The dynamics of the luxury real estate market are shifting as a new generation of affluent homebuyers enters the scene, according to a recent study titled “The Report: An Annual Review of Luxury Real Estate in 2017” from Coldwell Banker Global Luxury.

“While luxury real estate in the United States has always been a tale of two coasts, we were pleased to uncover many up-and-coming luxury hubs across the country, including tech towns like Raleigh-Durham and cultural capitals like Nashville, shaking things up in the luxury market,” said Coldwell Banker president Charlie Young in a statement.

Illustrating this point, the report ranked the top five “power markets” for buyers and sellers, defined as “both well-established and unexpected luxury markets based on indicators such as airport accessibility, ease of doing business, a prestige brand presence and a housing stock that prioritizes privacy, views and exclusivity.”

The top five “power markets” to watch for sellers in 2018 include: Denver; Nashville; San Francisco; Seattle; and Silicon Valley, California; while the top five buyer “power markets” worth keeping an eye on in 2018 include Boca Rotan, Florida; Miami; Park City, Utah; Santa Barbara, California; and Scottsdale, Arizona; according to the report, which profiled nearly 50 markets in this category around the country.

Rather than “location, location, location” being the main driver, lifestyle is increasingly motivating affluent buyers to take action, said Craig Hogan, Vice President of Luxury for Coldwell Banker Real Estate in an interview with Inman.

“High-net-worth money is moving from more expensive cities to ones with lower luxury median prices as mobility and accessibility increase,” he said in the report. This is creating opportunities in centers such as Seattle, Dallas and Sacramento.

“It might not be what the old guard has done in the past, but these buyers want to be closer to the action, they want to lock up and leave and go on to Florida, and you can’t do that if you own a 10,000 square foot or 20,000 square foot home with fountains. The trend is, moving forward, lifestyle trumping location,” Hogan told Inman.

The norm today is that the well-heeled have a number of smaller homes equipped with smart home tech that they can lock and leave, said the luxury expert. In Chicago, affluent buyers might also have a place in Airzona and Florida. “It’s this little thing called the weather,” said Hogan.

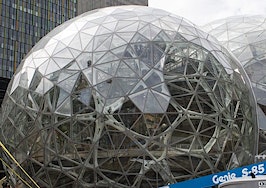

The Report; which included input from Coldwell Banker agents and data from The Institute for Luxury Home Marketing, Wealth-X, Unique Homes and others; also found that 14 out of 20 Amazon HQ2 finalists are represented in the report’s power markets, showing potential for growth in these cities with or without Amazon relocating there. These cities included Atlanta; Austin, Texas; Boston; Chicago; Dallas; Denver; Fairfax, Virginia; Los Angeles; Miami; Montgomery County, Nashville; New York City; Raleigh, North Carolina; and Washington, D.C.

One of the main messages to take away from the report was that the country’s luxury markets are stable, consistent and solid, added Hogan. Data provided by the Institute for Luxury Home Marketing in the report showed that luxury home prices “leveled off overall as inventory constraints eased last year and demand settled into a new ‘normal’ after an explosive eight-year post-recession housing boom.”

“All the press seems to love really super hypermarkets on fire with prices paid way out there. Of course, who doesn’t love that, but the story of the day is we are in good shape. Everything doesn’t have to be on fire to be good,” Hogan told Inman.