- A low-income housing group released a report last week that says the mortgage interest deduction (MID) disproportionately benefits wealthy homeowners and proposing three big changes.

- It suggests reducing MID-eligible mortgage amounts from $1 million to $500,000, introducing a 15-percent capped tax credit, and reinvesting the savings from these proposals into affordable rental housing.

- NAR believes tweaking the MID "amounts to a de facto tax increase on current or future homeowners."

How can the United States tackle the increasingly problematic issue of homelessness and housing poverty?

The National Low Income Housing Coalition (NLIHC) thinks that reforming the mortgage interest deduction (MID) is the way to move forward. But it’s going to have to lobby against the National Association of Realtors (NAR), which released a study earlier this year that showed taxes for middle-income homeowners (earning between $50,000 and $200,000 annually) rising instead of falling if MID is reformed.

What is the MID?

When most people buy a home, they use a mortgage loan to do it — and the bank charges them interest on that loan, which they pay over the loan’s lifetime (15 or 30 years are most common).

One of the perks of homeownership is that this mortgage interest is tax-deductible — so when homeowners prepare their taxes before April 15, they can reduce the amount of money they owe by what they paid on mortgage interest in the calendar year.

This isn’t the first time that a group has looked at tweaking the MID for one reason or another. The biggest criticism of the deduction is that it disproportionately benefits more wealthy taxpayers rather than middle-income and lower-income homeowners, especially because many middle-income and lower-income homeowners choose to take a standard deduction instead of itemizing their taxes.

But NAR, which has been protecting the MID for years, believes that changing the deduction would essentially result in a tax increase on homeowners.

The argument for killing MID

The NLIHC report, “Reforming the Mortgage Interest Deduction: How Tax Reform Can Help End Homelessness and Housing Poverty,” argues that most homeowners don’t take advantage of the MID — and those that do tend toward the higher-earning income brackets.

“The nonpartisan Congressional Budget Office (CBO) reports that 75 percent of the benefits of the MID go to the top 20 percent of earners,” the report states. “In fact, 15 percent of the benefits of the MID, or nearly $11 billion each year, goes to the top 1 percent of earners, the wealthiest households in America.

“Everyone else gets almost nothing.”

The report adds that the MID does not help increase the number of homeowners, but it does help increase the amount of mortgage debt that homeowners are willing to saddle, especially in the upper income brackets: “Economists agree that the MID does little to promote homeownership. Higher income households that benefit from the MID would likely choose to buy a home regardless of whether they receive a tax break. Instead, the MID incentivizes these higher income households to take on larger mortgages; greater mortgage debt results in more mortgage interest eligible for a tax break.”

What should be done?

The NLIHC has three suggestions for how the MID should be adjusted to better promote homeownership across all income levels.

1. Currently, mortgages up to $1 million are eligible for the MID. The report suggests that this amount be reduced to $500,000, which NLIHC believes will generate $87 billion in savings over 10 years.

2. Instead of a deduction, the report recommends a 15-percent capped tax credit, which it believes more people will take advantage of — many homeowners do not itemize their deductions, which means they don’t use the MID, so a tax credit would also benefit those citizens.

3. If these two changes are made, the report estimates $241 billion in savings, which it recommends be reinvested “over 10 years into affordable rental homes for families with the greatest, clearest housing needs.”

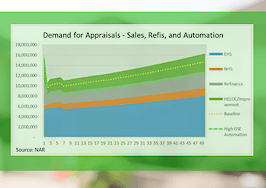

Here’s how the coalition thinks those savings will break down across household type.

But not everyone thinks there’s a problem with the MID, and that includes NAR. The association would prefer that legislators leave the deduction alone, thank you very much.

“Realtors are committed to protecting the current federal tax provisions that benefit real estate and have strong objections over proposals that further cap or limit the deductibility of mortgage interest,” said NAR President William Brown in a statement.

“Limiting the mortgage interest deduction amounts to a de facto tax increase on current or future homeowners. NAR’s commissioned study earlier this year revealed just how damaging this would be: homeowners with adjusted gross incomes between $50,000 and $200,000 would see their taxes rise by an average of $815. That’s on top of the fact that 83 percent of U.S. Federal income taxes are already paid by homeowners.

“The MID is an important benefit not just for the millions of current homeowners who depend on it, but also for renters looking to make the transition into homeownership. Current and future homeowners should be very wary of proposals that double the standard deduction and reform the MID,” he concluded.