Warren Buffett’s annual letter to investors, akin to a parent’s Christmas card detailing what all the kids have been up to, sheds light on the multinational holding company and the earnings performance of its subsidiaries. And lately, HomeServices of America, Berkshire’s real estate company under Berkshire Hathaway Home Energy, has been a big talking point.

The Omaha native and American business magnate, who admitted that he had “paid little attention” to HomeServices when Berkshire Hathaway “backed into the business” in 2000, gave the brokerage arm of his conglomerate a particularly glowing review in his 2017 letter released this week.

While HomeServices stood as the second-largest brokerage operation in the country by the end of 2016, said Buffet, it remained a long way behind Realogy, the owner of subsidiaries such as Coldwell Banker, NRT, Better Homes and Gardens Real Estate and ERA. But thanks to some important acquisitions in 2017, HomeServices had done some serious catching up, he said.

“In 2017, HomeServices’ growth exploded,” he wrote. “We acquired the industry’s third-largest operator, Long and Foster; number 12, Houlihan Lawrence; and Gloria Nilson. With those purchases we added 12,300 agents, raising our total to 40,950. HomeServices is now close to leading the country in home sales.”

From 2016 to 2017, HomeServices of America increased its transaction volume from $86 billion to $127 billion.

The chairman of the board, who has his fingers in a wide range of businesses — from building companies to a German piping system manufacturer — left no doubt that there was still work to be done for the Minneapolis-based real estate subsidiary.

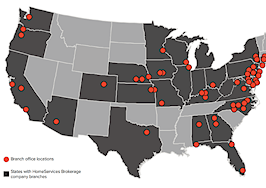

“Despite its recent acquisitions, HomeServices is on track to do only about 3 percent of the country’s home brokerage business in 2018. That leaves 97 percent to go. Given sensible prices, we will keep adding brokers in this most fundamental of businesses,” wrote Buffett.

HSA owns real estate brokerages, mortgage companies, settlement service providers, insurance companies, corporate relocation and affiliated businesses and is the majority owner of Berkshire Hathaway HomeServices, Real Living Real Estate and Prudential Real Estate franchise networks.