- Here's a recap of pending home sales, existing home sales, price indices and studies from NAR, RentCafé and Zillow.

Every month, economists release a number of indices, reports and analyses of the housing market, and it can be difficult to keep up with them all.

Thankfully, the National Association of Realtors (NAR) recapped the month in its Housing Minute monthly video series, and below is also a recap of the June housing news we covered at Inman.

Although the housing market is recovering, some demographics are still dealing with the impact of the recession.

- Zillow’s Home Equity Report revealed Gen-Xers are struggling to build equity since they bought their homes in the midst of the recession when home values plummeted.

- “Roughly half of American wealth is held in home equity,” said Zillow Chief Economist Dr. Svenja Gudell of the study results. “Paying off the home mortgage is a key step toward retirement for most Americans, and it’s clear from these results that Generation X is further from that goal than older generations because of the Great Recession.”

- On average, Gen-Xers (aged 35–50) have a loan-to-value ratio of 70 percent — just six percentage points lower than their millennial counterparts who just entered homebuying age.

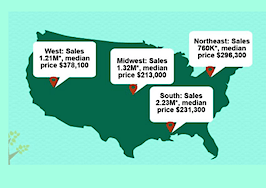

June sales are down 1.8 percent month-over-month and up 0.7 percent year-over-year, and June sales prices rose 6.5 percent year-over-year to a new peak median of $263,800.

- June existing home sales fell thanks to low inventory and a lull in contract signings over the past three months.

- The 6.5 percent year-over-year increase in home prices is part of a 64-month trend of rising home prices.

- “Closings were down in most of the country last month because interested buyers are being tripped up by supply that remains stuck at a meager level and price growth that’s straining their budget,” said National Association of Realtors Chief Economist Lawrence Yun.

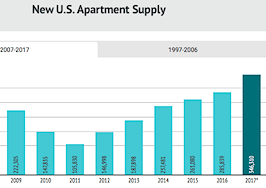

Rental construction is booming, keeping would-be buyers from making the leap into homeownership.

- According to RentCafé, rental construction is up 21 percent year-over-year — the highest level of building since 1997.

- The high level of construction is slowing the growth of monthly rent, making renting more attractive than owning a home, especially when home prices are growing 6.5 percent year-over-year.

- Renters in San Francisco, New York, Dallas, Houston and Nashville are benefitting the most from the boom in construction.

- Demographically, millennials and baby boomers are turning to rentals for a “fewer financial strings” lifestyle.

- “Lifestyle changes, a housing-stock shortage and high homes prices have led to more people than ever — of all ages — choosing to rent an apartment rather than buy a home,” said RentCafé Senior Analyst Doug Ressler.

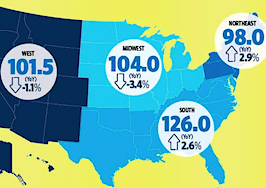

Signed contracts rose after a three-month decline, increasing 1.5 percent month-over-month to 110.2. But, pending home sales are still 7.1 percent lower than June 2016.

- Although there was a slight increase in signed contracts, low inventory is still holding back activity, especially in the starter homes segment of the market.

- “However, the home search will still likely be a strenuous undertaking in coming months because supply shortages in most areas are most severe at the lower end of the market,” said Yun.