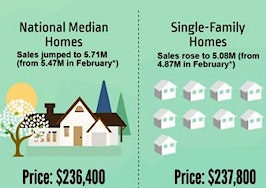

- In Q1, the national median single-family home price was $232,100, a 6.9 percent quarter-over-quarter and 5.9 percent year-over-year increase.

The National Association of Realtors (NAR) released its latest Metropolitan Median Area Prices and Affordability report, which boasted the best quarterly sales pace in nearly a decade.

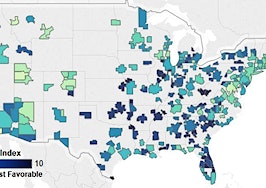

The median existing single-family price increased in 152 out of 178 measured markets, and only 25 markets reported lower median prices compared to Q1 2016. Furthermore, 30 metro areas experienced double-digit increases — unchanged from Q4 2016.

The national median single-family home price in Q1 was $232,100, a 6.9 percent quarter-over-quarter and 5.9 percent year-over-year increase.

“Prospective buyers poured into the market to start the year, and while their increased presence led to a boost in sales, new listings failed to keep up and hovered around record lows all quarter,” said NAR Chief Economist Lawrence Yun in a statement.

“Those able to successfully buy most likely had to outbid others — especially for those in the starter-home market — which in turn quickened price growth to the fastest quarterly pace in almost two years.

“Several metro areas with the healthiest job gains in recent years continue to see a large upswing in buyer demand but lack the commensurate ramp up in new home construction,” he added. “This is why many of these areas — in particular several parts of the South and West — are seeing unhealthy price appreciation that far exceeds incomes.”

Median prices and incomes

Despite the median household income increasing to $71,201, higher home prices and a spike in mortgage rates weakened affordability from 2016. In order to buy a single-family home at the national median price, a buyer making a 5 percent down payment would need a yearly income of $52,251.

A buyer making a 10 percent down payment would need a yearly income of $49,501, and a buyer making a 20 percent down payment would need a yearly income of $44,001.

Yun says the robust sales pace is “especially impressive” due to the lack of affordable housing, but many metros will need a “significant rise” in new inventory to keep the pace on the up and up.

“Last quarter’s robust pace of sales was especially impressive considering the affordability sting buyers experienced from higher prices and mortgage rates,” said Yun.

“High demand is poised to continue heading into the summer as long as job gains continue. However, many metro areas need to see a significant rise in new and existing inventory to meet this demand and cool down price growth.”

The areas where buyers are feeling the crunch from high median home prices are:

- San Jose, California ($1,070,000)

- San Francisco ($815,000)

- Anaheim-Santa Ana, California ($750,000)

- Urban Honolulu ($746,000)

- San Diego ($564,000)

The five most affordable cities are:

- Youngstown-Warren-Boardman, Ohio ($79,200)

- Cumberland, Maryland ($81,800)

- Decatur, Illinois ($86,100)

- Elmira, New York ($90,000)

- Binghamton, New York ($91,200)

Regional breakdown

In the Northeast, existing-home sales dropped 2.2 percent in the first quarter and are now 4.2 percentage points above the first quarter of 2016. The median existing single-family home price was $255,000, a 2.2 percent year-over-year increase.

In the Midwest, existing-home sales declined 4.3 percent in the first quarter and are 1.6 percentage points above a year ago. The median existing single-family home price was $176,000, a 5.7 percent year-over-year increase.

In the South, existing-home sales increased 5.8 percent in the first quarter and are 5.8 percentage points higher than the first quarter of 2016. The median existing single-family home price was $209,000, an 8.8 percent year-over-year increase.

In the West, existing-home sales rose 1.6 percent in the first quarter and are 7.4 percentage points above a year ago. The median existing single-family home price was $342,500, an 8.4 percent year-over-year increase.