According to ATTOM Data Solution’s Q3 2017 U.S. Home Equity and Underwater Report, the number of homes seriously underwater has dropped from six million to 4.6 million — the biggest year-over-year decrease seen since Q2 2015.

The 4.6 million seriously underwater properties (where the combined loan amount secured by the property was at least 25 percent higher than the property’s estimated market value) represented 8.7 percent of all U.S. properties with a mortgage, a 2.1 percentage point decrease from Q3 2016.

ATTOM Data Solutions Senior Vice President Daren Blomquist says the decrease in underwater homes is due to homeowners finally recovering home equity lost during the recession.

“Median home prices nationwide are up 9.4 percent so far in 2017, the fastest pace of appreciation through the first three quarters of a year since 2013,” Blomquist said. “Continued home price appreciation is also helping to grow the number of equity-rich homeowners across the country compared to a year ago.”

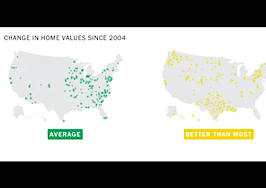

Louisiana (19.2 percent); Iowa (14.2 percent); Pennsylvania (14.0 percent); Mississippi (13.8 percent); and Alabama (13.7 percent) were the states with the highest share of seriously underwater properties.

At the metro level, Baton Rouge, La. (20.5 percent); Scranton, Pa. (19.5 percent); Youngstown, Ohio (18.2 percent); New Orleans (17.4 percent); and Dayton, Ohio (16.4 percent) had the highest number of underwater homeowners.

Meanwhile, Hawaii (41.9 percent); California (41.4 percent); New York (35.7 percent); Oregon (34.0 percent) and Washington (33.6 percent) had the highest levels of equity-rich homes where the combined loan amount secured by the property was 50 percent or less of the estimated market value of the property.

And to no one’s surprise, San Jose, Calif.; San Francisco, Calif.; Los Angeles, Calif.; Honolulu, Hawaii; and Oxnard-Thousand Oaks-Ventura, Calif. led the way in the number of equity-rich homes, which coincides with each of these metros’ home value growth over the past year.

About the study

The ATTOM Data Solutions U.S. Home Equity and Underwater report provides counts of residential properties based on several categories of equity — or loan to value (LTV) — at the state, metro, county and zip code level, along with the percentage of total residential properties with a mortgage that each equity category represents. The equity/LTV is calculated based on record-level open loan data and record-level estimated property value data derived from publicly recorded mortgage and deed of trust data collected and licensed by ATTOM Data Solutions nationwide for more than 150 million U.S. properties.