With home prices rising 6.6 percent year-over-year, it seems that renting would be the way to go, especially for residents of high-priced cities on the West Coast and East Coast. But SmartAsset’s latest Rent vs. Buy Calculator shows that’s not always so.

Before deciding to become a homeowner, SmartAsset says potential buyers need to consider how long they plan to stay in their current city, their current financial situation, the overall cost of renting (rent, application fees, security deposits, etc.), the overall cost of homeownership (down payment, closing costs, loan charges, cost of maintaining the home) and benefits of renting (flexibility) and owning (tax deductions, building equity).

“So, if renting is better in the short-run and buying is better in the long-run, when does the financial logic switch?” says the report. “When, in other words, do the long-run costs of renting begin to outweigh the upfront costs of buying?”

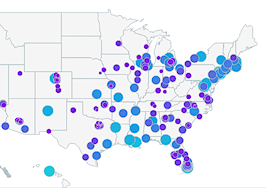

Nationally, the average time it takes for buying to beat renting (also known as the breakeven horizon) is 2.6 years, but the time could be more or less depending on the specific market a potential buyer lives in.

For a household in Atlanta making $100,000 a year with a mortgage rate of 4.5 percent, closing costs totaling $2,000 and a down payment of 20 percent, the breakeven horizon is two years — meaning that it makes more sense to buy a home if the household is planning to stay in the city for more than two years.

Even in San Francisco, where home prices have risen by 10 percent, SmartAsset says renters should go ahead and buy a home since rents are rising at nearly the same rate.

Meanwhile, in New York City, where home prices have risen by 1.45 percent since 2015, it only makes sense for a buyer looking at a two-bedroom, $350,000 apartment to sign on the dotted line if they plan to stay 18 years or more.

Source: SmartAsset

The top market for aspiring homebuyers is Stewart, Georgia, which is approximately two hours southwest of Atlanta. In Stewart, the average monthly mortgage is $380, while the average rent payment is $912. That brings the breakeven horizon to six months — the lowest on the Top 10 list.

Rounding out the top five is Livingston, Louisiana; Apache, Arizona; Roanoke City, Virginia; and Lucas, Iowa. Each of these cities has a breakeven horizon of one year, and average monthly mortgages less than $880. Furthermore, the average monthly rent is significantly more, sometimes double the average monthly mortgage.

“In the end, the rent vs. buy decision comes down to your preferences and plans,” said SmartAsset. If you know exactly how long you want to stay in your home and where you want to live, and you have some money saved up, the decision could be as easy as calculating which option will cost you less.”

“If your future is less clear, however, you may have more to consider.”

Find out where your city ranks here.