Every year, the National Association of Realtors pours ever-more millions of its members’ dues into a for-profit subsidiary that has never produced a profit and which 88 percent of its members don’t use regularly.

By the end of this year, that subsidiary — Realtors Property Resource (RPR) — will have inhaled nearly $180 million since its inception. Where exactly does that money go?

According to NAR, “the vast majority of RPR’s budget is devoted to technology to create, manage and grow” its property information database.

But who is building that technology? An Inman investigation has found that — for the most part, it’s not RPR. The company has 85 employees, about 20 of which are devoted to tech. But few of those people are software developers or engineers — the “coders” that bring RPR’s software into being. From their LinkedIn profiles, most appear to be project managers and analysts.

Inman has found that the developers who work for RPR are nearly all independent contractors. At least 19 contractors from four different consulting firms are currently working for RPR, according to our findings, and there are likely more.

In companies big and small across industries, outsourcing isn’t uncommon and can be an effective way to get work done. So why do these inconsistencies matter? At least a few intertwined reasons: transparency, money and the sluggish pace at which RPR appears to be operating.

First, RPR’s finances are a mystery to virtually all of the 1.3 million Realtors who pay for the company’s existence. NAR only provides select groups of members with information about how the company spends its money — and none of those groups include the NAR board of directors.

In addition, RPR has not been forthcoming to the industry or Inman about the fact that its technology — including the Advanced Multilist Platform (AMP) and Upstream — isn’t being built in-house.

Marty Frame

RPR President Marty Frame told Inman that “never more than a handful” of tech contractors work at RPR and therefore only 20 or 25 people total — employees and contract workers combined — were dedicated to tech. But the number of tech contractors we identified, at least 19, plus the 20 RPR tech employees, totals nearly 40.

Frame also said no consultants worked on AMP and Upstream “on a standing basis,” which we also discovered to be not correct.

When asked whether he could provide an estimate on how much of RPR’s funding goes to contract companies, Frame said, “I’m not even sure I have an estimate because it’s not a relevant enough portion of our budget.”

With five tech contractors or less, that may have been the case. But with a small army of at least 19 contractors, most of them software developers based out of RPR’s office in Irvine, California, where developers routinely make more than $100,000 per year, conservatively — “not relevant enough” is questionable.

At this time, it’s unclear why Frame did not accurately convey the structure of RPR’s tech resources to Inman. Frame and other RPR executives stopped responding to Inman’s questions when we confronted them with evidence of the inaccuracy of Frame’s statements.

Bob Goldberg

NAR leaders meet at the trade group’s annual conference this week in Chicago, from Nov. 1 through 6. According to NAR, its new CEO Bob Goldberg has already begun his promised assessment of RPR to see if the value it provides justifies the money spent on it.

Whatever he and NAR leaders decide, Realtors are looking to Goldberg to fulfill his inaugural pledge to “knock down the ivory tower facade of NAR” and improve transparency with members.

‘Bring some value that our members see’

Founded in 2009, RPR provides a comprehensive parcel-based database of more than 166 million properties and data tools to all of the nation’s Realtors at no additional cost.

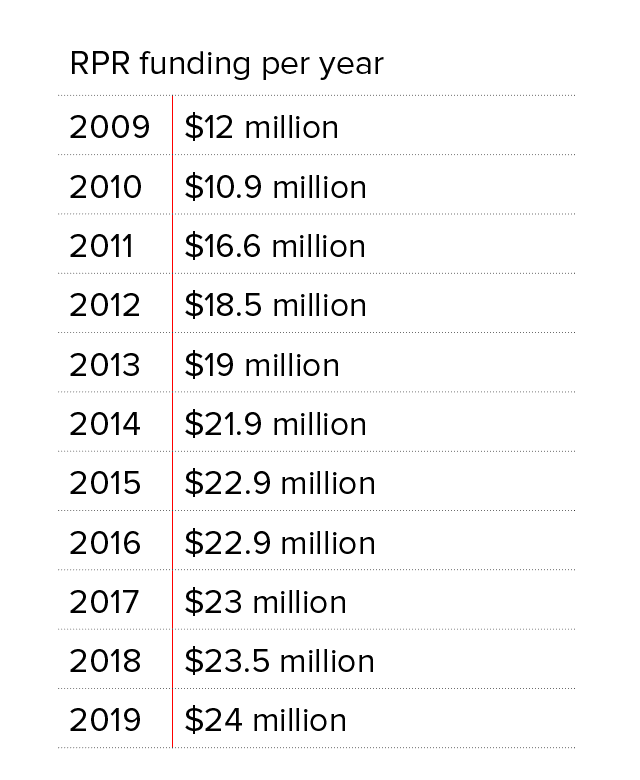

The company makes up 12 percent of NAR’s operating budget. From 2009 to the end of 2017, NAR will have spent $167.7 million on RPR, according to NAR Finance Committee reports, and nearly $180 million if you include the $12 million in funding approved in May, to be carved up among two quasi-independent projects, AMP and Upstream.

NAR has agreed to fund RPR to the tune of an additional $23.5 million in 2018, and the company is asking for an additional $24 million in 2019.

RPR was built on promises. First, that it would be self-sustaining three years after its launch, eventually generating $60 million to $80 million in annual revenue by offering lenders and government agencies comprehensive and accurate analytics products powered by public property records and MLS data. That plan didn’t pan out.

Then, the ideas for Upstream and AMP came along, and NAR saw new opportunities for revenue as a vendor. Upstream was conceived as the starting point and command and control center for all broker data, acting as the middleman between brokers and data recipients, including the 700 or so multiple listing services (MLSs) that they use to keep track of properties for sale.

AMP was to be a standards-based, back-end MLS database augmented with RPR’s property data. It would connect to various MLS “front ends,” the software that agents use to enter and edit listings, perform comparative market analyses, and other functions. These front-ends are typically included as a package with back-end MLS databases from MLS system vendors hired by MLSs. By separating the front-end from the back-end, AMP was supposed to let brokers choose which front-ends they wanted to use.

The funding NAR allocated to both projects in May is set to be exhausted by the end of this year.

Some high-profile members of NAR believe the money could have been better spent.

Cindy Hamann

“I believe NAR has wasted a lot of money on things that are not Realtor benefits,” said Cindy Hamann, a NAR director and chairman of the Houston Association of Realtors. “They could give Realtors Cloud CMA or DocuSign — that’s truly going to make a difference to the Realtor member.”

Hamann said she thought RPR could be good, but right now, NAR isn’t putting money toward something members are using.

While some consider RPR’s platform indispensable as a tool, they are in the minority. RPR’s platform currently has 150,000-plus “power users” (users that visit RPR more than once a month). That means only about 12 percent of Realtors use the tool on a regular basis.

Hamann, a real estate broker and 23-year Realtor, said part of this may be due to lack of awareness. She said agents don’t know what NAR does other than political lobbying.

“Bring some value that our members see,” Hamann said. “All they see is the dues going out. I’m happy that they fight for private property rights, but that’s just a part of it.”

Hamann encouraged NAR to think about key questions such as: “What does the Realtor need? What tools can NAR give the member to be more successful?”

She doesn’t think RPR and Upstream are it. “I think RPR has some good tools, but because I’m from Houston, we already have those tools and members use them,” she said, referring to RPR’s database for properties and associated data.

She believes new NAR CEO Bob Goldberg and President-Elect Elizabeth Mendenhall care how NAR is spending its money and the value it brings to members and is excited to see what changes they bring.

Where’s the sunshine?

When Goldberg became CEO he described his communication philosophy as “leadership in the sunshine,” which in practice means “tell everybody everything; keep them in the know,” he said.

This philosophy has apparently not yet trickled down to letting members in on RPR’s finances.

NAR’s 800 directors — the members responsible for informing their peers back home about NAR goings-on — do not receive a line-item budget for RPR when voting on whether to fund the company each year. They just see the overall figure RPR is requesting for the coming year.

Hamann said NAR should provide a line-item budget for RPR before votes. “How are we going to know what’s being spent?” Hamann asked rhetorically.

But NAR defended its decision to continue supplying only an overall budget to the directors.

“[U]nlike for NAR, line item budgets for RPR are not provided to the BOD as [RPR is] a wholly owned, for-profit subsidiary with its own board and governing bodies,” NAR spokeswoman Sara Wiskerchen told Inman via email, adding:

“The role of NAR’s 800 directors is to govern the association; while approving association expenditures of the association is part of the role, the responsibility for formulating and making specific recommendations concerning strategic and financial planning, investment management, and budgeting to oversee all of the association’s finances and resources falls to the Finance Committee. Their recommendations are reviewed and approved by the Budget Review Committee, Executive Committee and Leadership Team, as well as the larger BOD.”

The named committees and the leadership team review line-item budgets for RPR and include more than 60 members, Wiskerchen said. RPR’s own board of directors, which includes state and local association executives, MLS executives, and commercial and residential brokers, also reviews RPR’s budget line items in detail, she added.

“Their board regularly meets and reviews its budgets and financials in detail. The RPR staff also report annually to NAR’s Reserves Investment Advisory Board on its operations and financials,” she said.

At least one member of RPR’s board of directors was not happy in the role, however.

Bob Hale

Bob Hale, the Houston Association of Realtors’ well-known president and CEO, resigned from RPR’s board last week. Hale declined to comment for this story, but Hamann told Inman that in her opinion, Hale, whom she knows well, “just felt like he couldn’t make a difference and everything [at RPR] is already predetermined.”

Please NAR, I want s’more!

RPR asks for more money from the NAR board of directors every year. Why? According to NAR spokesperson Sara Wiskerchen:

“RPR continues to invest in and grow the technology to operate the database and analytics of the tool, and like all companies, it must also dedicate resources to annual maintenance and administration costs such as rent, insurance, utilities, salaries and benefits, and technology and data content licensing fees, so as the company grows more funds must be allocated to technology and operating expenses on an annual basis.”

Source: NAR

NAR declined to provide a percentage breakdown of RPR’s budget or to say what portion of the budget is devoted to technology. The trade group also declined to say how much of RPR’s budget goes to tech contractors. “RPR prudently makes use of subject matter experts as needed in their operations in the most cost effective and advantageous ways possible, whether employees or contractors,” Wiskerchen said.

However, there’s a chance things could change going forward. Currently a few months into his job, new NAR CEO Goldberg is in the midst of “working closely with Realtor leadership and staff to review all programs and how we provide the best value to our members,” Wiskerchen said.

“Of course, any future decision about funding RPR will go before NAR’s Finance Committee, the Leadership Team and our 800-member Board of Directors for them to weigh in,” she added.

Wiskerchen provided a few more general statements about how NAR was working for Realtors, but said NAR would decline further comment for this story.

Meet the happy contractors

Riad Bacchus is a project manager for Neudesic, a software development consultancy with hundreds of employees based in Irvine, California, around the corner from RPR.

He told Inman he’s worked for Neudesic since 2007. At that time, his client was an RPR precursor called Cyberhomes, owned by parent company Lender Processing Services Inc., but which NAR acquired for $12 million in 2009 and turned into the basis of its property database.

Marty Frame was general manager of Cyberhomes at the time, but he transitioned over to RPR as part of the acquisition and went on to become RPR President. Frame reportedly brought with him more than a dozen of the workers from the Cyberhomes team to help build out the RPR database. Three contractors have remained with the project since then, Bacchus among them, he told Inman.

Frame, for his part, did not volunteer a number, but said that when it came to contractors, “there are people we have worked with since our days as Cyberhomes more than a decade ago.”

Bacchus told Inman his job as a project manager is to make sure RPR’s engineering team remains on track with its projects, including the “core” RPR product and mobile app as well as Upstream and AMP. He describes himself as akin to a conductor who makes sure the various instruments in an orchestra work together in harmony and “make beautiful music.”

Bacchus confirmed the names of two dozen tech consultants who had either previously worked or were currently working for RPR and who Inman had also uncovered through our own reporting, including researching their profiles on LinkedIn.

Of those two dozen, Bacchus said 19 were currently working for RPR and 10 of them worked on Upstream and AMP. Ten of the 19 contractors are from Neudesic, six are with another tech consulting firm called Lateral Data Solutions, two are with a company called Toth Solutions and one is with a firm called Alphanuity. (These companies either declined to comment or did not respond to requests for comment.)

From an engineering perspective, consultants outnumber RPR employees, Bacchus said, but “we take our cues from them [RPR].” He said RPR staff decide what they want a product to look and act like, but that there is collaboration back and forth with contractors to come up with solutions.

Of those 19 contractors, maybe four have been working for RPR projects for less than a year, according to Bacchus.

“The RPR engagement is a very passionate engagement,” Bacchus said. “Our engineers tend to stay on for a long time,” some since the beginning, he said.

Bacchus said the way RPR treated its contractors made them want to stay on RPR projects for years.

“I’ve been part of gigs where consultants are treated like second-class citizens,” Bacchus noted. “At RPR they make a point of bringing you into the fold. There’s very little differentiation between staff and consultants.

“The work that we’re doing has impact on people’s lives. Realtors help a buyer and seller connect and buy the house of their dreams. [To] make that process more elegant and better for all the parties involved, it’s very rewarding.”

Mediocre reviews and a lawsuit alleging fraud

However, that’s not to say it’s all smiles in RPR contractor land. Reviews on Glassdoor paint Neudesic as a mediocre company. They include comments such as “this company seems solely interested in selling work with no plans to make the engagements a success” and “in the interest of profit, Neudesic has turned into a bodyshop, with people on deathmarch engagements for years at a time.”

Bacchus said those comments “are not reflective of the work that we do with RPR.”

More seriously, one of Neudesic’s clients, OneAZ Credit Union, has filed a lawsuit against Neudesic alleging breach of contract, fraud, and breach of fiduciary duty, among other charges.

The amended complaint filed in August alleges “Neudesic spent months fixing code defects of its own making” and “Neudesic failed to deliver, and misrepresented its capabilities to deliver, a data integration solution consistent with OneAZ’s best interests,” among other allegations.

Neudesic has filed a motion to dismiss all charges save one: breach of contract.

Neudesic did not respond to multiple requests for comment for this story.

For RPR’s part, Frame said he was unaware of the lawsuit, but had no problems with Neudesic’s ability to deliver. Such lawsuits are “sort of the lot-of-life of a contractor,” he said.

RPR goes dark

After Inman spoke with Bacchus, Frame stopped answering calls from Inman and requested emailed questions. When Inman asked whether Bacchus’s information about the contractors working for RPR was accurate and, if so, why Frame’s own statements didn’t match up, Frame did not contradict Bacchus’s information, but said, “I believe your questions were about Upstream, not the broader scope of RPR,” he said.

Frame added: “As a consultant, it’s worth noting that Riad will not have a full picture of RPR. Our team varies based on project load, with some resources on longer term engagements, some project focused, and some … who have engaged and disengaged at various times over the years based on our goals at the time.”

Frame also changed how he referred to RPR’s staffing model. He first said RPR had a “resource supplementation model” in which the company has a core group of developers that does most of the work and then supplements that core with specialized contractors. But then he said the following, which would seem to be at odds with his earlier statement:

“Flexible and contract-based resource models are common among larger software companies, which often outsource entire operations, for several reasons: companies working in this model develop a much deeper bench to draw from, and obviously also get the efficiency of working with resources that have a fixed scope and capped budget. This is how we’ve worked for years.”

When asked why he appeared to be trying to hide how many contractors RPR is using and the fact that several of them are working on AMP and Upstream, Frame said, “I couldn’t disagree with that opinion more. Neudesic’s work for us, and our staffing model in general, are topics we’ve discussed openly, regularly, and with pride since the beginning of RPR.”

Frame went on to say that RPR’s “presentations at [the NAR] Board of Directors meetings and in other forums at NAR regularly highlight our work with these partners by name, and obviously our model is well known among RPR’s advisory bodies and the other leadership groups to whom we are accountable.”

Near the conclusion of the reporting for this story in October, Inman sent Frame a portion of our interview notes in which it was clear that Inman’s initial questions were about RPR, not solely about the Upstream project. We included Frame’s previous responses as well. At this point, Frame stopped responding to Inman’s requests for comment. Other RPR executives also subsequently ignored requests for comment.

Why not make them employees?

Jim Harrison, president and CEO of Silicon Valley-based MLSListings, said he was aware that most of RPR’s tech team is made up of contractors.

Jim Harrison

“If it’s a short-term thing … you don’t want to tie up money when you only have six months work for them to do,” he said.

But upon finding out that some contractors had worked for RPR for years, he said he frowns on engineers being contractors for so long because there is a test for who qualifies to be an independent contractor in California. One element of the test, for instance, is whether the worker “typically performs work that is a regular part of a company’s business.”

“If I have a couple of years work for them to do, they’re not going to qualify to be a contractor,” Harrison said. “I’m going to have to make them an employee.”

NAR director Hamann wondered why RPR wouldn’t want to hire the best tech workers as employees considering how much money NAR is investing in the company.

“Otherwise you’re going to continue to be spending all these millions and millions of dollars and you’re at the mercy of these different vendors,” Hamann said.

For Hamann, Frame’s inconsistent statements illustrate a broader problem with RPR in general. “Why can’t they just tell the truth?” She asked. “I would like for NAR to be more transparent. Be more transparent. What are you hiding?”

“I’m very proud to be a Realtor and I hope as things change they will change for the benefit of the member because without the member there is no association,” she added.