Even as they taper support for mortgage markets, policymakers at the Federal Reserve are looking forward to offloading government debt and mortgage-backed securities from the Fed’s balance sheet, which has swelled to more than $8 trillion during the pandemic.

Although the Fed hasn’t set a timetable for shrinking its balance sheet, it’s likely to do so more quickly than it did after the 2007-09 recession, according to minutes of the Federal Open Market Committee’s most recent meeting.

The minutes, released Wednesday, put additional pressure on interest rates as investors weigh the prospect of more Fed tightening.

Yields on 10-year Treasurys, a key barometer for mortgage rates, surged above 1.7 percent after the minutes were released, a threshold not breached since April 2021. The 10-year dipped below 1 percent at the outset of 2021, and mortgage rates also hit record lows.

10-year Treasury yields

Source: Yahoo Finance.

The Optimal Blue Mortgage Market Indices, which track daily changes in mortgage rates, show rates on 30-year fixed-rate conforming mortgages have climbed 14 basis points in the last two weeks, from a December low of 3.28 percent to 3.42 percent as of Tuesday, Jan. 4.

Daily changes in 30-year fixed-rate mortgage rates

Mortgage rates are expected to continue climbing this year as the Fed withdraws the emergency support it provided to mortgage markets during the pandemic.

At the outset of the pandemic, the Fed began buying an extra $80 billion in long-term Treasury notes and $40 billion in mortgage-backed securities every month. The Fed’s $120 billion in monthly asset purchases helped push mortgage rates to record lows.

But as the economy recovered and concerns about inflation grew, the Fed started tapering its asset purchases by $15 billion a month in November, on a timetable designed to wind down its asset purchases by June. With inflation numbers continuing to come in hot, at its final meeting of the year the Fed decided to double the pace of tapering to $30 billion a month. The accelerated timetable puts the Fed on schedule to finish tapering — and stop growing its balance sheet — in March.

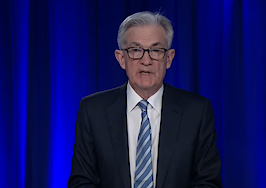

Federal Reserve Chairman Jerome Powell has said he wants to finish up tapering before the Fed starts raising the short-term federal funds rate from zero percent.

Now, minutes of the Dec. 14-15 meeting show that Fed policymakers are also eager to start running off the more than $8 trillion in assets now on its books, some of which dates back to “quantitative easing” undertaken in the wake of the 2007-09 mortgage meltdown and recession.

Policymakers noted that the Fed’s $8.27 trillion balance sheet is currently “much larger, both in dollar terms and relative to nominal gross domestic product” than it was after the last round of quantitative easing wrapped up in late 2014.

Fed quantitative easing surpasses $8 trillion

Assets held by the Federal Reserve through quantitative easing purchases now total $8.27 trillion, including $5.65 trillion of long-term Treasurys and $2.61 trillion in mortgage-backed securities. Source: Board of Governors of the Federal Reserve System, Federal Reserve Bank of St. Louis.

Once the Fed finishes tapering, it plans to continue to maintain its balance sheet by replacing Treasurys and mortgage-backed securities as they mature. But eventually, policymakers hope to start shrinking the Fed’s balance sheet by letting expiring assets “run off” without replacing them.

After the economy started to recover from the 2007-09 recession, the Fed started gradually raising the federal funds rate to keep inflation in check. It waited almost two years after the first increase to start shrinking its balance sheet.

Although the decision to shrink the balance sheet will be “data dependent,” almost all participants at the committee’s last meeting “agreed that it would likely be appropriate to initiate balance sheet runoff at some point after the first increase in the target range for the federal funds rate,” the minutes said. The timing “would likely be closer to that of policy rate liftoff” than in 2014.

Many committee members think the pace of any balance sheet runoff “would likely be faster” than in 2014, although monthly caps on the runoff of securities “could help ensure that the pace of runoff would be measured and predictable,” the minutes said.

In the long run, some committee members said they’d like to see the Fed’s balance sheet consist mostly of Treasurys, which could be accomplished by reinvesting principal from mortgage-backed securities into Treasurys “relatively soon,” or letting mortgages “run off the balance sheet faster than Treasury securities.”

No decisions about shrinking the Fed’s balance sheet were made at the meeting, and committee members agreed that changes in the target range for the federal funds rate “should be the … primary means for adjusting the stance of monetary policy.”

Because the ultimate source of funding for most mortgages are investors who purchase mortgage-backed securities, the Fed’s eventual withdrawal from mortgage markets is expected to put pressure on mortgage rates.

How much they’ll rise is a subject of debate. Economists at Fannie Mae expect inflation to moderate, and that mortgage rates will rise only gradually, to an average of 3.5 percent in the second half of 2022. Forecasters at the Mortgage Bankers Association envision a steeper rise, to 4.3 percent, over the same period.

Mortgage rate forecasts diverge

Source: Fannie Mae and Mortgage Bankers Association forecasts.

For now, the Fed hasn’t even finished tapering, and could change its mind and decide to keep buying mortgages beyond March if circumstances change, noted Pantheon Macroeconomics Chief Economist Ian Shepherdson.

Talking about shrinking the balance sheet helps the Fed telegraph its intentions, but Shepherdson doesn’t see an imminent move.

“We expect much more on this question at upcoming meetings, but we remain of the view that the Fed is unlikely to dive into outright balance sheet contraction in a hurry,” Shepherdson said in a statement. “Rate increases send a clearer message to the public, and we see no pressing need to take the risks associated with shrinking the balance sheet if the inflation numbers head down in the way we expect in the spring.”

Get Inman’s Extra Credit Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.