Real estate startup Lenda is launching a platform today that will allow borrowers to complete the home loan process online from start to finish without a loan officer as middleman.

Lenda’s platform lets borrowers receive rate quotes from Lenda, apply for a loan, sign lender disclosures, upload or snap photos of their documents, receive real-time status updates, process and close the loan — all online.

“This saves time and money, eliminates confusion, and provides for a happier mortgage experience,” said Lenda co-founder and CEO Jason van den Brand.

A combination of custom algorithms and integrations with technologies from other companies make it happen, he said. Lenda integrates with mortgage loan pricing engine LoanTek, electronic signature vendor DocuSign, online payment firm Stripe, and MeridianLink’s credit check toolkit CreditAPI.

“A loan officer’s job responsibility is to do exactly what our software already does,” van den Brand said. “The whole mantra with real estate agents for us has been to (get them to) fire their loan officers. You’ll hear us say that again and again.”

In that sense, it’s the opposite of the approach taken by Pre Approve Me App, a recently launched mobile app that generates near-instant loan preapprovals vetted by loan officers.

“Lenda is great for busy people,” van den Brand said. “We had a dad of two young children who used Lenda because he works 80-hour weeks and couldn’t spend time in a banker’s office. He purchased his San Francisco home with Lenda in 20 days, completed entirely online.”

Most people go online to try to find lenders and then the process immediately goes offline, but Lenda is the only “true” online lending site, he said.

“Everyone who you think does online lending is just a lead generation site,” he said, with the actual loan process done in person. “Lenda’s goal is to enable homeowners to make smart home finance decisions without ever leaving their home or receiving a sales call.”

The company originally formed as GoRefi in 2012 and rebranded as Lenda last month. This is the company’s first official product launch, though the platform has been in beta for a couple of years. Lenda raised a quarter million dollars in seed funding in a deal that closed in March.

Lenda is currently part of the prominent Silicon Valley accelerator 500 Startups, where its tag line is “TurboTax for Mortgage.”

The platform is currently focused on refinance loans, but the company is working with some real estate agents in private beta to add in functionality for purchase loans, van den Brand said. He anticipates that part of the platform will be ready sometime next quarter.

Also next quarter, Lenda plans to release a feature that will allow consumers to compare quotes from a variety of lenders, not just Lenda, as well as the ability for consumers to obtain loan preapprovals within a couple of hours that are vetted by an underwriting algorithm rather than a loan officer.

Lenda plans to integrate with Fannie Mae’s automated underwriting system in the fourth quarter.

“Borrowers will have a better experience because they’ll know upfront if their loan is approved and precisely what type of documentation is still needed to complete the process,” van den Brand said.

Van den Brand, who is also a licensed real estate broker, expects prospective buyers will contact a real estate agent when they are interested in buying a home and, if the agent has signed up for a free account with Lenda, the agent will then send the buyers an invitation to join Lenda’s platform.

The platform has built up a database of more than 500 agents in California — a number the company hopes to grow as it expands. For now, Lenda’s platform works only in California, but the company is applying for state lending licenses in Oregon and Washington, and expects those will be active starting in late August.

The company plans to use a mix of things to recruit agents to its network, including general marketing, word of mouth and conferences. Agents who join Lenda’s network will be able to reach out to their previous clients and provide additional value to them by helping them refinance, van den Brand said. Agents will also receive more business from borrowers using Lenda’s platform, he added.

“The more agents that work with us, the more we can refer business to them,” he said.

The company is also working on creating relationships with homebuilders, certified financial planners, accountants and financial advisers.

Agents using Lenda’s platform will be able to see the status of their clients’ loans in real time. Van den Brand anticipates any information agents and borrowers want will be available to them on the platform, but if they have further questions, they can call Lenda’s toll-free number to reach customer support, he said.

Most customers are now comfortable with transactions online, and therefore the company doesn’t get many phone calls, van den Brand said.

Given that the company has a five-person team, that’s very important, he added.

So far, Lenda has worked with about 30 borrowers whose average age is 48, according to van den Brand. He thinks this is largely because the 45 to 55 age group is more likely to refinance. But in the long run, he sees the platform being more targeted towards the millennial generation.

“The same people that bank online and buy insurance online, trade stocks online, (and) work with financial advisers online such as Wealthfront,” he said, referring to an automated investment service popular with young techies.

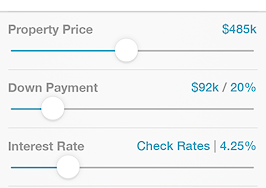

Lenda advertises online and says it can compete with some of the largest lenders in the country as far as pricing on mortgage rate tables and closing costs. The average Lenda user saves $18,450 on their home loan, the company said.

“We have lower costs just because we operate on lower margins. We’re not paying for loan officers and so when you calculate that savings over the life of the loan, that translates into 10 if not 20 of thousands of dollars in savings,” van den Brand said.