The small Florida-based startup Deedcoin sought to disrupt real estate commissions by making it possible for homebuyers to get a rebate on their agent commissions by buying, and then exchanging, Deedcoin’s own custom cryptocurrency token.

After a long-delayed token launch in February, the first homebuyer has made a home purchase involving Deedcoin.

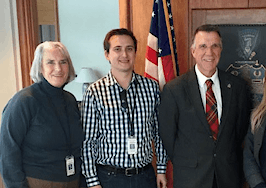

Agent Phil Mrzyglocki, left, with buyer George Moran. Credit: Deedcoin

George Moran, a 27-year-old district manager at Dunkin Donuts, bought his first home in Palm Bay, Florida through a Deedcoin transaction. He had been renting in Palm Bay for a while.

Before purchasing the 4-bedroom, 2-bath home for himself and his two children, Moran bought 20 Deedcoin for about $30. The cryptocurrency token is built on the Ethereum blockchain, a popular digital ledger system for keeping track of transactions.

Moran went through the regular homebuying process with Phil Mrzyglocki, Deedcoin’s media director and an agent at Momentum Realty. Most of Momentum Realty’s agents are involved with Deedcoin.

“I just started getting into blockchain and being interested in cryptocurrencies,” Moran told Inman in an interview. “I like what they’re trying to do — it has potential benefits to home buyers. I can help someone down the line by being the guinea pig here.”

After closing on his home, Moran traded in his Deedcoin for a $3,780 refund, equivalent to a 2 percent commission out of the 3 percent commission he paid. His agent received a 1 percent commission in U.S. dollars and the Deedcoin went back into the token network.

Agents who agree to use Deedcoin get a smaller commission, a tradeoff Mrzyglocki said is worth it to agents who see Deedcoin, with its commission rebates, as a line of customer acquisition.

The seller in this first transaction was informed that the buyer would receive a commission rebate through Deedcoin through an addendum form in the transaction. But the seller was an investor located in California, according to Mrzyglocki, so there wasn’t much conversation about it.

The first house purchased in a transaction involving Deedcoin. Credit: Deedcoin

“We tried it out the first time and it went over better than expected,” Mrzyglocki said. “It was just a small part of the process that had to get inserted.”

Deedcoin also plans to let sellers use the platform and receive commission rebates, but hasn’t completed a transaction with a seller yet.

Moran heard about Deedcoin through his brother, who’s involved in the cryptocurrency world. His brother met the Deedcoin crew and knew Moran was in the market for a house so set them up about six months ago.

“Everything was handled on their end, facilitating it and keeping me in the loop,” Moran said. “I didn’t have to do anything above and beyond what a typical homebuyer would do.”

The potential for a commission rebate after buying a house was appealing to Moran, and he’s excited to learn more about cryptocurrencies.

Deedcoin is one of several startups adapting cryptocurrencies to new use cases in real estate. Property Coin is a startup that backs its cryptocurrency tokens with real estate assets. Plenty of real estate listings now accept payment for the property itself via more mainstream cryptocurrencies, like bitcoin.

The Securities and Exchange Commission has been cracking down recently on token launches, accusing several crypto startups of fraud. Deedcoin received a tracking number from the SEC, implying it’s trying to avoid that fate.

After completing the transaction and moving into his new home, Moran doesn’t hold any Deedcoin anymore, but he might buy some down the line. Luckily, Deedcoin’s next token sale is coming up.