As 2017 draws to a close, it’s time for that hallowed annual tradition of making predictions for the next year that are sure to be wrong — or your money back. (Except on Inman, there will be no money back at all, sorry!)

Last year, I suffered for my art. I suffered for my audience. I suffered for you. Because the musical theme accompanying my 2017 predictions was “boy bands,” which meant listening to Backstreet Boys, NSYNC, 98 Degrees, and the like.

This year, I decided to limit the suffering to my sight. Love it or hate it, disco was an important era in the history of American music.

As a child of the ’80s, I didn’t care for disco. The garish fashion, the crazy hairstyles, the bell-bottoms, the incredibly corny looking men — they all served to solidify the worldview that disco was as awful as the clothing.

But as the years passed, I realized that disco is awesome party music. It’s just fun. Unlike some of the newer EDM and house, disco has a danceable beat no matter who you are, and no matter your level of physical fitness. It’s straight up funky, yo!

But the videos, ahh the videos! The sound is all good, but my optic nerves have been put under serious stress, just so I could bring you all these predictions to a soundtrack.

I understand. Sometimes, you must suffer for your art. I hope you understand as well. With that said, let’s boogie!

1. Realogy transforms to ‘Stay Alive’

Even though the headlines are filled with news about Zillow, Redfin, Compass, Keller Williams, 100-percent commission brokerages and the monster acquisition of Long & Foster by HomeServices of America, Realogy remains the standard against which all others are measured.

Disruptive brokerages are disruptive because they disrupt Realogy. Low-cost models are low-cost, compared to Realogy.

With $166 billion in volume in 2017, NRT — the operator of Realogy brands Coldwell Banker, Sotheby’s International Realty and more — is still some 60 percent larger than the new mega brokerage formed by HomeServices of America acquiring Long & Foster.

Even though Keller Williams is the largest single brand by agent count, the combined brands under Realogy Franchise Group are still larger. Realogy still touches one out of four sales in the U.S., at least for now.

The thing is, Realogy is in trouble. It has been in trouble for years now. Back in 2012, I wrote in a special report that dark storm clouds were gathering for Realogy, and by extension traditional brokerages. The reason? Pressure on commission splits as a result of the agent team phenomenon.

In last year’s predictions, I wrote that Realogy will start a low-cost brand to compete. I thought that given the clear signs of trouble (decreases in revenues and earnings and Richard Smith admitting that Realogy had a tough time competing for top agents), Realogy would create a low-cost alternative.

Turns out, I was wrong (the grading card post will come later), but that’s probably to Realogy’s detriment.

Since last year, Realogy has put in three C-level executives at the NRT with the mandate to solve the top agent recruitment problem. They went all-out aggressive.

The result? Realogy’s NRT unit posted a 32 percent decline in EBITDA. That led to a decline in profitability across the board, “primarily attributable to higher commission splits.” In response, Richard Smith (in what was his last earnings conference call as CEO) said:

“While we are successfully addressing the market share concerns, which we pointed out late last year, the cost of doing so, especially when compounded by the geographic mix being skewed toward the West Coast, the splits increased slightly more than anticipated. For the year, we estimate that NRT’s commission splits will be in the range of 70.25 percent to 70.5 percent as NRT field management balances trade-off between market share and split rating.

“In 2018, NRT management is tasked with the objective of slowing the rate of increase in commission splits and agent productivity gains, which are compensated at a much more favorable split to the company in the third and fourth quartile of our agent population.”

Good luck with that. The market forces are arrayed against this particular strategy.

Top producers are getting more effective, taking more market share, not less. They’re increasing their agent teams left and right to take advantage. The idea that somehow, brokerage technology and/or training and/or begging the agents to do productive activities by “managers” will make third and fourth quartile of agents sell more houses is, well, counter to experience.

Consider this: Compass (and its soon to be copycats) tempts superstars away from Realogy with big checks and promise of real technology.

Keller Williams hasn’t gone away; in fact, it continues to grow agent count and has over 173,000 agents now. And then the new crop of even lower-cost-than-KW companies such as RealtyOne, HomeSmart, eXp, NextHome, and so on and so forth are growing and proving that low-cost does work.

Furthermore, what NRT did in 2017 was offer very favorable splits to its top producers to compete. Say they offered 95/5 or something (not that crazy in today’s environment). How exactly are you going to take that back?

Answer: you’re not.

The “company lead generation” business sounds like a great idea, except that all of the leads come from the listings of top-producing agents. They have buyer’s agents on their teams they have to feed. How effective is a strategy of the broker taking buyer leads away from the teams of their top listing agents?

So, something’s gotta give. Realogy cannot keep doing the same thing and hope to stay alive for much longer.

Well, one definite change at Realogy is at the top: Ryan Schneider, formerly of Capital One, takes over as CEO at the end of the year. It’s all sorts of interesting that Realogy went to someone from outside the industry to lead it forward.

Coming from the finance world, Schneider has more experience with using technology and data, and it showed in his first comments on the succession plan:

“I am thrilled with the opportunity to join Realogy in this leadership capacity because I am convinced of the strength of its fully integrated business model, the quality of its people, the foundation for growth that it has built, the capacity it has for accelerating its growth based on new ways to use data, analytics and technology, and the unique advantages that Realogy can leverage in an industry that generated over $70 billion in commissions last year.”

(Emphasis added.)

I’m not entirely sure what this capacity for using data, analytics and technology is for Realogy, given that all of its producing agents are independent contractors who can tell Realogy to go pound sand.

But having a new CEO at the helm, with no preconceived notions of what does and doesn’t work in real estate, gives Realogy a chance to reinvent itself.

I think it will do that. Maybe it’s with a low-cost brand because none of its existing brands are competitive on cost. Maybe it’s with an employee model, like Redfin, to leverage new ways to use data, analytics and technology. But one way or another, Realogy transforms.

It has to if it wants to stay alive.

2. Redfin becomes third-largest brokerage by volume

Realogy is the largest brokerage in America; Redfin is the most important. We just didn’t know that until this year, when Redfin went public and had to disclose all kinds of information.

Take a look at just the facts from Redfin’s S-1:

- 20 million monthly uniques on its website and mobile app

- $16.2 billion in sales volume in 2016 (would have been no. 5 on RealTrends 500)

- 26,868 transaction sides in 2016 (would have been no. 10 on RealTrends 500)

- $267 million in revenues, a 44 percent year-over-year growth

- Gained market share in 81 of 84 markets

- Grew listings from 20 percent of its business to 30 percent of the business

- The average Redfin agent does 34 transactions a year and generated $350,000 in revenues (not sales, not GCI, but revenues) for Redfin

The industry had ignored Redfin for years, assuming that it was just a buy-side discount brokerage with a fancy website. Brokers and agents had been dismissing Redfin for years, saying things like, “I send my clients over there because they just come back to me.”

The employee model that Redfin has used from the beginning drew disdain from the industry because Redfin would have trouble attracting top-producing agents who have unlimited income potential as an independent contractor, have enormous egos that make them difficult to employ and do most of the business.

When Redfin filed to go public, a number of the real estate intelligentsia pointed to Redfin’s tiny market share numbers and suggested Redfin was yet another hyped up soon-to-fail company. What they forgot was that market share is a means to an end: revenues and ultimately profits.

Redfin’s Q3/2017 numbers are astonishing, for a brokerage:

- Revenues of $109.5 million for the quarter, up 35 percent YOY

- Net income of $10.6 million, up 53.8 percent YOY

- Gross margin of 38.1 percent

Now, Redfin calculates gross margin differently from other brokerages because it pays for all of the selling expenses of its employee agents. But it’s a decent stand-in for company dollar.

As of this writing, I am unaware of any brokerage in the U.S. with company dollar over 30 percent; the national average is around 15 percent. The brokerage then has to pay all of its operating expenses out of that 15 percent.

Result? The average brokerage in the U.S. has 3 percent profit margins; the best operators are sitting at around 5 percent to 6 percent profit margins.

Redfin is at 9.7 percent profit margin on 38.1 percent gross margins. Not impressive for a technology company, but impressive for a brokerage.

As a point of comparison, look at the NRT, Realogy’s in-house brokerage: NRT had EBITDA of $52 million on revenues of $1.3 billion, or a 4.1 percent profit margin. (And EBITDA is higher than net income, so the actual profit margin is lower than 4.1 percent.) That means, Redfin’s $10.6 million in profits is a fifth of NRT’s profits, and NRT has market share out the ass.

Plus, what other large brokerage (say in the top 50 of the Real Trends report) is growing revenues 35 percent YOY? Not Realogy and not HomeServices of America — which we know because both have to report their numbers.

But that’s not all.

I think Redfin’s revenues are tied directly to its web traffic, primarily because CEO Glenn Kelman and crew think of it that way as well. And Redfin’s traffic growth is impressive as hell: up 38 percent YOY to 24 million average monthly uniques in Q3/2017, which is 7 million additional uniques, compared to 9 million for Zillow and 2 million for realtor.com.

As I wrote in that post:

“Further, if you look at the key statistics that Redfin offers, there is (probably) a strong correlation between its website traffic and revenues (it’s 0.88, which is pretty damn strong, but if someone wants to do real stats and math, let me know.) And Redfin’s average revenue per 100,000 uniques over the past two years (from Q3/2015 to Q3/2017) is not $38,170, since it’s gotten better at converting the traffic. The average revenue per 100,000 users is $131,651 over the past 9 quarters.”

Some simple math suggests that if Redfin keeps up its traffic growth, we get Redfin’s 2018 revenue projections at an astonishing $533.7 million. If Redfin in 2016 generated $267 million on $16.7 billion of sales volume, that in turn suggests Redfin’s 2018 sales volume would be $33.4 billion.

Before I saw the Q3 numbers, I thought Redfin might do $25.2 billion in volume. While nobody knows whether Redfin can keep up its torrid growth, I think it’ll get way closer to $30 billion in volume than anybody thinks.

That would mean that Redfin surpasses Douglas Elliman, which did $24.6 billion in volume in 2017, and $22.2 billion in 2016, while concentrated in the extreme high-end markets of New York City and The Hamptons, and the high-end is slowing down already.

With HomeServices of America acquiring Long & Foster, that makes Redfin the third largest brokerage by volume in the country.

There is one very good reason why Redfin’s traffic growth is so closely correlated to revenue growth. Redfin doesn’t have “agent adoption” problems. When it invests in technology, new business processes or new efficiencies, all of its agents use that technology, business process or efficiency.

Because they’re employees. No one else can do this, because their agents are 1099 independent contractors who can and do routinely tell the broker/manager/company to go pound sand. (See, e.g., Realogy’s acquisition and subsequent rollout of the Zap Platform.)

In any event, I think Redfin kills it in 2018 short of any weird anti-trust type of moves (since the NAR-DOJ Settlement expires next year). Ain’t no stopping it now. It’s on the move, and it’s got the groove.

3. NAR ends its long love affair with RPR

Ah, Realtors Property Resource, usually shortened to RPR, to what can we compare thee? Obviously, I wasn’t in the industry in the ’60s, ’70s and ’80s, but for as long as I’ve been in real estate, I can’t think of anything that NAR has done that generated and generates as much passion and disagreement as RPR.

I wrote in 2009, when RPR launched, that NAR had declared war on the rest of the industry. OK, that was a bit of hyperbole, but in the eight years since, what we’ve had between NAR and the MLS community could be described as a cold war.

And of course, that cold war got a bit hotter when NAR and RPR decided to back Project Upstream.

Things have improved over the years, no doubt. To its credit, NAR has worked hard to repair the relationship with the MLS community, including hiring a tech-savvy millennial Caitlin McCrory as full-time manager of MLS.

NAR reached out to and partnered with CMLS on a number of fronts and sponsors RESO (Real Estate Standards Organization). And yet, there’s a tension between the MLS (and frankly, the local associations that own and operate them) and NAR. At least part of the reason is RPR and Upstream.

Over the years, there have been a number of people grumbling about RPR’s funding. Let’s remember that RPR was started as a company that would quickly break even and start making money by monetizing the data from the MLS.

A couple of years later, that changed when the mountains of money from Wall Street and others failed to materialize, and NAR decided to fund RPR out of member dues.

According to Inman, NAR has spent $180 million on RPR by the end of 2016, including $12 million for Upstream. Add another $23.5 million for 2018, already approved, and possibly $24 million in 2019.

Plus, at Midyear this year, NAR approved another $9 million for Upstream. So this isn’t an inexpensive toy here. It’s 12 percent of NAR’s total operating budget.

The problem is, there just isn’t much to show for all this money. RPR claims 150,000 “power users” or about 12 percent of Realtor members. Upstream has yet to deliver actual software in actual production (its beta test has been going on for a while), and there’s all kinds of evidence that the MLSs are fighting back effectively against Upstream. “The Pivot” would be one such example of Upstream choosing to accept reality.

Now, it’s not a deep state secret that RPR was Dale Stinton’s baby. As Inman put it, RPR was supposed to be an answer to the threat from Zillow, and “Dale Stinton hated Zillow as much as President Trump despises CNN.”

I think that’s a bit of hyperbole; Trump doesn’t despise CNN quite that much, nor does he see CNN as an existential threat to the U.S.

But there’s a new king on the throne now, and Bob Goldberg has no real incentive to keep Dale Stinton’s baby going. In fact, Goldberg has some incentive to kill RPR off next year.

Today, RPR’s failure can be laid at the feet of his predecessor. In two years, that’s no longer the case; he has to eat part of the blame for RPR going down.

Add to that a growing chorus of voices saying it’s time to cut losses on RPR, and I think we see NAR finally break up with RPR in 2018.

Perhaps it gets spun off as its own company, with a final $24 million payment. Or maybe NAR sells it off to somebody for a face-saving amount. (I think realtor.com operator Move Inc. is the ideal candidate, but who knows?)

Seeing as how NAR’s “The Future of Realtor Party” PAG (presidential advisory group) is recommending spending an additional $25 per member (which naturally means raising dues by an additional $25 per member), RPR is going to have to fight to keep its funding at current levels.

Eliminating the $24 million RPR is requesting for 2019 would go a long way toward covering the additional lobbying expenditure without a big dues increase.

Given that just about everybody agrees NAR’s strength and its proper role is in lobbying and government affairs, and given that RPR is a problem for the MLS-association relationship, it does seem like 2018 is the year when things change.

NAR will have had a love that was a gas, but it turned out to have a heart of glass. It seemed like the real thing, but with much mistrust, love will have gone behind.

4. Realtor MLSs start to convert to non-Realtor status

The biggest news out of NAR’s recently concluded convention in November was that “MLS of Choice” rules were approved by NAR’s Board of Directors.

Originally envisioned as a way to stop the MLS from the entirely indefensible policy of charging people who don’t use it, the actual changes go far, far deeper and have enormous consequences for the industry.

What NAR MLS policies 7.42 and 7.43 used to say was that the MLS could charge people in an office within the jurisdiction of its parent association(s) whether they used the MLS or not. It also allowed the MLS to force all of the offices of a brokerage to participate in the MLS if one office did.

The changes mean that the MLS may no longer force all of a brokerage’s offices to participate and that it cannot charge agents who don’t use the MLS as long as that agent can demonstrate that she belongs to another MLS.

Accordingly, the link between the MLS service area and the owner association(s) has been completely removed.

The motivation behind these changes are also spelled out:

“Brokers and agents will be empowered with a nimble MLS service structure that allows for innovation and competition amongst MLSs. The new approach will allow agents a choice in subscribing to any MLS in which their broker is a participant, and it will require MLSs to only assess brokers a fee based on their affiliated licensees who chose to subscribe to the MLS. However, MLSs will have the discretion to assess fees to agents affiliated with a participating office jurisdiction, if those agents have not subscribed to another MLS. This will result in a value-driven service structure that encourages competition amongst MLSs, responds to the evolving business needs and varied structures of brokerage firms, and, therefore, is in the best interest of brokers and their affiliated agents.”

(Emphasis added.)

It’s a good step forward because competition is good for the customer — in this case, the brokers and agents who have to pay for the MLS.

What it signifies is a new era for the MLS, in which competition, rather than monopoly, is supposed to rule the day. After these changes, I see absolutely no barrier to CRMLS offering MLS services to Topeka, Kansas.

There’s no reason BrightMLS couldn’t be the MLS for Vermont. HAR (Houston Association of Realtors), with its immensely successful public-facing website, can claim its service area is North America.

Hooray for competition! It’s the American way!

What’s interesting, however, is that the policy makes no reference to Realtor-owned MLSs. A commenter on my blog said this was an oversight, and that the intent was to allow waivers only for agents who belong to another Realtor MLS.

But the final policy omits any such reference, and according to NAR Legal, that’s exactly the way the policy is intended to work.

What that means is that the non-Realtor MLS has a massive price advantage in competing against a Realtor MLS. I wrote about this in detail earlier, but it bears repeating. This from Miami Association of Realtors is a fairly typical outlay for Association membership today:

- MLS: $299

- Local dues: $165

- Florida Realtor dues: $181

- NAR: $120

- Total: $745

Miami does offer a $75 credit if you pay your dues in full by the first deadline, dropping the cost to $670. Note that the MLS is only $299 per year, so $446 of the total cost is going to local, state and national Associations of Realtors.

A non-Realtor MLS — say one that is broker-owned, or like NY State MLS, privately owned — can either offer out its MLS at less than half the cost, charge the same as a Realtor MLS but deliver $446 worth of products and services, or charge less and deliver more.

To be fair, there is little such competition today. Why would there have been? The monopoly status of the MLS has been baked into the industry for decades. So people aren’t worried.

And most people dismiss the issue because producing agents aren’t going to leave the MLS, and besides, they love being a Realtor. If anything, non-Realtor MLS will have to offer waivers as well, so the two can compete on a level playing field. Maybe.

Thing is, that line of defense — that the Realtor MLS is just fine and no one is going to abandon it — relies on two assumptions.

The first assumption is that producing agents are all Realtors and happily so.

Inman published a Special Report last year literally titled “Do Realtor associations offer more than just a bill?” It’s a fascinating read, but the most fascinating is the stat that nearly 70 percent of Realtor members responded that they were forced to the join the association.

Most joined just to get access to the MLS; others joined because their brokerage forced them to join (under NAR’s Principal Realtor Rule).

I have real doubts on the assumption that only the non-productive agents felt forced to join. In fact, it’s quite possible that the reverse is true: the top producers don’t take advantage of or get involved with the association because they’re too busy taking listings, showing homes, writing up contracts and attending closings.

Maybe, maybe not.

But we do know from areas where a broker-owned MLS exists that association membership typically drops by 60 percent. And that 60 percent includes plenty of million-dollar agents. So, there’s that.

The second assumption is that the non-Realtor MLS is run by dumbasses who don’t realize the benefits of taking market share.

Any non-dumbass MLS operator will start to offer no-cost MLS membership with upcharges for various products and services to get market share. That way, an agent can maintain two MLS subscriptions, and wait for the low cost MLS to take off.

I mean, it isn’t as if the freemium business model is something new to the annals of business. Dropbox comes to mind, and it’s talking about $1 billion in revenue in 2017.

Realtor MLSs will spend a bunch of time and energy talking up the benefits of Realtor membership as if that isn’t exactly what the associations have been doing for a couple of decades now.

But the cost advantage is cost advantage and not subject to wishful thinking. If two products are the same, but one costs half of the other one due to a linked product or service you must purchase, well, the market will do as the market does.

Which brings us to my prediction, sure to be wrong: I think we’ll start to see the more forward-thinking, savvier or plain old under-competitive-pressure Realtor MLSs to start converting to non-Realtor MLSs.

It turns out that under NAR rules, a Realtor MLS is defined as one where one or more Realtor association own all of the ownership in the MLS; 100-percent ownership by Realtor organization is the threshold.

If that’s the case, then a local MLS/association could rationally conclude that it should sell 10 percent of the MLS to the brokers in the association. It keeps control in the family, as it were, and instantly removes the Realtor MLS status.

Savings of $400-plus per year per agent is pretty compelling, though brokers would need to setup non-Realtor companies (as many do today for so-called “referral shops”).

In turn, it allows that MLS to defend against cost-competitors on the one hand and go out and compete for business against Realtor MLSs around the country.

Most will not. In fact, maybe none will, but the advantage is simply too big to ignore. If the MLS world goes from local monopoly quasi-utilities to one of wide open competition, and if the new era is defined by kung fu fighting instead of non-competing kumbahyahs, then it helps not to have one arm tied behind one’s back.

5. The giants enter real estate, at last

2017 was the high water mark for venture capital flooding into real estate, along with every other industry. The biggest was the $450 million that Softbank poured into Compass, but let’s not forget that OfferPad raised $260 million in early 2017 as well.

One of the more curious things about real estate is that the technology side of it has long been dominated by startups. Don’t forget, Redfin and Zillow are barely 10 years old.

Sure, you have Move Inc. and CoreLogic and Black Knight (I guess Rapattoni is still around?), but for the most part, we’re talking about relatively small startups. Companies we think of as major, such as BoomTown, Placester — even Opendoor, Compass and OfferPad are all startups.

Given that the real estate industry is gigantic, highly fragmented, and filled with inefficiencies, it’s the perfect target for smart tech guys and gals with a glimmer in their eyes. It explains the flood of VC money into real estate.

Just the real estate brokerage market is a $158 billion a year industry, including commercial. Just the advertising piece is, according to Zillow’s IPO filing back in the day, $6.2 billion.

There are maybe 2 million people with real estate licenses, and 1.3 million or so are dues-paying Realtors. There may be as many as 857,492 business connected to real estate sales and brokerage, which might include commercial, property management, appraisers and the like.

So where are the real big guys? The giants of Silicon Valley?

Well, they began dipping their toes in the water in 2017. I think they’ll start to arrive in earnest in 2018.

First up, Facebook, which launched two major updates to its real estate advertising platform. (Most of the insights here comes from Mike DelPrete’s awesome site. Check out the post in full.)

One is expanding the Marketplace by adding thousands of rental listings. This wasn’t a small change: it involved an overhaul of the search experience as well as taking feeds from Zumper and Apartment List, two major rental websites. Here’s DelPrete’s commentary on the changes:

“On the rental front, the product refresh and accompanying listing partnerships are game changers. Syndicating listings from established rental sites — and improving the user experience for renters — will make rental search far more useful on Facebook, attracting users who will ultimately incentivize more landlords to post inventory directly to Facebook.

“Facebook isn’t settling for feature parity with powerful incumbents like Craigslist, encouraging landlords to post 360-degree photos to provide a better sense for what a listing is like.

“Facebook is smart to focus on rentals, which are an ideal entry point into residential real estate because competition is fragmented: there is no MLS or single source of truth for rental inventory. By supercharging its network effect through listing syndication and user-side tweaks, Facebook has a shot at replacing Craigslist as the most comprehensive database of rental listings in America.”

The other product is the new “Dynamic Ads for Real Estate” product, which launched in September. It not only allows brokers and agents to upload listings directly to Facebook, but it also allows for far more finely targeted advertising.

Again, DelPrete wrote:

“Until now, agents could only target broad audiences, capturing leads with less intent than users actively surfing a real estate portal for homes. By allowing brokerages to upload a catalog of live listings and target users based on their past interaction with specific listings, Facebook lets agents market to users who directly demonstrate affinity for their homes for sale, which should improve lead quality and ROI.”

Facebook has already been a big marketing channel for some real estate agents and brokers. The early adopters have been seeing incredible ROI. Inman reported that one agent spent $750 on a listing ad that yielded six contracts and hundreds of leads by targeting first-time homebuyers in her local market.

Even though Facebook ad prices have risen, the new Dynamic Ads for Real Estate allows for finer targeting, and the ability to upload listings will be huge. I mean, it is actually kind of frightening how much Facebook knows about me, especially once it has sucked in all kinds of data from my phone, Google searches and every device connected to Facebook — which is pretty much all of them.

I once walked through a mall in Japan, stopped for a hot second to look at an ultrasonic diffuser, and the next day, Facebook was serving up ads for an ultrasonic diffuser. I think they might be following me.

So yes, Facebook advertising for real estate could be amazing. Not for consumers, necessarily, but for brokers and agents? Ab-so-lute-ly.

DelPrete thinks Facebook could end up creating major problems for Zillow and other portals, especially once brokerages, franchises and even MLSs start syndicating to Facebook:

“The more precise targeting options available to agents, the stronger a case Facebook can make to brokers that they should syndicate listings directly to Facebook. This is when things get interesting: if enough agents use Facebook real estate ads in a given market, we can even imagine progressive MLS boards — who have been eager for more leverage against the portals — syndicating listings directly to Facebook.”

It’s a great analysis, and I could see that new reality coming to be. Because Zillow is huge and dominant in the real estate vertical, but let’s face it — it ain’t Facebook.

So I agree with DelPrete; these changes by Facebook could be a game changer.

But if Facebook gets in the game, it isn’t as if the other giants — particularly Google and Amazon — are likely to sit on the sidelines and watch Facebook dominate the $158 billion a year real estate brokerage space.

In fact, Inman reported back in July that Amazon was planning to enter the real estate space. Inman found a placeholder webpage that says, “Hire a Realtor” and spoke with a source who said “they were approached by a person who was looking for help with integrating agents into Amazon’s professional services marketplace.”

Amazon has since taken down that webpage, but it got the industry talking for a while about the prospect with a mix of fear and anticipation.

Was it just a test? Or is Amazon making preparations for a push into real estate? To add to the rumor mill, I heard from a source that Amazon recently recruited a significant number of people away from Redfin. Given that they’re both in Seattle, that may be nothing. Or it may be something. Who knows?

And then we have Google, who completely dominates search. Even today, when Zillow, realtor.com and Redfin have mobile apps that drive the majority of traffic to them, Google is the actual place where property search begins. The portals, franchises, brokers and agents are all still spending millions in maximizing search. The competition is fierce, but the rewards are worth it.

Google used to have a department that looked at real estate closely, and offered a way to put listings directly onto Google Maps. But it dropped that in 2011 and more or less exited focusing on real estate at all.

Turns out that it didn’t need to bother, as brokers, agents, franchises and portals all spent plenty of money on paid search ads as well as on optimizing organic search. They’ve been happy with the status quo.

Facebook’s entrance changes things. Facebook isn’t Zillow, as large as Zillow is. Facebook isn’t all that concerned about trying to optimize for search, and it’s certainly not going to spend on Google Adwords.

Will Google sit by and let Facebook take the lead in advertising solutions for real estate? Maybe, but I doubt it.

That means 2018 is shaping up to be the year when the real giants enter real estate.

I expect to see Amazon launch its “Hire a Realtor” service in some form or fashion, perhaps in limited markets as a test. I expect to see Google start to ramp up some sort of an advertising solution, again perhaps as a test, to get back into the waters it exited six years ago.

All of the competition will be good for real estate. Zillow and the portals will need to up their game significantly, while brokers and agents will have options for advertising, and consumers will, well, benefit if they’re in the market, and suffer through endless ads if they’re not.

But competition is good for everyone in the long run with lower prices and more choices.

Unless you’re Zillow, Move Inc. or (maybe) Redfin, all this attention by the giants of the internet economy is good news. Brokers and agents should start to feel love, to feel love, to feel love.

6. Revolution in MLS technology finally arrives

The news that Cloud MLX signed a major deal with CRMLS didn’t make a big splash, except with those of us toiling away in the MLS salt mines. But it’s a big deal.

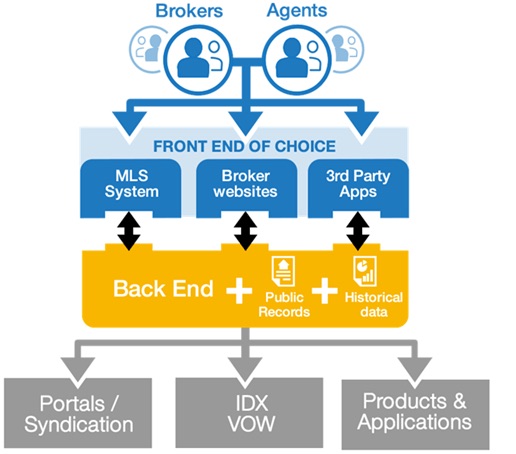

For years and years, the MLS industry has talked about the holy grail of “front end of choice” — or alternative interfaces for agents to input and search for listings. One of the primary motivations behind RESO was to create a single data standard to make things like front end of choice possible.

Bob Bemis, now VP of business development at RPR, wrote as Notorious B.O.B. back in 2015 advocating such a new architecture for the MLS:

“By separating the database (the back end) from the other elements of the system (the front ends) and opening access to the database through a collection of application program interfaces (API) and software developer kits (SDK), by contributing the APIs to a common-good licensing system and the software code that drives them to an open source repository, access to and open use of the database would be available to any technology partner with whom the MLS enters into a license agreement.”

He noted, as have I over the years, that the barriers were money, politics and plain old inertia: All MLS leaders were intrigued by the concept, but no one wanted to go first.

Well, with the deal between W&R Studios, creator of Cloud MLX, and CRMLS, those barriers are removed. CRMLS is the largest MLS in the country, and now that it has gone first, it removes the political and inertia barriers to other MLS CEOs who want to do the same.

W&R Studios is not a startup having to convince VCs to take a chance: it is now a well-established software company providing products to many an MLS and broker with a new product that has a bright future.

Thing is, for an MLS to implement Cloud MLX, it has to have a separate backend database like CRMLS does. Many of the larger MLSs in the country already have this setup, but most of the smaller MLSs who rely on vendor software do not.

That means three things:

- Existing MLS vendors such as CoreLogic and Black Knight have to start offering more and more separated MLS software platforms.

- It provides an opening for RPR’s AMP (Advanced Multi-List Platform), which is already bifurcated, using RPR’s database as its back-end.

- It makes Zillow a major player in MLS software, as its Bridge and Retsly platforms are perfectly suited for helping MLSs transition to the new Front-End of Choice environment. (One could argue that Zillow is already a major player, but this makes it potentially even more important.)

Cloud MLX is just the start. It’s the tip of the iceberg when it comes to outdated MLS software environments.

For one thing, Cloud MLX as it is today does not offer add/edit. It’s only for search and display. That will change because the annoyance in using one user interface (UI) to search for properties, then logging into a different UI to add/edit properties is comparable to getting felt up by TSA agents.

So I figure it’s just a matter of time before Greg Robertson and Dan Woolley release an add/edit module, with the MLS’s permission.

For another, this is just the front-end of the MLS. There’s no reason this architecture couldn’t be used for all sorts of tools. That’s the whole vision anyhow, from FlexMLS’s Spark Platform to RETS API and so on. That means the MLS no longer has to be in control over various add-ons to the MLS; each individual broker and agent can pick-and-choose (or even develop themselves) what they want.

I think 2018 is finally the year when this flexible MLS structure gets real adoption, driven by the leadership of CRMLS. No more one-size-fits-all — and much more of the that’s the way uh-huh, uh-huh, I like it!

7. Independent contractor lawsuits hit the agent team

A couple of years ago, there were real concerns that the 1099 independent contractor status of real estate agents was threatened by a series of lawsuits.

In fairly short order, you had Monell v. Boston Pads out of Massachusetts, Bararsani v. Coldwell Banker out of California and a number of smaller cases (Cruz v. Redfin, etc.).

There was much agitation and consternation amongst brokerage and association circles about what it might mean if some court somewhere held that real estate agents are not independent contractors after all.

Joel Singer of California Association of Realtors called such a decision a nuclear bomb on the industry if I remember correctly. He’s not entirely wrong in that assessment either.

Thankfully for Realtor associations and brokers everywhere, neither lawsuit went anywhere. In Monell, the court held for the defendant brokerage, and ruled that real estate agents are independent contractors, which various people celebrated — prematurely, in my opinion.

In Bararsani, Coldwell Banker reached a settlement without admitting anything. Bullets dodged! Whew!

Although I don’t think the brokerages are out of the woods just yet, I think these rulings and settlements (in particular, the $4.5 million settlement, which means the lawyer got $1.5 million for his troubles) sets up the next wave: labor law litigation against not brokerages, but against agent teams.

The key to the employee versus independent contractor analysis lies in the degree of control exercised by the alleged employer. (To be honest, there are differing tests all over the place, including the IRS, Department of Labor and each of the 50 states, but they’re all pretty similar, and the “control” issue is pretty common across the board.)

Using the U.S. Dept. of Labor’s six-part economic realities test as an example, we get this:

“6. What is the Nature and Degree of the Employer’s Control?

“As with the other economic realities factors, the employer’s control should be analyzed in light of the ultimate determination whether the worker is economically dependent on the employer or truly an independent businessperson. The worker must control meaningful aspects of the work performed such that it is possible to view the worker as a person conducting his or her own business. And the worker’s control over meaningful aspects of the work must be more than theoretical — the worker must actually exercise it. For example, an employer’s lack of control over workers is not particularly telling if the workers work from home or offsite.

“Technological advances and enhanced monitoring mechanisms may encourage companies to engage workers not as employees yet maintain stringent control over aspects of the workers’ jobs, from their schedules, to the way that they dress, to the tasks that they carry out. Some employers assert that the control that they exercise over workers is due to the nature of their business, regulatory requirements, or the desire to ensure that their customers are satisfied.

“However, control exercised over a worker, even for any or all of those reasons, still indicates that the worker is an employee.”

(Emphasis added.)

It is because of this “control test” that brokerages across the land are so hesitant telling in their agents what to do. So they’re very careful about “assigning” floor time or requiring anything at all short of outright violations of the law or the Code of Ethics.

You know who’s not so careful? That’s right — agent teams.

Think about the typical agent team, with a lead agent who owns the team, hires admin staff and then brings buyer’s agents “onto his (or her) team.” Those buyer’s agents are required to use the team’s software, respond to leads on the team’s timetable (or not get any leads at all), use the team’s transaction coordinator, use the team’s listing presentation, show up to team meetings (actually mandatory, unlike the broker’s sales meetings, which can be ignored safely) and so on.

In one case I heard of, a major agent team in the Seattle area requires its buyer’s agents to show up at 8:30 a.m. They do scripting and role-playing for an hour, and then they do cold-calling for a couple of hours. They are allowed to go on appointments only in the afternoon.

Obviously, all team members must use the team’s technology platform, enter all of the data into the team’s database and provide services to clients as per the team’s standards.

Of course, the transaction that the team member does is credited not to her, but to the lead agent, which is why some agents are “doing” 800 transactions a year — a feat that is impossible for a single human being.

This is extremely vulnerable to a lawsuit by the buyer’s agent that he or she is, in fact, an employee of the team. He or she doesn’t have to claim that he or she’s an employee of the brokerage; that case is weaker thanks to lawsuits in the past. But as far as I know, no one has yet sued an agent team claiming to be an employee.

That’ll change in 2018.

Given the $1.5 million payday for the lawyers in Bararsani, some enterprising attorney somewhere is going to find a plaintiff and bring lawsuits for back wages (many agents don’t make much money, even if they’re on a team), reimbursement of expenses (all those miles on the car driving people around!), health care (Obamacare FTW, if the team is large enough) and unemployment.

Of course, the state taxing authorities will get all sorts of interested and excited — that’s a lot of back taxes, unemployment insurance and other fun ways to leech money from businesses.

The agent team is unlikely to find strong support from brokerages because many brokers regard the agent team as the greatest threat to their profitability (and correctly so).

I don’t know if the associations will go to bat for them as they have for brokerages because they’re unlikely to lose members should the agent team lose in the same way they would if the brokerage lost.

What’s more, the agent team can’t change the way that brokerages have changed. They can’t start doing the “hands off” approach of brokerages.

Hands-on is the only way that an agent team can work at all. Imagine a team led by Joe Teamleader who is a listing machine. He wisely has a CRM system (say from BoomTown, which is built around teams) to track all inbound inquiries on his listings and wants to ensure that those potential buyers are taken care of.

Susie Teammember, a buyer’s agent on his team, wants to use her own CRM to keep track of the buyers that she got from Joe. In what world is Joe going to allow that to happen? If that buyer is not the team’s client, then all he’s doing is charging a very high referral fee to Susie so she can make a client out of his hard work.

It simply doesn’t work. The entire team concept relies on a degree of control by the team leader to deliver a consistent high-quality service, not by individual agents, but by the team as a whole.

Which means wholesale changes to how agent teams are setup, how buyer’s agents are compensated and the profit margins of the agent teams across the land.

But until such changes become commonplace, and even if they do, all of the buyer’s agents who once worked on a team have a valid claim for back wages, taxes (if they were employees, they don’t have to pay the various self-employment taxes), expenses and the like.

Lawyers are going to get rich; agents are going to get pissed. They’ll look back and wonder where are those happy days? They seem so hard to find. Whatever happened to our businesses? I wish I understood. It used to be so nice, it used to be so good.

A somber note

I thought about making this one of the seven predictions for 2018, but I think this projection is absolutely going to come true, unfortunately.

One of the biggest stories of 2017 outside of real estate has been the revelations of widespread sexual misconduct in the workplace, in Hollywood, the media and government.

Harvey Weinstein, once one of the most powerful men in Hollywood, was fired in disgrace. Matt Lauer, once the face of NBC, was revealed to be a horrid human being. Rep. John Conyers (D-MI), and Sen. Al Franken (D-MN) went or are going down.

Sexual misconduct allegations almost certainly torpedoed Roy Moore’s Senate run in Alabama. The names we have heard of reads like a who’s who in American media and entertainment: Kevin Spacey, Louis C.K., Garrison Keillor, Charlie Rose, David Sweeney, Mike Oreskes, Matt Zimmerman and the latest is Jerry Richardson, owner of the Carolina Panthers.

It seems inconceivable that the #MeToo movement, in which women are coming forward and breaking their silence on sexual harassment and sexual misconduct, is limited to Hollywood, big media and government.

We all know that the real estate industry is not immune from sexual harassment. There are plenty of whispers and accounts of horrible experiences, without names attached, often for good reason.

Many of the women who have suffered have, as did the women in the Jerry Richardson case, signed settlement with strict non-disclosure and non-disparagement agreements attached. But not everyone signed such settlements, and not everyone has even come forth.

It’s just a matter of time before the issue of sexual harassment hits real estate — and in a big way.

I am predicting that some C-level executive in a major real estate company goes down to allegations of sexual impropriety in the workplace sometime in 2018.

Final thoughts

Well, we’ve done it. We have reached the end of this monstrosity. We’ve done a little dance, made a little love and got down tonight. Predicting the future is a fool’s business, in all likelihood, but I do enjoy speculating on things because it actually points to the present and what’s going on today.

2017 was a big year in so many ways. We’ve had massive changes — across the White House, NAR, technology and the industry over all. I’ve had some massive, and positive, changes in my life as well, and I’m grateful for all of them.

And of course, I’m grateful for you all, the best-informed audience in real estate for continuing to slog through these too-long posts where I get to go on flights of fancy. I look forward to another year of debate, discussion and engagement on all manner of topics.

Robert Hahn is the Managing Partner of 7DS Associates, a marketing, technology and strategy consultancy focusing on the real estate industry. Check out his personal blog, The Notorious R.O.B. or find him on Twitter: @robhahn.