A battle for the soul of the Consumer Financial Protection Bureau (CFPB) played out Monday inside a federal building in Washington. The real estate industry watched with fascination as White House budget chief Mick Mulvaney sought to wrest power from the agency’s acting director.

Reporting for duty at 1700 G Street with a bag of donuts Monday morning, Mulvaney reportedly sent a missive introducing himself to the banking industry regulator’s 1,600 employees after its acting director Leandra English sent her own office-wide email. Citing separate, conflicting federal statutes over the weekend, Mulvaney and English both claim to be the rightful director of the agency, and English has filed a lawsuit to block the appointment.

“It has come to my attention that Ms. English has reached out to many of you this morning via email in an attempt to exercise certain duties of the Acting Director,” Mulvaney wrote in an email, according to The Washington Post. “This is unfortunate but, in the atmosphere of the day, probably not unexpected. Please disregard any instructions you receive from Ms. English in her presumed capacity as acting director. I apologize for this being the very first thing you hear from me. However, under the circumstances I suppose it is necessary. If you’re at 1700 G Street today, please stop by the fourth floor to say hello and grab a doughnut.”

Mulvaney brings donuts to his first day at CFPB. Couldn’t hurt. pic.twitter.com/BpKJ2nd1L0

— Katie Rogers (@katierogers) November 27, 2017

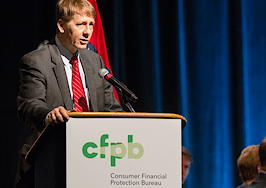

The power struggle revved up following the Nov. 16 resignation of Richard Cordray, the polarizing Obama administration appointee who drew ire from bankers and real estate professionals alike for his aggressive pursuit of fraud perpetrated by banks, credit unions, securities firms, mortgage servicing operations and foreclosure relief services. In his resignation letter, he named English as his heir apparent, but President Donald Trump countered later with his own nominee, Mulvaney, currently the director of the Office of Management and Budget.

7:56am: Mulvaney spox tweets photo of him “hard at work”

7:57am: English sends email signed “acting director”

10am: Mulvaney memo offers donuts, tells staff to “disregard” English’s instructions & report her

Lawsuit over CFPB control still in progress…https://t.co/CxuQPBdIqY pic.twitter.com/uGPZvs2QXV

— Anna Massoglia (@annalecta) November 27, 2017

A budget hawk and supporter of financial deregulation, Mulvaney, a Republican, once called the CFPB a “sick, sad joke,” fueling concern that the Trump Administration intends to dismantle the agency, which launched in 2011 as a response to the financial crisis two years earlier. Last week, Trump himself called it a “total disaster” and vowed to “bring it back to life.”

Government watchdogs, elected officials and real estate professionals on Monday weighed in on both sides, characterizing Mulvaney’s disputed appointment as alternately a boon for mortgage originators and a threat to homebuying consumers.

Citing the agency’s rejected interpretation of the Real Estate Settlement Procedures Act (RESPA) involving payments under an anti-kickback provision last year, Brian Levy, an attorney with Katten & Temple in Chicago, said he was hopeful that Mulvaney would review the Consumer Financial Protection Bureau’s hazy enforcement practices.

“I hope that Mulvaney continues strong enforcement,” Levy told Inman News. “I don’t think the message should be that it’s open season. I think that when industry breaks the law, when they violate consumer statutes, they should be held accountable for that, but I also think that there’s been a lot of effort by the CFPB to go after industry practices that the industry doesn’t even know are illegal, and that nobody has been told is illegal.”

Paul Bland, the executive director of Public Justice, a nonprofit organization that advocates for criminal and economic fairness, warned that deregulation in the real estate and mortgage industries may result in a repeat of the financial crises of 2008, in which reckless lending led to a housing bubble that eventually wreaked havoc on the economy.

“It’s going to be a big win for mortgage services and, in the short-term, for originators, but I think it will be a huge loss for consumers over the long run and probably a loss for investors in the long run,” said Bland. “If the mortgage originating industry generates a bunch of weak mortgages that are going to go down they will have set those up in the stock market by securitizing them, so you’re going to see a bunch of short-term risky behavior that generates profits for one segment of the economy and then, should there be another downturn, there’s going to be a lot of harm to borrowers and investors.”

U.S. Rep. Nydia Velazquez (D-NY), a longtime defender of the Dodd-Frank Act and for whom CFPB’s Legislative Affairs Assistant Director briefly worked, on Monday accused Trump of stacking the deck for corporations and Wall Street titans.

“The Consumer Financial Protection Bureau has been a great example of government working for people,” Velazquez said in a Facebook post Monday. “By appointing Mick Mulvaney, President Trump has put Wall Street before working families & is trying to destroy the agency from within. The Trump Administration must abandon this potentially illegal move.”

Elsewhere, those who watched the English and Mulvaney feud with morbid fascination offered their own commentary on Twitter and Facebook. Dan Lavoie, a speechwriter for New York attorney General Eric Schneiderman, and himself no fan of the Trump administration, chimed in with this tweet:

Staff meeting at the CFPB today. pic.twitter.com/LytZwhHPpZ

— Dan Lavoie (@djlavoie) November 27, 2017

Email Jotham Sederstrom