Real estate startup Homeward announced Monday it has secured $25 million in funding on its mission to make the process of moving into a new home simple and seamless for current homeowners.

Founded by Keller Williams mega agent Tim Heyl, the startup raised $4 million of equity funding, led by LiveOak Venture Partners with additional participation by the founders of OpCity, ApartmentList and others, as well as $21 million in debt funding secured from Genesis Capital and Keystone Bank.

“The current process of home buying is backwards,” Heyl said. “Buyers have to sell their existing home and then rush to find a new one. We remove this uncertainty by letting buyers use our cash to secure their next home first. Then they can take their time and sell their existing home for its full market value.”

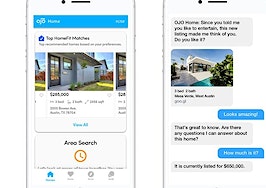

Heyl said the funding will help expand the company’s support teams and acquisition initiatives, as well as improve its web and mobile customer experience to help scale its product offering. The company currently operates in Texas, Georgia and Colorado, and Heyl said the company is focused on increasing market share in those markets.

The funding will power the expansion of Homeward’s support teams and acquisition initiatives, as well as to improve its web and mobile customer experience to scale its initial product offering, The Homeward Way. The company’s innovative business model enables customers to make all-cash offers to secure their next home prior to selling their existing home.

The process has six steps. First, a homeowner submits an online application and Homeward calculates equity and provides the homeowner with an approval in minutes. The company uses a combination of an automated valuation model and real estate experts to determine the home value.

“Really, at the core of the problem that we’re solving, is that banks and lenders won’t give a very well qualified homeowner any credit for the equity that they have in their home until it’s liquidated,” Heyl said.

Once the homeowner is approved, they work with a real estate agent and purchase their next home without having to list their current home. Using Homeward’s funds, the homeowner is able to make an all-cash offer.

The homeowner then leases the new home from Homeward, while they work on selling their old home with an agent. If the home doesn’t sell, Homeward will buy it at a pre-agreed upon price. Once the home sells, the consumer can then get a mortgage and buy their new home from Homeward at the original purchase price.

Homeward charges a 1.9 percent fee on the home that the consumer is purchasing, but Heyl said more than that fee is usually covered by the savings associated with having an all-cash offer.

“Because they are making an all-cash offer with Homeward’s funds, they are significantly more competitive in the actual offer space than anyone else making an offer on that property or in that market in general,” Heyl said. “Our customers are saving over 2 percent compared to what’s happening in the market place on the properties that they’re buying.”

“We have customers that are the fifth-highest offer out of eight offers but it’s still being selected because it’s an all-cash offer,” Heyl added. “The service tends to pay for itself.”

Heyl has been a real estate agent with Keller Williams for more than a decade, at an extremely high level. His team, The Heyl Group, ranked as the 25th most productive team in the Real Trends Thousand with 920 transactions closed in 2018.

Homeward is intended to be a tech startup that not only offers a service for consumers, but boosts the agent as well. It’s a platform that agents can present to consumers as part of their value proposition.

“Without Homeward, my clients would still be in their old house.” Matt McKnight, a real-estate broker in Austin, Texas, said in a statement. “The right home in the right neighborhood popped up well before they had considered listing. Homeward’s all-cash offer secured the house and gave us the time we needed to list their existing home without feeling rushed.”

Agents are still the ones negotiating the offer and collecting commission. Agents are still the ones listing the home and collecting their commission for that service, Heyl said.

“The villain here is not the professional, it’s not the agent, it’s not the mortgage lender, it’s not the title company,” Heyl said. “I believe the process, the whole process, and the way that it’s been designed from the beginning, it just wasn’t thoughtful of the consumer.”

“With homeward we’re not trying to disrupt the agent or disrupt whatever professional,” Heyl added. “We’re focused on, how do we put the consumer in the center, redesign this thing around the consumer.”