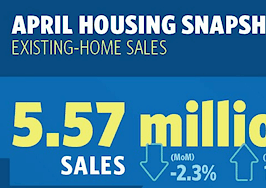

- May existing-home sales rose 1.1 percent to a seasonally adjusted annual rate (SAAR) of 5.62 million -- up from 5.56 million in April.

After a “notable decline” in April, existing-home sales are back on track with a record high in median home prices and a record low for the median days on market.

In May, the National Association of Realtors existing-home sales rose 1.1 percent to a seasonally adjusted annual rate (SAAR) of 5.62 million — up from a downwardly revised 5.56 million in April.

This month’s sales pace is 2.7 percentage points above May 2016 and is the third highest SAAR sales pace over the past year.

Source: National Association of Realtors

May’s numbers bolstered by ‘consumer resilience’

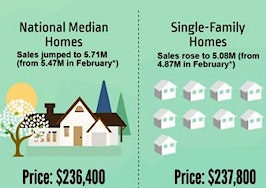

The median existing-home price for all housing types in May rose 5.8 percentage points to $252,800, which marks the 63rd consecutive month of year-over-year gains.

Total housing inventory experienced a small boost as well, with a 2.1 percentage point jump to 1.96 million homes for sale. Despite the increase, inventory is still 8.4 percentage points below May 2016 and is the 24th consecutive month of year-over-year declines. Unsold inventory is at a 4.2-month supply, a 0.5 percent year-over-year decline.

NAR Chief Economist Lawrence Yun says the month’s existing-home sales show the resilience among consumers who are determined to overcome challenging market conditions.

“The job market in most of the country is healthy and the recent downward trend in mortgage rates continues to keep buyer interest at a robust level,” Yun said.

“Those able to close on a home last month are probably feeling both happy and relieved. Listings in the affordable price range are scarce, homes are coming off the market at an extremely fast pace and the prevalence of multiple offers in some markets are pushing prices higher.”

Builder breakdown

Distressed sales, which include foreclosures and short sales, were at 5 percent — unchanged from April, and a 1 percentage point drop from May 2016. Four percent of May sales were foreclosures, and 1 percent were short sales.

Single-family home sales were at a SAAR of 4.98 million — a 1.0 percentage point month-over-month increase and a 2.7 percentage point year-over-year increase. The sales price for single-family homes increased by 6.0 percentage points to $254,600.

Existing condominium and co-op sales rose 1.6 percentage points to a SAAR of 640,000 units, 3.2 percentage points higher than a year ago. The median existing condo price was $238,700 in January — up 4.8 percentage points from 2016.

How did buying patterns vary across the country?

- In the Northeast, existing-home sales jumped 6.8 percent to an annual rate of 780,000 million, up 2.6 percent from a year ago.

Median price: $281,300, a 4.7 percent year-over-year increase. - In the Midwest, existing-home sales fell 5.9 percent to an annual rate of 1.28 million.

Median price: $203,900, a 7.3 percent year-over-year increase. - In the South, existing-home sales rose 2.2 percent to an annual rate of 2.34 million.

Median price: $221,900, a 5.3 percent year-over-year increase. - In the West, existing-home sales increased 3.4 percent to an annual rate of 1.22 million.

Median price: $368,800, a 6.9 percent year-over-year increase.

Existing-home sales are based on transaction closings from MLSs and include single-family homes, town homes, condominiums and co-ops.

Seasonally adjusted annual rates are used in reporting monthly data to help accommodate for seasonal variation; the annual rate for any given month represents what the total number of actual sales for a year would be if the pace for that month were maintained for a whole year.