Tax rates for agents and brokerages could significantly decrease and the mortgage interest deduction (MID) could become ever more elusive to homeowners under a tax reform plan unveiled Wednesday by Congressional Republicans and the Trump administration.

In what could be a boon for some real estate companies and a potential bust for homeowners, the proposal calls for reducing the tax rate on limited liability companies and other so-called pass-through entities to 25 percent while potentially jeopardizing a $70 billion annual tax expenditure by doubling the standard tax deduction, experts said.

Additionally, tax credits for low-income housing would be taken off the table.

“The idea that this plan would help average Americans instead of the wealthy and big corporations has been a hoax all along,” Frank Clemente of Americans for Tax Fairness told CNBC, echoing many real estate lobbying groups and Democrats who overwhelmingly panned the proposal. “This isn’t tax reform, it’s a big giveaway to millionaires and corporations and it won’t trickle down to the rest of us.”

Short on details and broad in scope, the proposal, negotiated over several months among a group known as “The Big Six,” including Treasury Secretary Steve Mnuchin, National Economic Director Gary Cohn and top House and Senate Republicans, would lower corporate rates from 35 to 20 percent while slashing the number of personal tax brackets from seven to three. Without going in to detail, the business-friendly tax plan also recommends terminating deductions on domestic production and increasing the child tax credit.

Despite the proposal’s preservation of the MID in practice, realty groups and housing advocates, claim standard tax deduction increases threaten what benefit the MID offers to middle-class homeowners by rendering it far more regressive — and out of reach to all but the wealthiest of Americans. National Low Income Housing Coalition officials instead recommended reducing tax break eligibility from $1 million to $500,000 and converting the deduction into a credit, which they estimate would positively impact 15 million mortgage holders who currently do not benefit from the deductions.

“This proposal recommends a backdoor elimination of the mortgage interest deduction for all but the top 5 percent who would still itemize their deductions,” said National Association of Realtors President William Brown in a statement issued Wednesday, echoing concerns the group voiced in May.

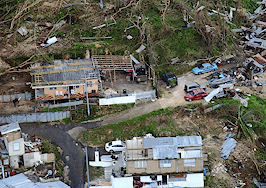

“When combined with the elimination of the state and local tax deduction, these efforts represent a tax increase on millions of middle-class homeowners. That tax increase flies in the face of a reform effort ostensibly aimed at lowering the tax burden for Americans. At the same time, the lost incentive to purchase a home could cause home values to fall.”

Steve Cook, a real estate communications consultant, added that effectively nullifying the MID could threaten the economy by reducing tax incentives for homebuyers.

“Recent studies show that the mortgage interest deduction raises the value of homes and the buyer power of homebuyers by about 20 percent,” Cook told Inman via email.

Brokerage firms and development companies, meanwhile, would likely benefit from lower tax rates planned for pass-through entities — those sole proprietorships, partnerships, LLCs and S-corporations so named for the profits and losses that “pass” directly to private owners, as opposed to public corporations, experts said. Approximately 95 percent of all American businesses are considered “pass-through.”

“This framework is focused on supporting American jobs, on making taxes fairer and on growing families’ paychecks,” Senate Majority Leader Mitch McConnell said in a statement issued Wednesday shortly after the proposal was made public.