Softbank’s Vision Fund, the venture capital arm of Japanese conglomerate SoftBank, is seeking to raise an additional $15 billion to more heavily invest in tech startups, according to a recent Bloomberg report.

The venture capital fund has led multiple massive funding rounds for both Compass and Opendoor.

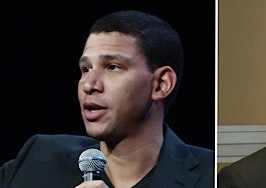

Compass CEO Robert Reffkin directly addressed the controversy surrounding SoftBank’s financing by Saudi Arabia’s sovereign wealth fund, in the wake of the death of Saudi journalist Jamal Khashoggi, at Inman’s CEO Connect event in January 2019.

“I think there’s nothing about that, that is okay, from a human level and from a business level,” Reffkin said, repeating similar statements he made in October. “There’s nothing about that, that I support. It makes me consider what I want to do in the future.”

Compass claims it’s valued at $4.4 billion and has raised $1.2 billion to-date, including two recent funding rounds led by the SoftBank Vision Fund.

A Compass source told Inman that Reffkin’s January comments weren’t intended to distance the company from SoftBank, but more directly address the alleged killing of Khashoggi.

The source said Compass would not take any option off the table and pointed out that SoftBank was both a partner and trusted advisor.

Opendoor co-founder JD Ross spoke to the controversy on stage at Bloomberg’s “Sooner Than You Think” technology summit in Brooklyn in October 2018.

“The hope is that this kind of controversy leads to changes in Saudi Arabia, and that the capital becomes, you know, better in that way,” Ross said, in a longer statement addressing the funding. “I think they’re sort of separate topics. One is capital and one is humanism and human rights, and I’m on the side of focusing on the human rights side.”

In March 2019, Opendoor raised an additional $300 million, part of which was funded by SoftBank’s Vision Fund.

A spokesperson for Opendoor told Inman, “We have no comment,” when asked if last year’s controversy surrounding its Saudi funding caused Opendoor to re-consider its relationship with SoftBank at all.

SoftBank’s Vision Fund had $7.2 billion in operating income for the nine-month period ending on December 31, 2018, according to the company’s year-end financial reporting. Over the same period, SoftBank made 49 investments totaling $45.5 billion, according to the report, and it has a total invested capital of $97 billion.

It’s made investments in Uber, WeWork, Slack, Doordash and other hot startups.

The Bloomberg report states that SoftBank has considered a multitude of ways to raise more capital including asking state-backed investors from Saudi Arabia and Abu Dhabi to waive their rights to debt repayments.

SoftBank has also reportedly discussed starting a second fund, which could draw from a new pool of investors, according to the report.

A spokesperson for SoftBank did not immediately respond to a request for comment.