Despite the ongoing coronavirus pandemic and the looming autumn season, a new report from real estate tech firm MoxiWorks suggests home sales will remain strong during the next month and a half.

The report indicates that in September of this year, 564,000 homes should sell in the U.S. That would be down 5 percent from 594,000 sales in August, but that drop off would be considerably smaller than the historical average decrease of 14 percent from August to September. In other words, if MoxiWorks predictions come true, September should be considerably better than average when it comes to home sales.

The report also indicates that in October, the U.S. should see 569,000 home sales — a very slight increase compared to the September predictions.

Credit: MoxiWorks

The report additionally predicts that for all of 2021, the U.S. should see a total of 6.8 million home sales. That would almost equal “the all-time peak of 7 million home sales in 2005,” the report adds.

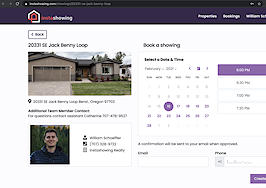

MoxiWorks — which offers a variety of real estate technologies including customer relationship management and marketing tools — compiled the report by examining data about listings and sales that it gets from users and multiple listing services. Company CEO York Baur told Inman the data represents 97 percent of the home sales footprint in the U.S.

MoxiWorks prior market prediction for August ended up being within 1 percent of what actually happened.

York Baur

Baur ultimately attributed the strong fall sales predictions to several factors. First, he said the ongoing pandemic continues to drive people into new homes and new regions as they seek better housing and work-from-home options.

Second, Baur pointed to interest rates.

“That’s a huge factor in driving home transactions and it continues to be at a historic low,” he explained.

And third, Baur noted that government mortgage forbearance programs are ending, which will likely “introduce more inventory into the market.” He went on to explain that unlike during the Great Recession, most homeowners today have significant equity in their homes, meaning they’re more likely to sell than to default. And that, in turn, means that there could be a new infusion of inventory hitting the market sooner than might otherwise happen in the event of a foreclosure crisis.

“Those homes in theory will come on the market and be sold this year,” Baur added.

Baur said the forbearance issue is a short-term trend, though low interest rates and the pandemic-driven shift to new locations could be “more durable.”

Either way, though, Baur framed the uniqueness of this year’s market as an opportunity for agents.

“I think given how unusual this market is, it’s all the more important for agents to stay in touch with the people they know,” he noted. “Agent serve as a trusted advisor, and people need a lot of advice right now. It’s a perfect opportunity for an agent to demonstrate their value.”