- Pacific Union International is aggressively gobbling up market share in the Golden State through mergers and acquisitions.

Today San Francisco-based Pacific Union International formally announced its intent to merge with Partners Trust, an independent luxury brokerage with more than 240 associates in the Los Angeles area. The merger is expected to close next week. Terms of the deal were not disclosed.

This is the second L.A.-market merger for Pacific Union in the last eight months, following its December 2016 consolidation with Beverly Hills-based John Aaroe Group.

Together with Fidelity National Financial, Pacific Union also has a controlling interest in L.A.’s Gibson International and in 2015 scooped up San Francisco-based The Mark Company, illustrating the independent heavyweight’s trajectory in joining forces with sizzling boutiques that serve the hottest markets in the Golden State. CEO Mark McLaughlin signaled there is more to come as the company builds its presence in the California and creates what he calls “the real estate firm of the future.”

The merger creates the largest independent luxury real estate brokerage in California by sales volume, according to a joint press release put out by the companies.

“We expect to execute four additional mergers in the months ahead — two in Northern California and two in Southern California — and we forecast projected sales volume in 2017 in excess of $15 billion,” McLaughlin said. That’s up from the combined brokerages’ 2016 sales volume of $12.61 billion.

“We will continue to focus on recruiting and retaining top real estate professionals and providing an exceptional level of client service in both Northern and Southern California,” he added.

It’s no secret that California real estate is on fire; prices are sky-high and competition among brokerages looking to grab a bigger slice is fierce. Last week, another independent giant — 110-year-old Douglas Elliman — announced the acquisition of Los Angeles-based Teles Properties to expand Elliman’s toe-hold in the Southern California housing market — so it appears the race is on.

Matthew Perry’s Hollywood Hills architectural listed for sale by Partners Trust, Photo credit: Michael McNamara/Shooting LA

The merger, bringing the combined agent number to 1,447, takes the brokerage to 47 offices in Northern and Southern California, according to Pacific Union.

The perfect time to merge

Partners Trust was founded in 2009 by Nick Segal, F. Ron Smith, Richard Stearns and Hugh Evans. With a 2016 sales volume of $2.47 billion, it has produced total sales of more than $10 billion since its debut. The firm has offices in Beverly Hills, Brentwood, Santa Monica, Ocean Park, Malibu, La Cañada Flintridge and Pasadena.

Why was the timing right for Partners Trust?

“The real estate business continues to evolve and is doing so faster than ever,” CEO Nick Segal said. “Uniting with Pacific Union allows us to create the largest independent real estate brokerage in California and the dominant force in the Los Angeles real estate market — all while maintaining the nimbleness of a neighborhood-focused, independent brokerage.

“We immediately strengthen our position as a market leader, deepen our marketing and technology tool chest and expand our global reach. It allows us to create the most ideal road map for the ultimate client experience in Los Angeles,” he added.

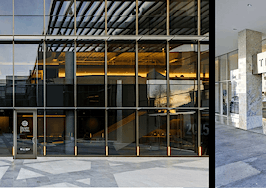

- Pacific Union International’s Marin County Listing Pairs Contemporary Architecture with Redwoods, Photo Credit: Jacob Elliott

McLaughlin said he admired Partners Trust’s impressive year-over-year growth as well as its principles of integrity and trust with its clients.

As a result of the merger, Partners Trust will extend its new development business in Los Angeles’ new condominium market with The Mark Company, Pacific Union’s urban sales and marketing specialist.

John Aaroe Group and Partners Trust will continue to operate as separate brands with current leadership remaining in their respective Los Angeles offices.

Partners Trust will incorporate Pacific Union’s marketing and business intelligence assets into its real estate practice as John Aaroe Group has done.

“We’ve seen a dramatic 30 percent year-to-year increase in sales volume as a direct result of our merger with Pacific Union in 2016,” said John Aaroe, founder and president of John Aaroe Group.