- Renters believe it's a good time to buy, but are unable to save because of rent growth and high home prices outpacing income.

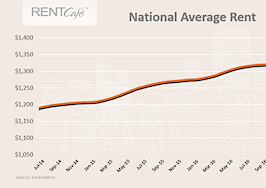

According to the RealPage Q3 supply and demand report, the national average rent has increased by 0.9 percent month-over-month and 2.6 percent year-over-year, bringing the average rent to $1,316.

Sacramento remained the rent growth leader in Q3 with 6.9 percent annual growth, followed by Las Vegas with a 5.8 percent year-over-year hike.

Meanwhile, cities such as Atlanta (3.5 percent); Dallas (2.8 percent); and Charlotte, North Carolina (2.5 percent); which are usually rent growth leaders, are absent from the Q3 list thanks to increased rental construction.

Apartment occupancy is at a robust 95.5 percent. Even in markets with the highest rent growth, such as Sacramento and Minneapolis, rental occupancy rates are at 97.0 – 97.9 percent, but overall rates are expected to slide at the end of the year.

Occupancy typically peaks in the third quarter and then falls off a bit due to seasonally slow leasing at the end of the year, according to Jay Denton, vice president of RealPage’s Axiometrics group. “We have some concern about how much occupancy could deteriorate during the next few months, given big blocks of new supply are set for delivery during the seasonal leasing lull,” he said.

RealPage’s assessment aligns with other studies that revealed renters are opting to avoid the uber-competitive (and expensive) housing market even in the face of moderate rental growth.

In the National Association of Realtors’ (NAR) latest Housing Opportunities and Market Experience (HOME) survey, renters said even with rent increases they’d resign their lease (42 percent) or find a cheaper rental (44 percent) instead of buying a home.

NAR Chief Economist Lawrence Yun said renters are deciding to stay put because income growth isn’t keeping up with home price growth, the latter of which has risen for a consecutive 66 months to a median average of $253,500.

While renters believe it’s a good time to buy, their ability to put aside savings for a home purchase has been negatively impacted by rent and home prices that have outpaced incomes in the past few years, Yun explained. And this trend is likely to spill over into next year as these factors continue to hold back renters who would prefer to be homeowners.