The COVID-19 pandemic, stay-at-home orders and limitations to in-person activity greatly increased technology adoption in all facets of life. For the real estate industry, COVID-19 may have led to increased tech acceleration, but technology was already reshaping the industry even before the pandemic struck.

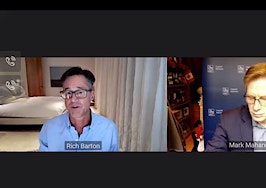

By now, in fact, the prevalence of technology in real estate has become an expected part of the consumer experience, Zillow CEO Rich Barton said during the company’s third quarter earnings call back in November.

“Across every industry, there has been a COVID-catalyzed and dramatic increase and reliance upon and adoption of technology,” Barton said. “The concrete is setting on new digital habits for life and work, and it is highly unlikely that we go back to the old analog ways.”

In the real estate technology space, COVID-19 wasn’t the only story, but it was clearly the dominant one. Here, below, are the top industry tech stories — both paramedic-related, and not — of 2020.

The lines between iBuyer and brokerage blur

Many in the industry believe it was a long time coming, but in the year 2020, the nation’s top iBuyers made big moves into corners of the industry traditionally occupied by real estate brokerages.

In September, Zillow announced that starting in January 2021, its own licensed employees would represent the company in buying and selling homes, a marked shift from the way the company has managed transactions since it launched Zillow Offers. Previously, the company was represented by a local agent on the ground in each market.

Offerpad launched its real estate solutions center in June, a business model pivot that offered the company’s clients the chance to sell their home to Offerpad for a direct, quick-close, all-cash sale, or list their homes for sale with licensed Offerpad employees as well as utilize the company’s concierge services to prep the home for market.

In May, meanwhile, Opendoor introduced its new “Home Reserve” platform, an offering that would allow the iBuyer to list sellers’ homes while purchasing and reserving their next home with all-cash offers. In August, it was revealed that the company was hiring agents for the platform.

COVID pauses iBuyer home purchases

Nearly every major iBuyer — outside of Keller Williams — was forced to suspend the homebuying segment of their business as the pandemic raged. It was a move first made by Redfin, but soon Opendoor, Zillow, Offerpad and Realogy all followed suit, due to safety concerns.

The companies returned to market with new safety tools and protocols, but the pandemic-fueled pause still lead to a massive drop in market share for the year. A study released by real estate tech company zavvie found that purchases by iBuyers were down 82 percent overall in the third quarter of 2020.

Digital closings become the norm

Less than a year ago, it was illegal in many states to close a real estate transaction digitally. Dan Casey, the CEO of Realogy Title Group, estimated that only about half of U.S. states allowed for digital notary when the pandemic struck in March. More than a dozen quickly adopted emergency measures to allow for digital notary.

In October, Notarize, a remote online notarization service, reported that the prior six months saw a 600 percent increase in demand for its services. The company subsequently announced partnerships with Adobe and dotloop and unveiled new tools aimed at increasing the visibility of digital closing tools.

Barton estimated that nearly two-thirds of Zillow Offers transactions were closed with remote notary in the third quarter.

Alternative financing models rise

The year also saw the rise — or in some cases, the rebrand — of alternative financing models, which some refer to as home swap or bridge loan startups.

In January, Orchard rebranded from Perch and in September, the company raised $69 million to launch a mortgage division aimed at serving dual-track consumers — those buying and selling at the same time — where homeowners can use the existing capital in home to buy another home.

Knock, which was previously mentioned with the likes of iBuyers, also pivoted to mortgage, bridge loans and concierge services. The company launched its “Knock Home Swap” where it seeks to partner with agents, rather than its old direct-to-consumer model.

Both Knock and Orchard will likely have some competition in the alternative financing space, when Zillow alum Greg Schwartz’s Tomo, which he announced in October, comes to market initially as a digital mortgage and transaction company.

The SPAC comes to real estate

The use of special purpose acquisition companies (SPAC) as a means to take a startup public rather than an initial public offering has become a more prevalent trend in the tech industry, in general, but 2020 saw Opendoor going public by this method, becoming the first big real estate company to do so.

Opendoor, which plans to debut publicly on December 21, will do so after a merger with special purpose acquisition company Social Capital Hedosophia Holdings Corp. II.

Spencer Rascoff, the former longtime CEO and co-founder of Zillow started his own SPAC, Supernova Partners Acquisition Company. Rascoff, in a statement, said his company, “intends to partner with an advantaged growth company that benefits from thematic shifts and tech-enabled trends, with large addressable market, competitive differentiation and a transparent corporate culture anchored in strong values.”

Competition rises among real estate portals

The tailwinds of COVID-19 has meant record-setting traffic for Zillow, as well as its competitors. And with more and more brokerages dumping cash into portal development and a number of acquisitions, there’s becoming more and more competition for an increasing number of consumer eyeballs.

In the early months of the year, before the COVID-19 pandemic struck, Keller Williams, RE/MAX and Realogy all launched revamped consumer experiences with new real estate listing portals.

OJO Labs acquired Movoto — along with a fundraising round — to invest in the portal and bolster its existing business, and realtor.com continued to shuffle its leadership team in 2020, elevating Opcity leaders to more prominent roles and appointing a new CEO.

CoStar Group acquired Homesnap in the waning months of the year, giving both portals more resources. CoStar Group CEO Andy Florance has been direct and explicit about his plans to challenge Zillow.

The virtual tour becomes ubiquitous

The want for virtual and 3D tours skyrocketed in 2020 as stay-at-home orders exploded in the early days of the COVID-19 pandemic, as people still needed to transact, but looked for ways to do so safely.

In an April study, Zillow reported an 89 percent increase in the creation of 3D tours in March over February for residential sale listings. Multi-family rentals saw 2,327 percent increase in 3D tours over that same period.

A December study released by OJO, based on data compiled by its Movoto platform, looked at the increase in virtual tours on a local level. In Austin, for example, the availability of virtual tours grew 147 percent between March 2020 and August 2020.

RE/MAX goes shopping

While many companies in the real estate space were forced to enact significant layoffs, RE/MAX did the opposite. It spent 2020 scooping up technology companies to bolster its offerings to agents.

In September, the company announced the acquisition of wemlo, a 20-month-old, Florida-based fintech startup that provides third-party mortgage loan processing services. It was the first major technology investment into the company’s Motto Mortgage brand.

That same month, the company acquired Gadberry Group, an Arkansas-based location intelligence data company with 16 employees.

The year started with RE/MAX closing the acquisition of First, a company that offers a machine learning-powered platform that helps inform agents of the best time to reach out to existing clients in their sphere.

Tech-focused real estate companies see share value explode

In the early, uncertain days of the pandemic, Redfin was trading near $10 a share, the lowest in company history. Zillow’s stock price dropped below $25 a share, and eXp World Holdings was trading at around $7 per share. All three of those companies have seen their share price explode in 2020.

While RE/MAX and Realogy — two other publicly traded real estate companies — also enjoyed strong years, it was the three more tech-focused companies that saw values soar.

As of December 8, Redfin and eXp World Holdings were booth trading at around $55 per share and Zillow was trading at more than $115 per share.

Lone Wolf becomes both acquirer and acquiree

Lone Wolf Technologies — a real estate tech vendor and software firm that provides transaction management solutions and back-office solutions — received a new backer in Stone Point Capital after Vista Equity Partners sold its stake in the company in October.

But that wasn’t the only transaction the company was involved in. Lone Wolf also acquired W+R Studios, the maker of Cloud CMA in November.