The success of multimillion-dollar big-broker project Upstream hinges on whether MLSs are willing to play ball. The yet-to-be launched platform is ultimately intended to function as a middleman between brokers and the recipients of their data, including MLSs and vendors.

But a recent survey suggests the vast majority of MLSs are not yet on board, either because they need more information about the project or because they flat-out aren’t interested in participating.

In an online survey fielded between November 2016 and March 2017, real estate consulting firm WAV Group asked members of the Council of Multiple Listing Services (CMLS) about their awareness of certain industry initiatives and whether they were participating or planned to participate in them. Seventy-one percent of CMLS member MLSs responded.

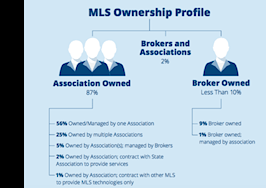

Source: 2017 CMLS Best Practices Survey Report

All were aware of Upstream and virtually all were aware of the other two initiatives mentioned in the survey: the Broker Public Portal and the Advanced Multi-List Platform (AMP).

The Broker Public Portal is the first national public-facing MLS website, while AMP hopes to be an MLS back-end system provider for small-to-midsize MLSs. National Association of Realtors (NAR) subsidiary Realtors Property Resource (RPR) is building both AMP and Upstream with several millions in NAR member funds.

All three initiatives depend on MLS participation. But most appear to be skeptical of them. Only 20 percent of respondent MLSs were either “already participating” or “in full support” of AMP, while 30 percent said the same about Upstream and 35 percent said the same about BPP. The rest said they either are “Not sure, need to know more” or have “No interest in participating.”

“Given all three of these initiatives are in various stages of development, it seems likely more MLSs will commit (or not) in the later stages of development,” the report said.

“Almost all MLSs expressed that their interest is tied to whether or not these services would benefit the brokers they serve and the agents they support.”

Alex Lange

Upstream CEO Alex Lange told Inman he wasn’t surprised by the survey results, but said the stats in the report are based on the number of MLSs, not the number of agents they represent. The nation’s 700 or so MLSs vary in size from a few dozen subscribers to more than 80,000 and the report doesn’t break down its percentages by representation.

“The top 55 MLSs represent over 1 million agents so, in theory, I’d only need the ‘right’ 8 percent to cover almost everyone,” Lange said via email.

He also noted that the survey came out before Upstream publicly decided to align to standards from the Real Estate Standards Organization (RESO) on Sept. 21. That decision has resulted in more support from MLSs, at least in part because it will eliminate some of the expense of MLS integration with Upstream, according to Lange.

By the end of the month, he expects to have signed commitments to participate in Upstream from MLSs representing 250,000 agents. These MLSs are either agreeing to integrate with Upstream and accept listings first entered into Upstream, or agreeing to feed listings from the MLS to Upstream at broker request.

Even if MLSs choose not to participate, Upstream has “strong support” among brokers who are prepared, if necessary, to enter their listings in both Upstream and their MLS at once and turn off syndication in the MLS, except IDX and VOW feeds. “It’s still less entry than they do today and they gain distribution control,” Lange said.

Marilyn Wilson

WAV Group’s Marilyn Wilson told Inman that neither Upstream or AMP are “ready for prime time yet,” so MLSs don’t fully understand the scope of what they would be signing up for — making it tough for them to be fully supportive.

As for the BPP, she said 700,000 agents already have access to it, “so it looks like that initiative has made some great progress even since the survey was fielded.”

WAV Group is a consultant for both BPP and Upstream.