed as hard to meet production goals and have more freedom to develop their own marketing style.

While the softer benefits of the independent brokerage are persuasive to some, for others it comes down to the financials.

“Why spend my money advertising a big brokerage’s name where my advertising could send leads to someone else in the brokerage?” said an indie broker from Indianapolis. “Paying a big brokerage $100,000 a year for a name doesn’t do anything for my business.”

Register for the Indie Broker Summit

But just as getting started as a mom-and-pop wings shack might be more difficult than opening up a new Chick-fil-A, so too does name matter in the real estate industry. The most powerful card a franchise holds is brand recognition (75 percent). Training (48 percent), scalable technology (40 percent) and a bigger reach (39 percent) were the other top advantages respondents selected.

“A franchise brand still has local in-depth knowledge since they do pull their agent base from the local market,” one respondent noted.

Franchisors also offer a better network of top-producing agents to mastermind with, said another, and relocation referrals flow more abundantly at the big-name brokers. A company based in New York sending executives to Austin, Texas, for instance, would be more inclined to use a nationwide brand to help its staff members than to find a local brokerage.

– Kentucky-based indie broker

“Independent brokerages are seen as more boutique specialists able to cater to a client’s special needs, while franchise brokerages are seen as volume brokers providing a more standard service to the masses,” said one Boston-based indie broker. Because franchise brands appeal to big markets, independent brokerages sometimes spend more time explaining their worth to those who don’t initially fit their niche client base, according to Inman’s research.

Culture: Intentional, creative and team-oriented

A company’s culture is crafted by a number of factors — a firm’s collective makeup of personalities, work environment, mission and values, ethics and shared behaviors — some of which develop organically while others are handed down or created at the top.

An indie firm’s unique, thriving culture is the biggest attraction for agents, independent-affiliate survey respondents said (41 percent), followed by offering a place that supports agents’ brands (20 percent).

Culture tends to be more intentional, creative and team-oriented at indie brokerages because like-minded hires are chosen with care, according to the survey.

“We are a tight-knit, limited group of agents that are highly performing and work well together as a small team,” said a Washington state-based independent managing broker. “We do not want additional members unless they fit my very specific criteria.”

“We are a tight-knit, limited group of agents that are highly performing and work well together as a small team,” said a Washington state-based independent managing broker. “We do not want additional members unless they fit my very specific criteria.”

A successful Seattle-based indie broker added: “Our entire company works as a team with very large amount of support staff per agent to increase their personal ability to produce.”

Other factors serving as indie brokerages’ value proposition to agents included a unique business model, “informality,” mentoring and “zero micro-managing.”

A number of respondents mentioned 100% commission as the biggest perk, a model blazed by Re/Max (which now promotes a 95/5 split) that’s currently gaining major traction among indie brokers and agents across the country.

The white glove service factor

While culture draws in agents, indie brokerages position themselves to consumers as offering a high level of end-to-end customer service (45 percent) and as experts in the local market (29 percent).

Anecdotally, survey participants discussed how the flexibility to provide a certain kind of service tailored to young homebuyers can also be an advantage.

“I work primarily with millennials,” said an independent Charlotte-based broker. “They want a personalized experience, where they do not feel like they are being sold, and they can interact solely via technology.

“When I worked for a big brand, I could not provide that type of service to them because the brand had expectations of what I would do. On my own, I can do whatever I want.”

An indie broker-owner from Pennsylvania added: “The collective marketing power of the franchise gives it a significantly better presence in the market; however, their suite of services is based on a business model that is old, tired and because of their size, less appealing to younger clients.” Respondents indicated that older clientele may be disinclined to go with a “no-name” company, while a newer generation of buyers and sellers is looking for the best agent, regardless of his or her ties to a specific brand.

“The older clientele can take a bit more education as they feel that the brands have some ‘extra’ something,” said a Houston-based indie broker. “Once we explain that we all have the same MLS and set of tools, it makes for an easy conversation.”

An independent Honolulu-based broker added that “innovation, originality and privacy are commonly aligned qualities of an independent. Customers are seeking expertise and negotiation skills from an independent, personalized and customized perspective.”

A number of respondents felt that sellers — more than buyers — were interested in working with a recognized brand “due to national marketing reach and exposure.”

Still, many top producers have a loyal client base who would follow them anywhere: “If they are coming from another market, they may feel more attracted to a familiar brand, initially,” said the CEO of a Nashville-based indie brokerage. “However, as for repeat clients … NAR statistics show that they only remember their agent rather than the company the agent represented.”

A Keller Williams agent in Tennessee added, “In my market, the agent is more important than the firm. For example if I left my brokerage today, I believe I would retain at least 90 percent of my client base.”

One Chicago indie firm’s top producer thinks more and more people are shopping based on agent reviews and the individual agent’s sales experience rather than “the brand behind the agent.”

The struggle is real (estate): Indie and franchisor challenges

Both franchise-affiliated and independent-affiliated respondents were asked what agents struggle with the most at their brokerages.

In parsing out responses between the two groups, Inman’s survey revealed that among indie brokers, the two biggest challenges are a lack of planning (20 percent) and a lack of tech-savviness (16 percent).

Independents also specifically said they struggled with lead generation, brand recognition, strong competitors, a misconception that bigger brokerages offered more services and exposure, inventory, and the flood of new agents on the market.

Meanwhile, franchise brokers and agents indicated that a lack of motivation and drive (23 percent) — compared to only 10 percent of indies — and a lack of tech-savviness (22 percent) are what their agents struggle with the most. The results indicate that indie brokers could perhaps address systems and planning as a priority, while franchisors have work to do on inspiring agent motivation.

Brokerages were also kept busy responding to downward pressure on retained company dollars thanks to rising commission splits and the growing number of discount brokerages.

One indie respondent reported being nervous about recruiting in the first year of opening: “We’ve just recently opened our indie shop and aren’t recruiting yet, but I feel recruiting quality agents may be the difficult part. I’m not interested in any agent — only quality agents.”

David threatened by the industry Goliaths

Inman’s survey asked respondents to share what they thought was the biggest threat facing independent brokerages. Collectively, survey takers said that the ability to run a profitable business (22 percent) and competition from large brokerages and franchisors (19 percent) were the biggest threats.

But again, parsing out the results is interesting.

Independent agents and brokers said that the biggest threat to their own business model is competition from large brokerages and franchisors (21 percent), followed by profitability (16 percent).

That perception differs among franchisors, who cited profitability as indie brokers’ biggest challenge (37 percent), followed by lack of brand awareness (18 percent).

Register for the Indie Broker Summit

Some smaller operations mentioned the replacement of aging agents as a concern. One independent Nevada-based broker with over 100 agents said he worried about the “consolidation threats of larger firms, new real estate models of limited services and flat fees paid to the broker from agents.” Another respondent was concerned that large corporate and franchise models would “embed in the agent pool” and consolidate further.

– Mississippi-based indie broker

Large firms dominating industry policy was also a concern: “MLSs being run by franchises creating rules that hurt independents is a threat,” said one respondent.

A shift in the market might could also be a threat, thought one California independent: “With a market like we have now — when properties sell themselves and skills are not the differentiation — low fee independents work. When markets shift and require visibility, skills and credibility, big franchises can outlast us,” she said.

And the same threat that every small business faces also persists in real estate: Not all independent brokerage startups will survive. “Our area sees independent brokers come and go,” said an Ohio-based broker affiliated with a franchise brand. Many indie brokers offer “deep discount fees” and don’t provide agent support. Eventually, they price themselves out of the market, and those who “stay in business increase their fees and splits with agents to survive,” he said.

Stop ‘trying to be the broker for all agents’

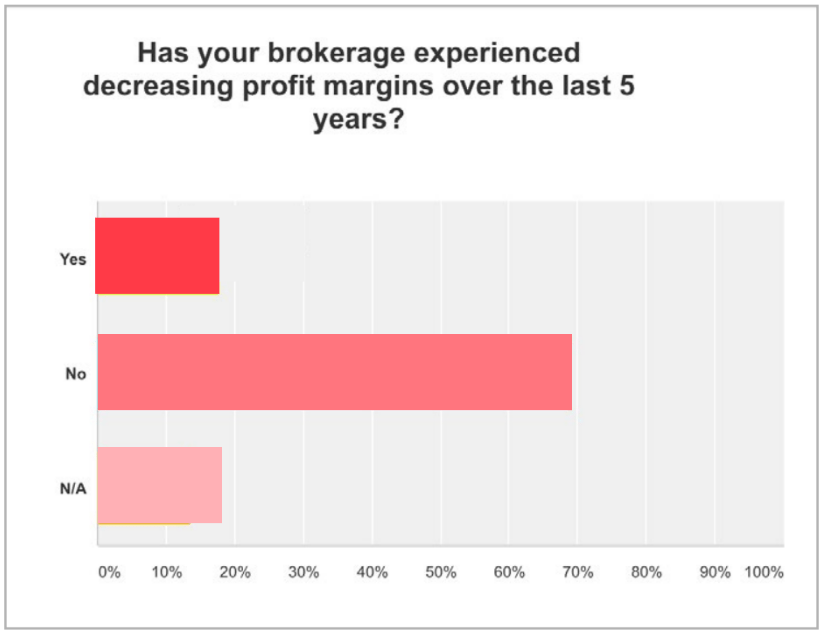

The majority (65 percent) of respondents — from both independent firms and franchises — said they were not experiencing a decrease in profit margins. Only 23 percent said they were experiencing a decrease, and they are taking steps to improve margins.

The results also showed that indies are faring better than franchisors when it comes to profit — 17 percent of indie brokers reported shrinking margins, compared to 30 percent of their franchise counterparts.

An independent brokerage in Oakland, California, is recruiting agents with the most growth potential, making agents more accountable for their charges and doing a complete inventory of their vendors: “We are confronting some, firing others, renegotiating contracts, challenging invoices and thoroughly vetting any vendor before hiring,” the broker added.

One Nevada-based broker affiliated with a franchise brand said that the company had to stop “trying to be the broker for all agents” and, instead, invest time and money into those who fit the company culture. For one independent, Oregon-based broker, it was about becoming hyperlocal, focusing on the largest community and marketing heavily in that area.

For some indie firms, leaving a franchise is what improved their margins: “We left a franchise and went independent over four years ago to retain and grow our profits,” said one Nevada-based company owner. Another Georgia-based broker left a franchise brand in December 2016 to open an independent team brokerage and has been more profitable in 2017. She said that “every expense is measured by return on investment.”

Tempted by the forbidden franchise?

Twenty seven percent of independent brokers and agents say they are courted monthly by franchise brands; 22 percent are courted quarterly; and 11 percent are courted weekly. Even so, 91 percent of independent brokers aren’t affiliated with a franchise brand because they “didn’t see the value.”

We asked what it would take for an independent brokerage to consider affiliating with a franchise. While the survey revealed that 45 percent would never affiliate with a franchise brand, 18 percent said they would if they were set to retire and didn’t have a leadership transition in place; and 15 percent claimed they’d consider affiliation if they had an interest in growing their agent count with scalable technology and other business tools. A handful of independent brokers said a 100-percent commission brokerage might tempt them.

The need for geographical expansion would convince 4 percent to consider a franchise’s offer. Owners of independent companies find it more challenging to win business outside their network once they move into new territories, but they have no problem competing with franchises within their own market, said one independent Toronto-based broker.

A number of those surveyed said they tried the franchise route but did not enjoy the experience.

One Seattle independent broker was affiliated with a franchise for several years, but the alliance lead to more financial burdens than gains. After that experience, the broker said future franchising would have to come with an annual option to leave, and the franchise would have to prove it was increasing revenue to the company rather than wasting money on fees and other expenses.

‘Money talks and BS walks’

What could a franchise brand do to make itself more appealing to an indie firm? “Nothing” was the most common response from independent players in the survey, but some elaborate:

“Nothing would make a franchise brand more appealing to me personally,” said one Georgia broker/owner. “Co-mingling my brand with a franchise brand only adds layers of bureaucracy and confusion for the consumer.”

Register for the Indie Broker Summit

A Mississippi-based independent broker — with a large firm — who is courted regularly by brands explained why the franchise format doesn’t work in real estate, in his opinion:

“A franchise is a packaged business that the owner can just plug in and rely on systems put in place. I think that works great for a restaurant. But not for real estate. It has been successful but I think it has been artificially so. The ’80s and ’90s were the times of franchises. Everything got franchised. I think real estate is inherently local and so the benefits of a franchise in this industry are minimal.”

A number of other suggestions included lowering their costs, increasing their lead generation models, being quicker to change and offering more local control. An “honest to goodness CRM” was one plea, and another person suggested for franchises “not to be stuck in the last decade.”

One popular request was for franchises to have training programs that aren’t so cookie cutter; another was to give agents more independence to decide what they charge and how they brand.

“Money talks and BS walks,” said an independent Florida broker who gets frequent approaches from franchises that just want to offer an “override” on what your agents bring in. “Purchase my firm with actual money,” he advised.

One independent Detroit broker said franchises would be smart to incorporate a human touch: “I would like to see them truly care about my business, our culture and the agents,” he said. “Make it less of a money grab. Stop looking at agents as just a cap.”

Franchisor technology: ‘I’m so fancy’

There is an assumption that the tech offered at franchise firms is better than what independents can afford.

Sixty five percent of survey takers said they believe franchises have more sophisticated technology, while 35 percent believe independent brokerages do.

Some indie brokers say these numbers shouldn’t deter people from starting their own brokerages. One North Carolina-based agent affiliated with an indie broker said she not only has much better technology there than she did with the “big brand,” but she has a much better command of it as well.

Another bonus of being affiliated with an independent brand is having the option to avoid sales meetings and time-blocking for cold calls and handwritten notes. If you’re an agent who needs to do those things, you still can; but this self-proclaimed “one-woman band” dedicates her time to the referrals and past clients who make up her 90 percent lead conversion rate: “The only people I talk to are people who want to work with me and are ready to do it right now,” she said.

An indie broker from Washington state said tech solutions need a focus on quality not quantity. Available technology is scalable but off the shelf, and large brokerages are “usually following tech, not creating it,” said the broker.

Some respondents argued that tech has made it less necessary for indies to join forces with franchises as it has leveled the playing field: “The game has changed — the internet has allowed talent to trump brand,” said an experienced Miami broker who has taken the independent route. Tech allows smaller firms to be more lithe and adapt to changes more quickly, said a broker affiliated with a franchise firm.

The word from indie experts

If you are thinking of taking the independent route, don’t stress about leaving behind the franchise’s tech support, says Becky Babcock, co-founder of Path & Post Real Estate, an independent brokerage based in North Atlanta.

Becky Babcock

Babcock’s team at ERA Sunrise Realty was no. 1 in the ERA franchise system until leaving in early 2016. When affiliated with the franchise brand, her team deviated from the franchise-offered technology, which was one sign that they were ready to move on.

Babcock is thoroughly enjoying the experience of being independent. “Being locally owned and operated — we have the freedom to innovate and the agility to react,” she said, adding that it’s difficult to turn a franchise cruise ship around when you want to make changes.

Independent-affiliated survey respondents also cited the following technologies as having the biggest return on investment for their firm:

- Matterport (creator of 3-D virtual tours)

- DocuSign (e-signature and digital transaction software)

- BoomTown (CRM and lead generation)

- Contactually (CRM)

- Top Producer (CRM)

- Realtors Property Resource (real estate database)

- Follow Up Boss (lead management software)

When it came to the top platforms for tracking production and revenue for their business — both at the broker and agent level — many indie respondents

Vanessa Bergmark

mentioned QuickBooks and BrokerWolf.

There are some small brokerages that feel they need support with branding, legal aspects or lead generation marketing; however, many independent brokerages have strong systems in place that put them on par with franchises operating at very high levels.

Vanessa Bergmark, owner of fast-growing California independent brokerage Red Oak Realty, based in Oakland and Berkeley, sees indie brokers leading industry innovation.

Everyone should be prepared for shifts and thorny transitions; but many franchise leaders don’t expect change, Bergmark said, asking: “Why would you if you’ve been at the top of the food chain for so long?

“It’ll be the next group of agents who are going to come in and make a difference,” she said. And some of indies have plans to venture into franchise land.

“Why go somewhere else?” said a Pennsylvania-based independent broker when asked if he would ever move to a franchise. “We believe our business model is so unique that we will become a franchise brand in the future.”

Register for the Indie Broker Summit

The full Special Report features a series of indie broker profiles in addition to the report findings. View it here!