- National Association of Realtors Chief Economist Lawrence Yun presented his midyear forecast at the 2017 Realtors Legislative Meetings and Trade Expo.

- Yun says the future success of the housing market heavily depends upon housing starts, which need to be at 1.5 million to fulfill buyer demand.

National Association of Realtors Chief Economist Lawrence Yun presented his midyear forecast at the 2017 Realtors Legislative Meetings and Trade Expo.

Yun predicted that a multi-year stretch of robust job gains paired with growing household confidence will bring existing-home sales to a decade high, but low inventory, the lack of affordable housing and modest economic growth are keeping homeownership rates at historic lows.

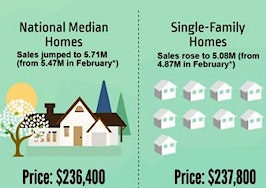

The 2017 Q1 existing-home sales pace (5.62 million) is the best in a decade, and Yun says he expects for the year to end with 5.64 million existing-home sales — a 3.5 percent year-over-year gain and the best sales pace since 2006 (6.47 million).

Moreover, Yun expects the national median existing-home price to climb 5 percentage points over the next year.

Housing starts to get a lift, but it won’t be enough

“The housing market has exceeded expectations ever since the election, despite depressed inventory and higher mortgage rates,” said Yun at the conference. “The combination of the stock market being at record highs, 16 million new jobs created since 2010, pent-up household formation and rising consumer confidence are giving more households the assurance and ability to purchase a home.”

“The combination of the stock market being at record highs, 16 million new jobs created since 2010, pent-up household formation and rising consumer confidence are giving more households the assurance and ability to purchase a home.”

Although Yun is positive about the sales gains the housing market has been experiencing, he says they should be growing at a faster rate thanks to a healthy and robust labor market. Buyers are quickly purchasing housing at low and mid-range prices, and there isn’t enough inventory to meet the demand of buyers who are looking for affordable housing.

Housing construction starts are expected to jump 8.4 percent to 1.27 million, but Yun says that won’t be enough to fulfill the 1.5 million homes needed to fill the inventory gap.

“We have been under the 50-year average of single-family housing starts for 10 years now,” he said.

“Limited lots, labor shortages, tight construction lending and higher lumber costs are impeding the building industry’s ability to produce more single-family homes. There’s little doubt first-time buyer participation would improve and the homeownership rate would rise if there was simply more inventory.”

Levers for change: Boosting young households and job growth

Jonathan Spader, senior research associate at the Joint Center for Housing Studies at Harvard University, and Mark Calabria, chief economist and assistant to Vice President Mike Pence, were also onstage during Yun’s presentation and offered their expertise on what needs to be done to strengthen the housing market.

Spader says the future of homeownership will be dependent on how well young and minority households will be able to infiltrate the housing market and become homeowners.

“Stagnant household incomes, rising rental costs, student loan debt and limited supply have all contributed to slower purchasing activity,” Spader said.

“When the homeownership rate stabilizes, there will be an increase in homeowner households. Young and minority households’ ability to reach the market will play a big role in how much the actual rate can rise in coming years.”

Calabria had a different point of view, saying that doubling down on job growth will be the key to future success.

“A strong labor market will drive a strong housing market, but you can’t have a strong housing market without a strong economic foundation,” said Calabria.

“The recovery has been uneven with roughly 70 counties making up roughly half of all job growth. The White House’s proposed plans to cut corporate and individual tax cuts will help large and small businesses grow, hire and ultimately contribute to more households buying homes as more money goes into their pockets.”

Yun ended his presentation saying that rising interest rates and home prices are here to stay, and that an increase in housing starts will lead to a healthy bump in sales.

“There was a lot of uncertainty at the start of the year, but a very strong first quarter sets the stage for a modest sales increase compared to last year,” said Yun.

“However, prices are still rising too fast in many areas and are outpacing incomes. That is why housing starts need to rise to alleviate supply shortages. There will be more sales if there’s a meaningful bump in new and existing inventory.”