- Nationally, home prices have reached their 2006 peak, but not every market has equally recovered, according to the annual JCHS "State of the Nation's Housing" report.

- Many low-income neighborhoods are seeing growth mostly in suburban and outlying areas, while affordability in "hot" markets remains a big issue.

DENVER — “Our mission as a center is quite simple: To raise housing issues and inform policy,” said Dr. Chris Herbert, the managing director of the Joint Center for Housing Studies (JCHS) at Harvard University.

To that end, he gave reporters at the National Association of Real Estate Editors (NAREE) conference a sneak peek at the annual State of the Nation’s Housing report on Wednesday; it will be released to the general public on Friday, June 16, at the National League of Cities.

Herbert said that the housing market is finally “coming back to normal,” by which he means that home prices are once again reaching the former peaks reached in 2006, and that the rise in home prices has been widespread.

However, he noted that “even though national prices are back to their peak,” that doesn’t apply to every market. In 32 out of 100 markets examined by JCHS, prices remain below 2006 peaks.

“So the story that the housing market has recovered has to be taken with a grain of salt; it depends where you are in the country,” he said.

Low-income neighborhoods, in particular, are “much less likely” to have re-achieved the peak pricing of 2006 — most of the growth in those neighborhoods has been in suburban and outlying areas — and “the peak price isn’t necessarily the price we want to hold as a benchmark,” Herbert noted.

To help ameliorate the price effects of the boom-and-bust years, JCHS looked at current home prices relative to the year 2000, factored in inflation and then tried to see where prices might be if we hadn’t gone through that market bubble and crash.

Where’s the supply?

“We have a lot of ‘glue’ in the housing market; housing prices are going up — why aren’t we seeing the supply response?” Herbert asked.

He added that the first-time homebuyer part of the market is the tightest right now. “That part of the market is more likely to be underwater, more likely to be under-equitied.”

In addition, 4 million homes have shifted from owner-occupied to rentals, and many of those were the entry-level homes that first-time buyers are coveting today.

“We’re not seeing homebuilders building entry-level homes,” Herbert noted.

What about rentals?

Rent is also increasing in apartment markets, he said — “this despite the fact that we’ve been adding more rental housing than we have in almost any year going back to the 1980s.”

He said that 95 percent of multi-family starts are intended for the rental market. “So we’re adding a bunch of supply, but we’ve had demand that’s unprecedented.”

One problem is that many of the rental units being built are at the high end of the market — there has been big growth in high-cost rentals. “Rentals under $800 a month have gone down by 260,000 units,” said Herbert. “Units renting for more than $2,000 per month have gone up.”

What are the challenges?

According to JCHS, the cost burden of owning (or renting) is getting worse for many households, especially renters, minorities and low-income households. By “affordability,” what JCHS is measuring is whether people are spending more than 30 percent of their income on housing.

Owners are in better shape than renters, he said. “Many, many fewer first-time buyers are moving in.” But the number of renters hasn’t changed significantly.

And with rising health care costs, the burden of child care and other demands on income, reaching that 30-percent threshold seems to be increasingly difficult.

Another issue involves the demographics of homeownership — by 2035, it’s estimated that one-third of all households in the United States will be age 65 or older. That demands a mortgage market that will work better for multigenerational households, said Herbert, in addition to accessible housing that will accommodate the needs of several generations.

“We move much less as a country overall, and we move less as we age,” he added. “We’re seeing a lot of boomers staying in their homes and fixing those homes up.”

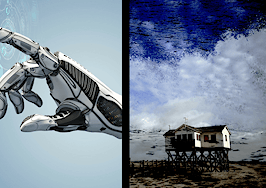

Finally, JCHS noted that housing wealth is threatened by climate change. In its report, it said that “nationwide, nearly 1.9 million homes worth over $880 billion in 2016 are at risk of being submerged at least to the first floor by 2100” as a result of rising sea levels.