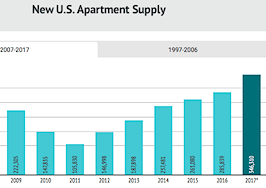

The housing market has experienced multi-year gains in home price growth, which has made it harder for millennials, young families and those with lower incomes to jump into homebuying. Instead of purchasing lower priced fixer-uppers, would-be buyers have decided to continue renting in the midst of record-high apartment construction that has caused rental price growth to slow.

Although renting is cheaper than owning a home, overall, it doesn’t mean all renters are spared from the pinch of unaffordable housing. According to WalletHub’s latest weekly study, 11.1 million renters spend 50 percent of their monthly income on housing costs — well above the affordability benchmark of 30 percent or less.

Furthermore, WalletHub analysts compared 150 of the largest rental markets based on 21 key measures of attractiveness, such as rental affordability, historical rental-prices changes, forecasted change of median rent, city satisfaction and the job market.

When it comes down to monthly rent, Plano, Texas; Overland Park, Kansas; Sioux Falls, North Dakota; Lincoln, Nebraska; and Huntsville, Alabama are the five most affordable markets. Meanwhile, San Bernardino, California; Detroit, Michigan; Newark, New Jersey; Miami, Florida; and Hialeah, Florida are the most expensive.

When all 21 factors are put into play, all five “most affordable” markets still make the “best of” list, but the more expensive Arizona cities — Scottsdale, Peoria and Gilbert — take the top spots thanks to a high quality of life.

On the other hand, only three of the five most expensive markets made it on the “worst of” list. The moderately inexpensive cities of Jackson, Mississippi and Memphis, Tennessee made it on the list because of a lower quality of life that includes a lack of access to quality schools, less overall safety and fewer job opportunities.

Improving things for renters

Clinic Professor in the College of Law at Loyola University New Orleans Davida Finger says the key to improving the rental market lies in the hands of lawmakers who can enact laws to improve renter safety and health.

“Local policymakers can improve rental housing, including affordability, by approving rental registry legislation that requires owners to register rental units with an agreement for government oversight on baseline habitability standards,” said Finger.

“By creating oversight on rental conditions, local policymakers can improve overall public health and minimize economic and emotional strain on renters, who become trapped in substandard units.”

Assistant Professor of Real Estate in the Wharton Real Estate Department at the University of Pennsylvania Benjamin Keys says to get the best deal, renters need to search for a property with the same specificity that buyers do.

“When thinking about value, renters should consider ways in which their preferred apartment might differ from the average unit on the market,” said Keys. “A generic unit in a generic building in a popular neighborhood is probably priced efficiently, but quirky buildings in quirky neighborhoods may deviate from the efficient market because of their idiosyncrasies.”

“Put differently, renters should play ‘Moneyball’ with the apartment attributes that they might value more highly than some residents,” he added. “If you don’t value certain building amenities as much as the average renter, then avoid looking at buildings that emphasize those features.”

“Never planning on using that rooftop pool? Don’t subsidize the pool users, and live somewhere else more cheaply! Think about what attributes of an apartment are most important, and prioritize those attributes. You may find that your list is different from the list of other renters, and deals can be found.”

Get your city’s rank here.