Young Alfred, a home insurance marketplace, has added $10 million in fuel to its tank.

The company, which announced a Series A funding round October 25, touts the “most advanced home insurance shopping platform.”

Homeowners can visit the site to compare and purchase home insurance options from a range of insurance companies. The marketplace highlights the “fine pint” in policies for consumers, according to a press release.

The funding round was led by Gradient Ventures, Google’s artificial intelligence-focused venture arm. Pear Ventures, ERA and Newfund Capital also participated in the deal. Zach Bratun-Glennon, a partner at Gradient, will join Young Alfred’s board.

“Large players in the real estate industry” have expressed interest in Young Alfred’s platform, Young Alfred co-founder David Stasie said in a statement. The company will deploy some of its new capital to capitalize on this. It plans to release an application programming interface (API) that other websites and firms could use to offer a similar insurance-purchasing experience.

Young Alfred said it’s exploring “uncharted territory” by making phone calls for buying home insurance unnecessary. But as a licensed agency itself in 50 states, the company can provide on-demand service and assistance from licensed insurance agents, whether by email, text, chat or phone, according to the Young Alfred.

The startup was founded by hedge fund and private equity vets who were “surprised by the small amount of data available to consumers” during the home insurance-purchasing process.

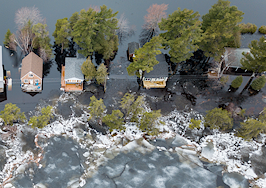

Home insurance premiums paid every year are expected to rise from $100 billion to $140 billion by 2025, with an increase in catastrophic events driving the growth, the company noted.

Recent papers published by Federal Reserve of San Francisco noted that climate change will also impact flood insurance rates and mortgage credit availability.