Billionaire California real estate developer Rick Caruso revealed this week that he plans to let tenants at his properties pay their rent in bitcoin.

Rick Caruso. Credit: Phillip Faraone and Getty Images

Caruso made the announcement during an interview Wednesday on CNBC. Though he offered few details about when a bitcoin rent program would specifically begin or how it would work, he did say that he believes “cryptocurrency is here to stay.”

“We believe that bitcoin is the right investment for us,” Caruso continued. “It’s part of our treasury management. So we’ve allocated a percentage of what would normally go into the capital markets into bitcoin.”

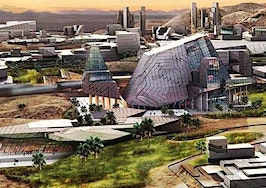

Caruso’s properties are among some of the highest profile developments in the Los Angeles area. In central L.A., he owns The Grove, an open-air mall near Beverly Hills that features a functional old-fashion trolley car. The mall is a popular destination among tourists.

The Grove, Caruso’s mall near Beverly Hills. Credit: Jim Dalrymple II

About 13 miles northeast, Caruso also owns the Americana at Brand, a similar open air mall that includes luxury housing units above stores.

Caruso’s eponymous company did not immediately respond to Inman’s request for more information on its bitcoin program Thursday.

However, during the CNBC interview, Caruso said that he has partnered with Gemini, a cryptocurrency exchange run by Cameron and Tyler Winklevoss — the twins who are most famous for their legal battles with Facebook founder Mark Zuckerberg. In the 2010 movie The Social Network, Armie Hammer portrayed both twins.

Cameron Winklevoss, left, and Tyler Winklevoss in New York City in 2017. Credit: Craig Barritt and Getty Images.

In addition to rent payments, Caruso’s company also plans to begin using cryptocurrency in its customer rewards program. And Caruso said during his CNBC interview that he believes consumers will return to properties like his after the coronavirus pandemic subsides.

Still, it remains to be seen how many consumers might actually want to use cryptocurrency to pay their rent. When bitcoin was first invented in 2008, the idea was that it would be a new kind of decentralized currency, meaning it wouldn’t be controlled by any one person or government like other currencies.

For years, that dream seemed attainable and it prompted curious experiments. In 2013, for example, a newly wed couple embarked on an experiment to see if they could live by only paying for things with bitcoin. Via a Kickstarter campaign, they raised at least 82 bitcoins, which at the time was about $7,000.

But over the years, the price of bitcoin has exploded and as of Thursday a single coin was trading for over $57,000. The result of this explosive price growth is that investors have come to treat bitcoin less as a currency and more as an asset.

That, in turn, raises the question of who would actually want to pay rent with a bitcoin if there’s a good chance that it’ll be worth a lot more just days or weeks later. If that newly wed couple had just kept their bitcoins instead of spending them on gas and burritos and rent, for example, they’d now be worth a staggering $4.7 million. With those kinds of gains in the recent past, why would anyone spend their bitcoin and risk missing out on massive gains?

During the CNBC interview, Caruso was asked about the volatility of bitcoin’s price, though the CNBC host framed the question as though the issue was a potential risk for the company, not the consumer. It’s true that bitcoin’s price has crashed in the past, and if that happened it could reduce the value of the bitcoin Caruso’s company collects. But so far the price has recovered every time, meaning that it has always been advantageous to collect bitcoin — as Caruso’s company plans to do — and always been a bad idea to spend it on things like rent.

In any case, Caruso said during the interview that Gemini will assist in addressing volatility. And speaking broadly of his company’s cryptocurrency program, including reward offerings and other things, he said it will “literally be a game changer in the retail experience for consumers.”

“Our consumers,” he added, “are going to benefit mightily from this.”