The Federal Housing Administration (FHA) Wednesday released new approval guidelines to ease the process for buyers to purchase an FHA-insured condominium. The new policy will allow certain condos to be eligible for FHA mortgage insurance even if the project is not FHA approved.

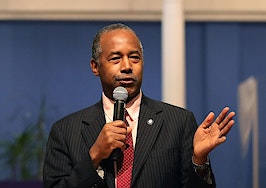

“Condominiums have increasingly become a source of affordable, sustainable homeownership for many families and it’s critical that FHA be there to help them,” U.S. Housing and Urban Development (HUD) Secretary Ben Carson said in a statement. “Today, we take an important step to open more doors to homeownership for younger, first-time American buyers as well as seniors hoping to age-in-place.”

The overall goal of the rule from HUD’s perspective is to reduce regulatory barriers that restrict condo opportunities. The changes include a new single-unit approval process to make it easier for individual condos to be eligible, called “spot-approval,” in units with more than 10 units where less than 10 percent were purchased with FHA mortgages.

It also extends the recertification requirements for approved condo projects from two to three years and allows more mixed-use projects to be eligible for FHA insurance.

New restrictions were put in place in 2009, which limited the number of properties that would be allowed to receive FHA loans and this new guidance from HUD and FHA is an effort towards removing those limitations.

The National Association of Realtors has long advocated for changes to the FHA condo rules. There are 8.7 million condos nationwide, but only 17,792 FHA loans were approved for condos in the past year, according to NAR. The overall decline in condo sales can be attributed to the lack of clear guidance, according to NAR.

“It goes without saying that condominiums are often the most affordable option for first-time home buyers, small families, and those in urban areas,” NAR President John Smaby said in a statement. “This ruling, which culminates years of collaboration between HUD and NAR, will help reverse recent declines in condo sales and ensure the FHA is fulfilling its primary mission to the American people.”