The real-estate industry isn’t immune to the transformations wrought by the digital world, mobile networks and huge infusions of capital. Yes, we hear about new and emerging technologies every day, but where is all this taking us?

Let’s pull back and look at the bigger picture. Here are the four major disruptive forces that I see shaping the real estate brokerage industry going ahead into the future.

1. Software eating into commissions

In 2011, Marc Andreessen, the venture capital investor, software engineer and co-founder of Netscape penned a widely read op-ed in the Wall Street Journal headlined “Why Software Is Eating The World.” If you haven’t already read it, you should because it’s still relevant.

Among other things, he wrote: “More and more major businesses and industries are being run on software and delivered as online services — from movies to agriculture to national defense.

“Many of the winners are Silicon Valley-style entrepreneurial technology companies that are invading and overturning established industry structures. Over the next 10 years, I expect many more industries to be disrupted by software, with new world-beating Silicon Valley companies doing the disruption in more cases than not.”

The jury may still be out on some of the bigger names in the real-estate industry in terms of profitability, but there’s no doubt that they’re harnessing the technology trends and developments to build their businesses to make the residential homebuying and selling business more efficient both for consumers and agents themselves. MarketWatch, for example, as a fascinating deep dive on the impact of big data, search and artificial intelligence on this industry.

The point is: Both leaders and rank-and-file agents need to understand the impact of these technologies to better serve their clients and to operate more efficiently.

On a day-to-day level, Facebook, Google and Zillow are just a few of the big names eating into a bigger and bigger share of the real estate commission pie every day. With tens of millions of real estate leads captured online by these tech giants every year, more agents depend on online lead-gens as their main source of new business.

Google and Facebook, like Zillow, are advertising companies. They “eat” into the commission by taking a larger and larger share of the commission income in the form of necessary online ad spends Realtors need to maintain a steady flow of opportunity.

So while on the one hand they help to generate the commission, on the other they must be paid for doing it which means that spend is “eating” directly into a broker’s eventual commission. (Some agents have made creative use of YouTube, however, to combat these costs.)

Recent industry figures cite the average online lead costs anywhere from $20 to $220 dollars; that’s a wide range. I personally have talked to agents in expansionary modes who spend 40 percent-plus of their commissions on leads, and that army is growing.

The online advertising industry pioneered the pay-for-performance model. Moving forward, it will be just a matter-of-time before Zillow offers a pay-for-performance option that pays Zillow a percentage of the commission generated on their leads rather than on a per lead basis. When that happens, Google and Facebook will follow.

It’s worth noting that the source of tech giants’ wrestling power is the vast amount of money and research and development that these companies have at their disposal. In short, they can afford to be risk takers.

With dedicated resources assigned to crunch data and customer preferences across millions of servers, these firms are leveraging their software prowess and getting stronger and smarter every day.

Overall, the machines are eating into the real estate commission pie. Only the most adaptable, best-organized agents and agent teams will be able to withhold or even gain ground in this tug of war. Agents who are not technology-minded stand to lose the most in the land grab.

2. New wave of capital inflow

Traditional real estate brokerages are not well-capitalized because of thin margins and their propensity for avoiding financial risk. By design, brokerages historically have taken little financial risk compared to other industries.

For example, oil companies have sizable annual budgets for exploration and technology companies continually invest in R&D in order to stay relevant. These industries deploy capital in order to take on uncertain outcomes — and yet a brokerage does not. This simple business model invites competition. New entrants to the industry almost all come with cash ready to spend.

Technology-enabled brokers have already raised capital and readily use it for both technology investments and acquiring high producing agent teams.

Consider that today, close to half a billion dollars of inventory is sitting on Zillow’s balance sheet — presumably attributed to its iBuyer home inventories — or that OfferPad is providing capital to Keller Offers. It’s clear that the capital inflow is flexing its muscle and having an impact.

The question becomes what will this infusion mean for future business models? If Carvana can sell you a car entirely online, will we one day buy and sell homes the very same way? It certainly feels like the world is moving that way.

3. Brokerages becoming more virtual

Virtual brokerage as a business model is on the rise. From an accounting perspective, the key innovation of virtual brokers is their willingness to redirect long-term operating cash inflow into the hands of sponsoring agents’ intent on boosting recruiting and training – effectively doubling down on a key, traditional value creation for real estate brokers.

According to the National Association of Realtors there are currently 1.3 million active licensed agents across the United States and that number is expected to rise as the industry keeps pace with overall employment growth.

To make the numbers work, brokerages must not only improve how they recruit, but also place more emphasis on training agents for maximum productivity.

But productivity improvements alone are not enough to stay at the top of the game. To compensate for the lack of physical interactions given so few physical offices, brokerages must invest in technologies such as virtual worlds and social networks such as eXp Realty’s VirBELA and Real’s internally-developed system.

Connectivity for agents is key and these technologies can serve as the lynch pin to meet the evolving needs of a virtual model.

4. Brokerages forced to become technology shops

The rise of more technology applications is driven by many things but perhaps nothing as important as the pervasive nature of mobile technology.

In the PC era, agents were not major beneficiaries of technology because they simply couldn’t spend the day tethered to their desk in front of a computer. In the smartphone era, however that has all changed.

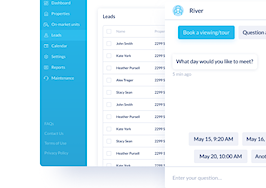

Mobile is a powerful productivity multiplier for agents. Thanks to easy-to-use mobile CRM applications and even power dialers with chatbots, agents can respond to a customer in real-time while making use of their own often fragmented time, such as when waiting for a customer at home showing.

Mobile technology may be the biggest game changer, but Google and Facebook as platforms are a close second. Although Zillow has a vast amount of leads and many of them are high-quality leads, Google and Facebook have an almost endless supply as millions of intended consumers traverse their platforms.

These leads generally cost less but take more time and work to convert. Smart agent teams are organizing themselves to process leads more efficiently especially as lead prices increase steadily. Operational automation, data-driven insights, and artificial intelligence are some of the advancements empowering agents to improve organization, collaboration, and team performance.

All that said, the historical lack of resources at the brokerage level has left the important technology choices to agents and teams when they should in fact be a core function of the brokerage. Workflow and lead processing are an integral part of any sales organization.

However, investing in technology is both a risk and an opportunity. Many are trying. For example, eXp Realty acquired VirBELA late last year to provide a virtual meeting space for its dispersed agents operating without a common physical office.

This is an example of brokerages shifting their cost structure: Increasing spending on tech and reducing spending on physical space rental. It’s doing what other brokerages must: Prioritizing technology in their budgets while spending less on aspects of the business that’s less efficient.

To build out the technology and operational stack, brokerages often ponder over whether they should build their own systems, or buy one.

The optimum solution should lie somewhere in between. It’s a hybrid approach, building the differentiating firmware in-house to support its unique business model while buying the best technologies available to power sales, marketing, compliance and office automation.

To make it work, you need to hire someone to seamlessly connect all the software pieces together and properly evolve the code base to keep current.In other words, you need someone like a chief technology officer.

Today’s real estate brokerages are responding to giant forces unleashed by big technology firms. Software is eating into the commission pool and capital is shifting business toward e-commerce.

These trends may be seen as disruptive, but they can also be beneficial for the future of the real estate brokerage industry. By testing new business model innovations and learning to be more tech savvy, brokerages can embrace these dynamic market forces and find a path to success.

Joe Chen is CEO of Chime Technologies, a venture capital investor, and serial entrepreneur. His thoughts on real estate technology, fintech, and artificial intelligence, can be viewed on LinkedIn.