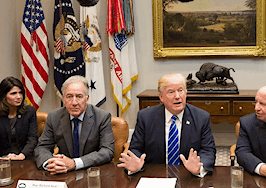

President Donald Trump Thursday named former Carlyle Group partner and consummate Wall Street insider Jerome “Jay” Powell as chair of the Fed, a move real estate professionals roundly cheered, calling the decision “the best possible choice” for the currently buoyant housing market.

Expected to take a slow-but-steady approach in the vein of current chair Janet Yellen, Powell will take the reins in February, when analysts predict he will guide a vibrant economy by cautiously raising interest rates and easing banking regulations put in place following the 2008 financial crisis.

His nomination, which will now be decided before the Senate, lays to rest worries by many analysts that Trump would instead tap Stanford University economist John Taylor, whose views on the Fed veer sharply from those of Powell and other frontrunners.

“We couldn’t have hoped for better,” said Lou Barnes, a mortgage broker based in Boulder, Colorado. “It’s not a bad news angle — it’s a good news angle. The damage that could have been done by John Taylor — my imagination doesn’t go far enough! This shift to Powell, that’s the best news for any real estate broker, homebuyer or homeseller of the year.”

The first chair in four decades without a degree in economics, Powell served as a clerk in the United States Court of Appeals for the Second Circuit in New York before diving into private practice at the investment bank Dillon, Read & Co. and, a decade later, the Carlyle Group. Along the way, he was appointed to the Treasury Department by President George W. Bush and worked at several other high-profile private investment firms before being nominated in 2012 to the Federal Reserve Board of Governors by President Barack Obama.

Matthew Gardner, chief economist of Windermere Real Estate, echoed Barnes, saying his continuity of vision is a strength, while warning that Powell’s ties to Wall Street could be cause for alarm.

“It’s probably as good a choice as housing advocates could have expected to get from this administration,” said Gardner. “He’s a fiscal dove, he has an interest in not raising interest rates rapidly. He’ll travel the same line as Janet Yellen in terms of raising rates — but not too quickly.”

“He’s got very close ties to Wall Street, and that is a bit of a concern,” added Gardner. “However, on the other hand, he’s on record as pushing back on proposals to allow banks to increase their leverage, which is actually a good thing, that he supports not allowing that.”

Email Jotham Sederstrom